Welcome our blog. This is where we share thought-provoking, no-holds-barred opinions and commentaries on all things retirement income, financial planning and investing!

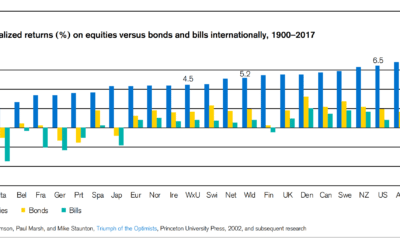

Lessons from 118 years of asset class returns data

The annual Credit Suisse Global Investment Returns Yearbook (2018) should be on your reading list. Compiled by Professors Elroy Dimson (Cambridge), Paul Marsh and Mike Staunton (London Business School), this epic publication provides incredible insight into asset...

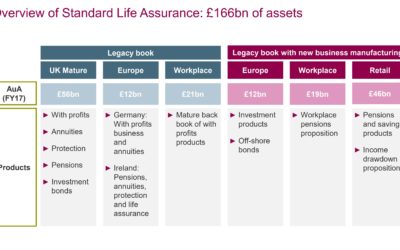

Phoenixed! The end of Standard Life as we know it and implication for platform users

The big news on Friday is that Standard Life Aberdeen (SLA) has agreed to flog its life and pension business to the grandmaster of dead closed book consolidation, aka Phoenix Group. Phoenix is where customer service goes to die. It's where life policies become...

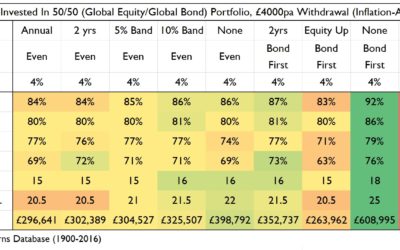

Cash reserve buffers, withdrawal rates and old wives’ fables for retirement portfolios

Managing retirement income portfolios is riddled with old wives’ fables; practices handed down from adviser to adviser but with very little empirical basis. (Really, these practices are often promulgated by men, so the term ‘old men’s fables’ is probably more...

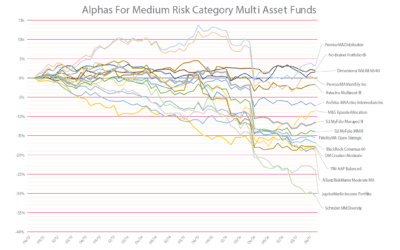

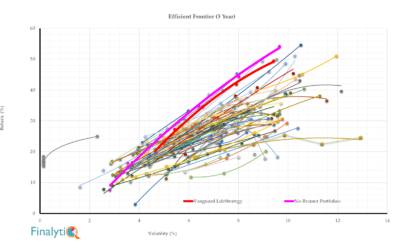

The art of delivering negative alpha

One area we looked at in the latest multi-asset fund research is whether multi-asset managers can justify their existence (and high fees), by pointing to the alpha they generate. This is the return they can bring in, over and above the market portfolio. To illustrate...

The Multi-Asset Fund Gravy Train

In the late 1600s, William III introduced the so-called Window Tax, a levy on people living in homes with more than six windows, a crude measure of prosperity at the time. To avoid this tax, some homeowners responded by bricking up all windows except the six! As the...

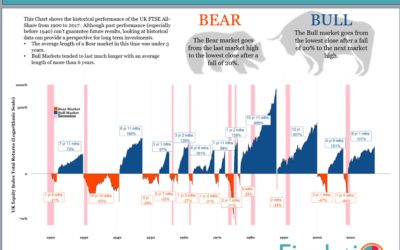

Spotting the equity market bubble

Everywhere you turn these days, there’s talk of asset class ‘bubbles.’ Apparently, we’ve got a bond bubble. An equity market bubble. A property price bubble. A Bitcoin bubble. Oh, and a passive fund bubble! Hell, we’ve got a bubble of bubbles! It’s not hard to...

3,000+

Avid Subscribers