Welcome our blog. This is where we share thought-provoking, no-holds-barred opinions and commentaries on all things retirement income, financial planning and investing!

Cambridge University’s Professor Elroy Dimson to speak at Science of Retirement Conference 2019

We’re delighted and honoured to announce that Professor Elroy Dimson from Cambridge University will deliver a keynote at the Science of Retirement Conference on Thurs., 28th February 2019 at the Science Museum, London. Jack Bogle once said that ‘investment...

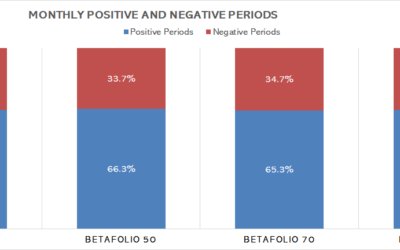

The less you look (or the best managed volatility strategy in the world)

<blockquote class="twitter-tweet" data-lang="en"><p lang="en" dir="ltr">If you wish to lower the volatility of your portfolio, stop looking at it so often.</p>— Rick Ferri, CFA (@Rick_Ferri) <a...

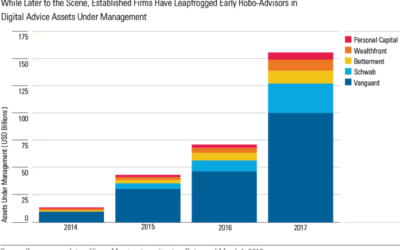

Robo-advice and the art of growing customers for the competition

‘We have been growing customers for General Motors’ observed Lewis Crusoe, a vice-president of the Ford Motor Company in the 1950s. Mr Crusoe was talking about a well-known problem at the company; low-income Ford owners were trading up to a medium-priced...

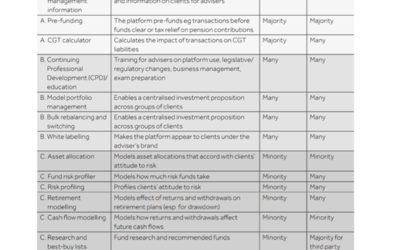

Will the FCA’s inducement rules kill off on-platform tools?

Should advisers use free – but often inferior – tools offered by platforms and product providers, or should they pay for best-of-breed, independent tools available in the marketplace? This debate has raged among advisers for a long time. The FCA might have...

Cobras, Unintended Consequences & Multi-Asset Funds

Today, we publish our Multi-Asset Fund Guide 2018 titled Dysfunctional Families. This guide is an in-depth analysis of 91 fund families consisting of 402 individual funds in which a £148bn of client’s money is invested. The story of the cobra in India during...

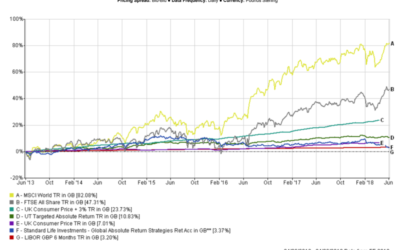

Living on planet GARS: Lessons in how (NOT) to invest

A recent article in the Guardian is the latest indictment of the Standard Life GARS fund. The fund has underperformed virtually all imaginable benchmarks over the last three and five years. 3-Year Cumulative Return 5-Year Cumulative Return Is it just me or does anyone...

3,000+

Avid Subscribers