Should advisers use free – but often inferior – tools offered by platforms and product providers, or should they pay for best-of-breed, independent tools available in the marketplace?

This debate has raged among advisers for a long time.

The FCA might have inadvertently settled this debate in its interim report on the platform market study (MS17/1.2). The regulator’s focus here is on whether platform tools have clear direct or indirect benefits for consumers, or whether they have any potential to incentivise advisers. In this case, the risk is that advisers would be less likely to act in the best interests of their clients.

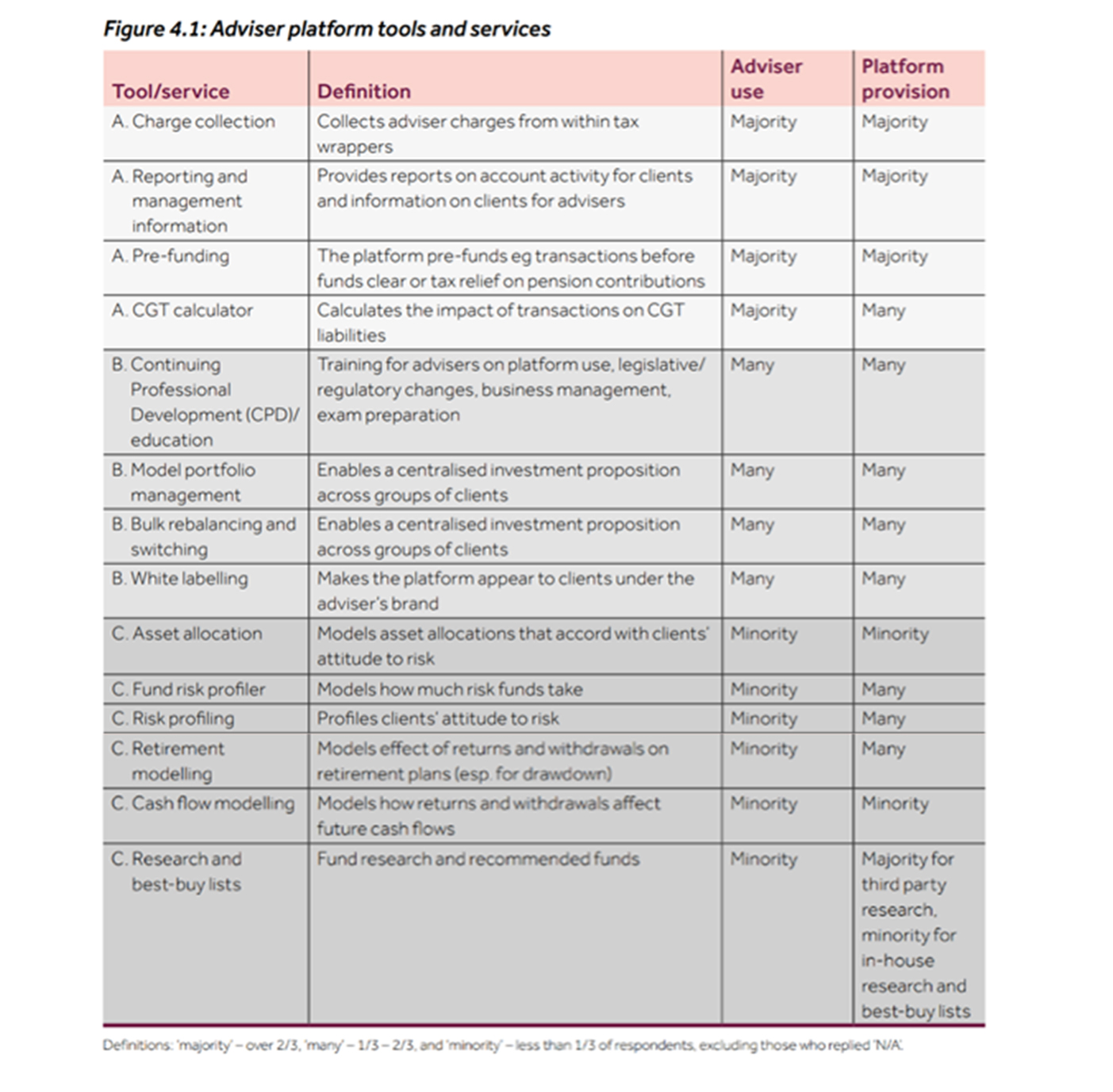

The FCA put tools into three categories depending on their availability on platforms and popularity with advisers.

The regulator’s view of each category is:

- A: tools provided by most platforms and used by most advisers. ‘We consider that the first group of tools (A) that most advisers use, and most platforms provide, has little potential to distort advisers’ incentives. They all appear to have tangible, if not necessarily direct benefits for their clients. It seems reasonable for advisers to choose platforms that provide good quality versions of these tools and services.’

- B: tools provided by many platforms and used by many advisers. ‘We are more concerned about the second group of tools (B), as it is unclear what benefits clients get from them and they could disincentivise advisers from switching platform. Advisers’ descriptions of how these benefit their clients were mostly limited to the argument that these tools save them time or make them appear more professional.’

- C: tools provided by a few platforms and used by a few advisers. ‘Advisers use the last group of tools (C) less commonly. Most advisers told us that they are paying to use 3rd party versions of these tools elsewhere, which they say they prefer on the grounds of independence and consistency. These tools are aids for advisers when performing aspects of their financial planning service, and are subject to the same provisions on non-monetary benefits. We found that only a minority of adviser platforms make them available and that the cost of platforms providing these services appears relatively small compared to the overall cost base of platforms.’

In English, the FCA doesn’t seem concerned per se by the fact that clients are paying for these tools used by advisers. The question is, does the availability of tools create a bias in the adviser’s product/platform selection process in a way that could be detrimental to the client? Also, does the tool count as a non-monetary benefit under the inducement rules?

[bctt tweet=”The FCA doesn’t seem concerned per se by the fact that clients are paying for these tools used by advisers. The question is, does the availability of tools create a bias in the adviser’s platform selection process?” username=”AbrahamOnMoney”]

Furthermore, even if advisers can show that tools such as bulk-rebalancing do have an indirect client benefit because it makes the adviser’s process more efficient and reduces errors, there’s no evidence that advisers are passing on efficiency savings to clients by reducing their advice charge. Of course, one might argue that since most advisers have already designed their investment proposition to include the use of a platform, the efficiency savings have already been priced into the adviser fee. In other words, the adviser fee would be much higher if it weren’t for the platform. The problem is that this is a lot harder to prove.

What next?

The implication here is that if you’re using tools on platforms in category B or C above, chances are you’re receiving a non-monitory benefit from the provider.

For advisers, the options are simple:

- avoid using provider tools (in classes B and C above) completely or

- keep a comprehensive record of the tools you use as non-monetary benefits received from providers. You’ll also have to show that receiving these benefits doesn’t have an undue influence on your provider selection. For this, we’ll refer you to COBS 2.3.1R and COBS 2.3A.15R

Providers are bound to become increasingly nervous about offering these kinds of tools. This has already started. When the regulator flagged provision of pension transfer value analysis (TVAS) tools as a potential breach of inducement rules, at least six providers pulled this service almost immediately. Then FCA amended COBS to make it clearer that the provision and acceptance of these tools are in breach of inducement rules. The regulator noted at the time:

‘We consider it is unlikely that providing or accepting free TVA or appropriate pension transfer analysis (APTA) software would fall within the narrower definition [i.e., the smaller class of non-monetary benefits that fall outside the inducement rules] and so should not be used.’

Now, some providers may choose to continue to offer these tools but charge advisers separately. But I don’t see this flying with advisers who have been used to getting the tools for free. Alternatively, platforms could simply go back to basics – i.e., they provide custody, administration and reporting services to advisers with no tools for bulk-rebalancing, retirement modelling, and planning, etc.

Either way, it looks like we are seeing the beginning of the end for free tools from providers. This isn’t necessarily a terrible thing, as providers’ tools are often inferior compared to independent third-party tools. Across the pond in the US, platforms tend to provide bare-bone custody and administration, and they make data available for third-party software providers for rebalancing, tax optimisation, and reporting. The benefit of this is that platforms can actually focus on getting the basics right, and leave advanced features and functionality to specialist software providers.

[bctt tweet=”It looks like we are seeing the beginning of the end for free tools on the adviser platforms. This isn’t necessarily a terrible thing, as providers’ tools are often inferior compared to independent third-party tools. ” username=”AbrahamOnMoney”]

Presumably, advisers will demand lower costs for bare-bone platforms if they have to pay for third-party tools elsewhere. This is likely to impact the financial performance of platforms.

Either way, I believe third-party tools will thrive.

- Integration between platforms and third-party tools will become more crucial than ever. Back-office systems may once again have a chance to become the hub for most advisers’ activities by being the link between platforms and third-party tools. Intelliflo is already leading the charge in this regard with its API which gives a third-party access to its data.

- The UK adviser technology space has experienced anaemic growth, partly because advisers have been content to settle for free but inferior tools available via product providers. As inducement rules and regulatory pressure limits providers’ ability to offer free tools, advisers will have no choice but to pay for best-of-breed tools. This will no doubt be positive for adviser fintech businesses and ultimately, for advisers!

Good post Abraham, but I disagree with your comment “In other words, the adviser fee would be much higher if it weren’t for the platform. The problem is that this is a lot harder to prove”. These tools save time and increase accuracy, both of which reduce cost.

If you get rid of these tools and the time an adviser takes to complete a review increases or the costs (and extra time leading to more costs) of correcting errors increases, then these extra costs will have to be picked up by someone.

Either the client pays, or adviser profitability reduces. If you reduce profitability and margins then you cannot invest for the future and a serious error or unexpected bill sends you to the wall (just ask Carillion!).

Brilliant and thoughtful article. It seems to be a natural evolution. However, how do we get through the ensuing chaos in between?

Using anything offered ‘free’ provided by a product provider (and that includes ‘free’ golf and rugby tickets) immediately compromises the adviser/advice firm.

Remember Standard Life’s Tillinghast Tower-Perrins asset allocation tool? Low risk/medium risk and high risk investors all shoehorned 25% into Standard Life’s commercial property funds. Kerching! The Selestia asset allocation tool on the other hand suggested 0% to commercial property.

Not forgetting the hopelessly inaccurate (and indefensible) product provider ‘free’ defined benefit pension transfer analysis reports – bridging pension missed off, benefits undervalued and critical yields understated. I was at and O and M training event where we picked these acts of fiction apart. So, perhaps a widely available and recognisable portfolio valuation tool is fine but any ‘provider tools’ more complex than that represent a risk and a potential conflict of interest to the end user. Perhaps the FCA are not interested but IFAs and FAs should be. When the claims comes in you’ll see clearly that product providers are not your friend.