Parmenion was one of the very few decent platforms. The tech is good, the service isn’t too shabby, and the UI doesn’t make you want to puke. Which is more than you can say for most adviser platforms.

At 30bps, it not cheap – but many advisers use it because the discretionary rebalancing for its passive portfolio on the platform was ‘free’ i.e. included in the price. Alas, the folk at Parmenion now have a different idea. From January 2022, Parmenion is increasing fees for passive investors, to pay for its fee reduction for active.

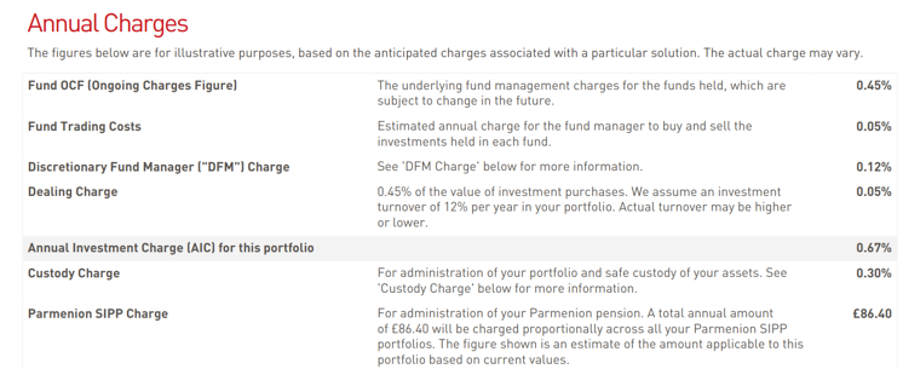

But it’s apparently not enough they’re introducing 0.12% for passive portfolio, which you might say is fair enough, but they are throwing the entire platform sector back to the dark ages by introducing fund switching/rebalancing fees. This, according to Parmenion, translates to a further 0.05% a year, taking the total fee for the DFM rebalancing on passive portfolio to 0.17%.

Effect from January 2022. The following changes will be implemented:

- The annual Discretionary Fund Management (DFM) charge for their active solutions will fall to 0.24%.

- There will be a new annual DFM charge for Passive solutions of 0.12%.

- There will be a new dealing charge of 0.45% for fund switch and rebalance purchases across all solutions. This is a reduction from 0.90% on active solutions and an increase from zero on passive solutions.

- They are introducing a new minimum monthly custody charge of £5 per client.

- There will be a new Parmenion SIPP charge of £18 a quarter (£72 a year) plus VAT.

So, in summary, they have reduced the charges for ‘active DFM’ and increased it for passive’ solutions.

The price for Parmenion’s active portfolio has always looked extortionate to me, but I also figured that advisers who insist on propping up the asset management industry by paying over the odds for underlying active funds – and for someone to shove these funds about – deserve whatever treatment they get. What I hadn’t realised is that Parmenion charge separate fund switching fees on top on its DFM fee.

They don’t stop there. They are also introducing a £86.40 a year fee on SIPPs, in addition to the 0.30%! Who knows what they’re smoking, but it must be pretty strong stuff!

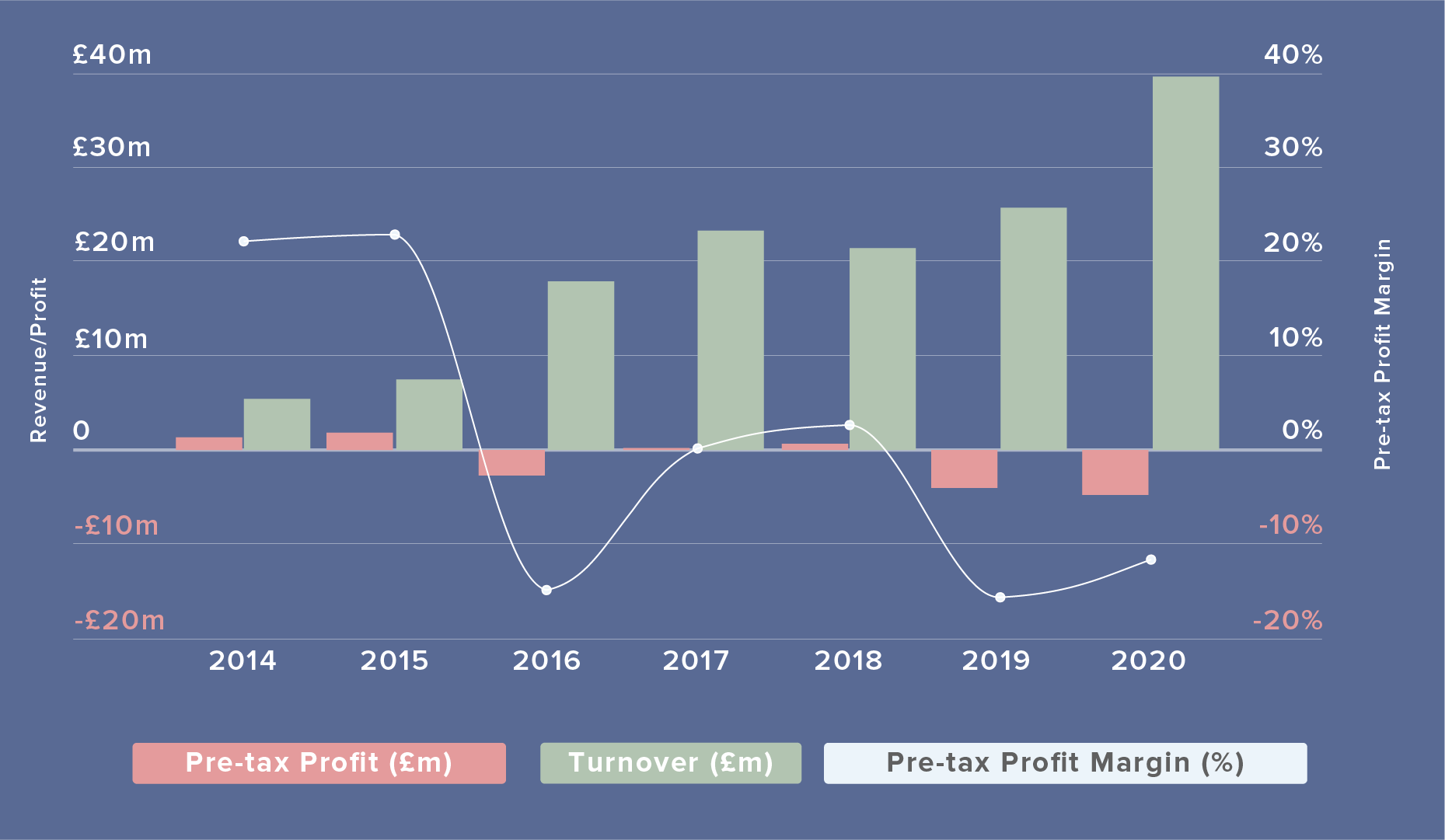

Parmenion was well run and previously ranked well on the annual FinalytiQ Platform Profitability Rating. Until Aberdeen, and then SLA, stuck their dirty fingers in. As it turns out, Parmenion never really fitted within SLA’s overall strategy, and having turned what was a very profitable business into a loss-maker, no thanks to the significant increase in administrative costs, and a proposed partnership with Virgin Money that never materialised, SLA finally pulled the plug and sold it to PE house Preservation Capital for a reported £102m. That’s twice what Aberdeen paid for it 5 years ago.

And as soon as the PE folk got involved, Parmenion put up its price. Many advisers are nervous about an influx of PE money into the platform industry, but I am not sure what the alternative is. Platforms, like any business, need stable capital to grow, and that has to come from a strategic interest from existing players (the previous status for Parmenion i.e. its ownership by SLA), direct public listing (which Parmenion is clearly not ready for) or Private Equity. As we noted in our latest platform report, c£3bn of transactions have taken place in the platform market in the past year, and most of that comes from PE. (Side note – Advisers often conflate PE with VC, but they are distinctly different. VC is essentially about backing early-stage companies on a mission to disrupt a sector and build new stuff. PE typically invests in mature businesses with proven strategies where they believe value can be extracted in the medium-term, through exits in the public market or corporate sale.) No one should expect PE capital to fund some kind of innovative technology or propositional development. The focus shifts to delivering value for shareholders in preparation for the ultimate exit.

Parmenion is obviously banking on advisers staying put. If history is anything to go by, they might be right. The platform sector has learned that advisers would rather stick a pin in their own butt than move off a platform that’s heading in the wrong direction. Since the sale of Cofunds to Aegon in 2016, and the subsequent shambolic platform migration, advisers have inadvertently reinforced the message that they and their clients can be taken for granted by platforms/providers. Is it therefore any surprise that opportunistic PE investors are queuing at the door to buy and merge platforms, and once they get their hands on the price jewel, they can do pretty much anything they want. Advisers will moan and groan but sadly the assets stay.

It makes no sense for advisers investing in low-cost portfolio or index funds to continue to keep their assets on Parmenion. But the only weapon advisers have in combating this type of insane price increase is to vote with the client’s assets.