‘We have been growing customers for General Motors’ observed Lewis Crusoe, a vice-president of the Ford Motor Company in the 1950s.

Mr Crusoe was talking about a well-known problem at the company; low-income Ford owners were trading up to a medium-priced car from its big rival General Motors, as soon as their earnings rose above a certain level.

To address this problem, Ford invested over $250 million to design a new model, the Ford Edsel, especially aimed at the mid-market.

It was launched amidst an obscene fanfare and Ford expected to sell 200,000 Edsels in the first year alone. Well, things didn’t quite work out that way. As John Brooks observed in his book Business Adventures:

‘To be precise, two years two months and fifteen days later Ford had sold only 109,466 Edsels, and, beyond a doubt, many hundreds, if not several thousands, of those were bought by Ford executives, dealers, salesmen, advertising men, assembly-line workers, and others who had a personal interest in seeing the car succeed. The 109,466 amounted to considerably less than one per cent of the passenger cars sold in the United States during that period, and on November 19, 1959, having lost, according to some outside estimates, around $ 350 million on the Edsel, the Ford Company permanently discontinued its production.’

The latest news in robo land is that Nutmeg is piloting one-on-one human advice for £350 a pop. Launched in 2012 as a digital investment firm, Nutmeg now has over £1bn + in assets. So far though, it’s burned £41.8 million of the £70 million funding it raised! At this stage, it’s hard to say that Nutmeg has been a roaring success.

But Nutmeg won’t be the first robo-advice firm to provide human advice. Across the pond, Betterment recently introduced referrals to human advisers through its Betterment Advisor Network. JempStemp and FutureAdviser changed their business model from B2C to B2B, effectively becoming a sales tool for banks and financial advisors after being acquired by Invesco and BlackRock.

The question is this: why are robo-advisers switching to offering human advice, the very thing they started out to compete against?

My guess – and it’s only a guess – is that D2C robos have recognised that most people with sizeable wealth actually do need or want a human to help them make sense of it. They want more than portfolio management.

Most users of D2C robo-platforms are customers that human advisers won’t deal with anyway. But the bad news for robos is that these people will build their wealth over time and many will eventually want the help and guidance of a human adviser. In other words, robo-advisers have been growing customers for human advisers.

[bctt tweet=”Robo advisers came into the market wanting to eat human advisers’ lunches, but instead, over the last five years, they’ve been busy cooking a sumptuous feast for them without realising it.” username=”AbrahamOnMoney”]

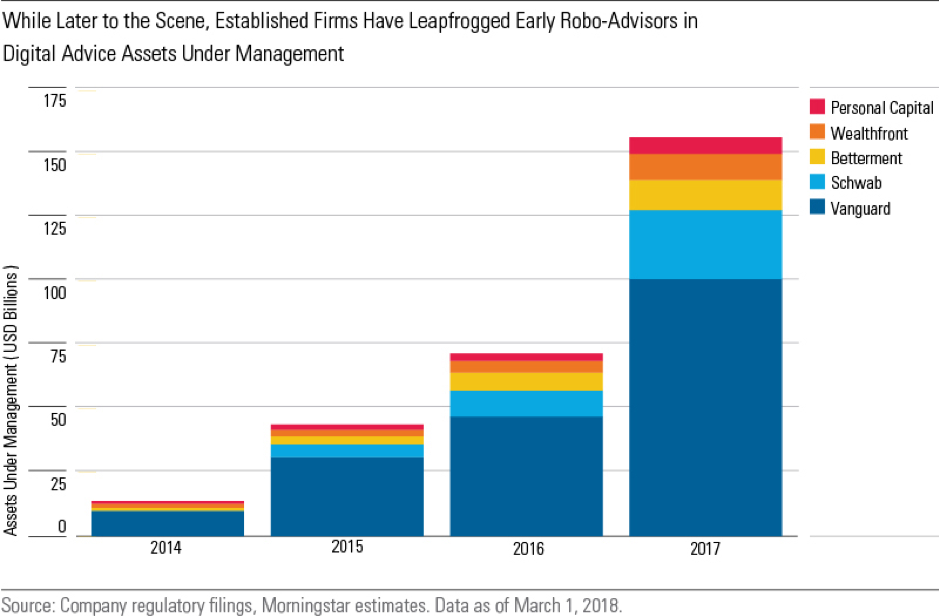

It turns out the most successful and fastest growing robos are those who combine both digital and human advice – cue Vanguard PAS, which offers a digital portfolio and access to a CFP for 30bps. It now has over $100 billion in assets, which is more than all the robo start-ups combined.

So, in an attempt to attract hitherto hard-to-reach clients, robos are trying to out-human human advisors by err… becoming more human.

In a way, this should worry us. I am not worried that robos are trying to digitise basic financial planning. I’m more worried about the fact that so far, they’ve failed miserably.

The reality is that 90% of people don’t have access to human financial advisers. These people will benefit from robos the most. They’re the proverbial low-income Ford users. They are the GM owners of the future. But robos are simply not serving these people successfully. And rather of trying to figure out how best do it, they’re pivoting their services to sell Fords to GM owners.

Nutmeg’s price point of £350 is unlikely to appeal to people who need the comprehensive advice that human advisers provide. And it may be a bit much for those just looking to set up an ISA.

There’s a real risk that ultimately, they end up failing to serve either market segment successfully.