One area we looked at in the latest multi-asset fund research is whether multi-asset managers can justify their existence (and high fees), by pointing to the alpha they generate. This is the return they can bring in, over and above the market portfolio.

To illustrate this point, we looked at the alpha for the last five years of multi-asset funds. For this assessment, we divided multi-asset funds into five risk categories, based broadly on their asset allocation and volatility of each fund. Each risk category includes funds aimed at clients with similar risk profiles.

Then we examined the alpha delivered by each fund. The alpha here is the difference between the performance of a fund and the performance of a comparable Vanguard LifeStrategy fund. We chose LifeStrategy because it represents a real-life attempt to capture the global market portfolio returns, for as low a fee as possible.

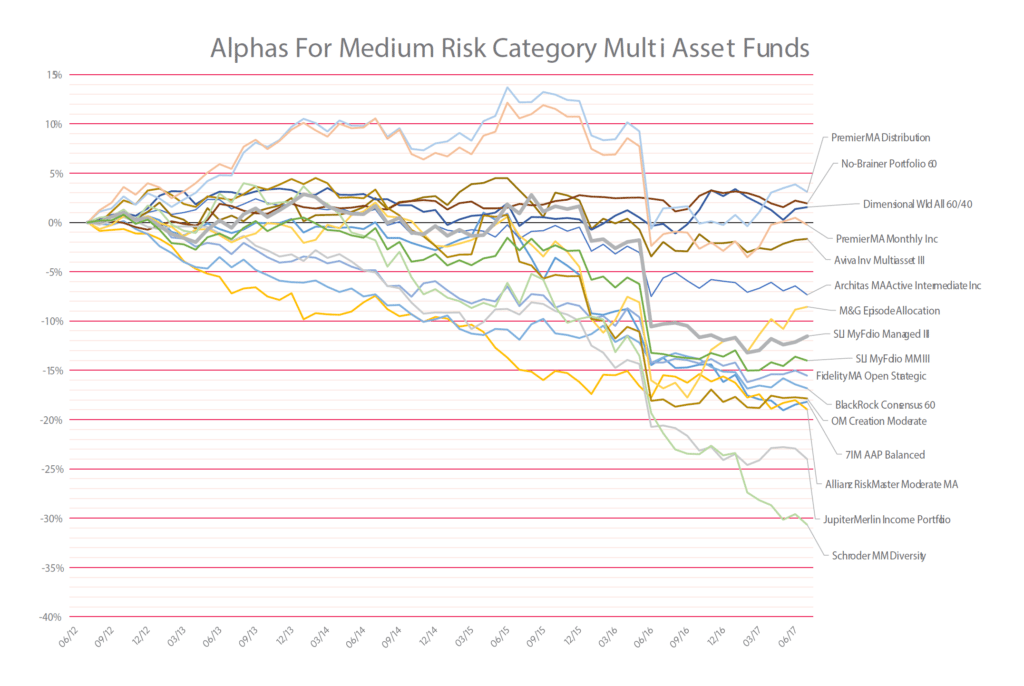

The chart below shows the alpha for a selection of multi-asset funds in Medium Risk Category, compared against LifeStrategy 60 fund.

The results are clear; whatever level of risk you chose to take, an overwhelming majority of multi-asset funds delivered negative alpha! Sadly, most multi-asset managers aren’t able to justify their costs. Indeed, most of them have damaged returns substantially over the last five years.

Many of these funds underperformed an equivalent Vanguard LifeStrategy by as much as 10% to 35% in the last five years!

I can hear people say ‘ but we’ve had an incredible bull market over the last five year’. Yes, but is it worth giving up 10% to 30% return over the last five years, in the hope of avoiding a possible market correction? That’s one hell of a price to pay!

The implication is that people investing in these funds are being asked to pay extra for negative alpha!

[bctt tweet=”Is it worth giving up 10% to 30% return over the last five years, in the hope of avoiding a possible market correction? ” username=”AbrahamOnMoney”]

–

One active and passive DFM that I spoke to recently suggested that as markets may be at a peak, it is a time for me to move my passive to active strategies (35bps more on the DFM charges).

For clients who are educated well by advisers to hold a balanced portfolio (in terms of asset allocation, not risk) then ultimately I cannot see how active can be better apart from by the skill of a fund manager, which may well change year on year, and active does really mean chasing a return. At a 10-35% cost to the client as you suggest, that’s a massive expense for the hope that you might beat a benchmark.

You have not measured “alpha” here or anything of the sort. You have compared a handful of multi asset strategies and then extrapolate the past performance of the Vanguard fund as a guide to it’s future outperformance. I thought there were rules against that?