Most of today’s portfolio management theories and practices are primarily designed to optimise return and manage risk during the accumulation stage of investing. However, there is an increasing acknowledgement of that investing for income in retirement is markedly different than investing in the accumulation stage. This is particularly due to how withdrawals amplify sequence risk in retirement portfolios. Client’s objective in retirement changes drastically from simply maximising long term return to supporting monthly/annual income, for what is finite but precisely unknown period of time.

Yet, in many cases, we continue to use these portfolio management practices (e.g Efficient Frontier etc) to manage portfolios in retirement, when in actual fact they weren’t necessarily designed for that purpose since they don’t take account of impact of withdrawals and the need for portfolio longevity.

Enjoy reading this stuff? Then join us for more at the Science of Retirement Income Conference 2016!

The Received Wisdom of Rebalancing

Rebalancing is one of such practices; while there remain some questions over whether ‘Rebalancing Bonus’ actually exists (since it depends on the correlation between the expected return of asset classes in the portfolio), there is a general acknowledgement that rebalancing helps optimise risk-adjusted return and deliver a more consistent investment experience.

And when it comes to managing a retirement portfolio, common sense suggests that rebalancing – selling assets that have performed well and buying more assets that underperformed – shouldn’t do much harm to the portfolio because it helps avoid or reduce unfavourable liquidation of asset that have fallen the most. Periodic rebalancing ensures that asset that are up the most are sold, while buying the ones that are down the most! When combined with the need to take withdrawal from a retirement portfolio, common sense suggests that the rebalancing ensures that much the withdrawal are taken from the best performing asset classes, giving the asset classes that have fallen some that to recover.

Right?

But what if we don’t rebalance the portfolio at all? What if we simply make withdrawal from the asset classes that have fallen the most and avoid rebalancing the portfolio? Or better still, what if we liquidate assets within the portfolio based on their relative expected return and again, avoid rebalancing altogether? In other words, since bonds have lower expected return than equities, what if we liquidate the bonds first to pay income, giving the equity allocation more time to grow? Put another way, what if you eat your bonds first, equities later?

[bctt tweet=”In a retirement portfolio, liquidating bonds first, equities later introduces time-diversification” via=”no”]

Time Diversification

In a retirement portfolio, ‘eating bonds first and equity later‘ introduces the concept of time-diversification; the idea that the longer you hold equities for, the higher the chances outperforming bonds. According to Barclays Equity Gilt Study, since 1899, equity outperformed bonds 73% over any 5 years period, 79% of times over any 10 year period and 88% of times over any 18 years period. The point is, the longer you hold equities, the probability of experience bad outcome reduces.

Accordingly, when thinking about spending retirement portfolio, does it makes any sense to diversify across time by spending bonds first (which is less risky in the short term but with lower long term expected return), giving the equity allocation more time to grow?

And does rebalancing (which effectively trounce this benefit of time diversification) actually reduces portfolio longevity, thereby resulting in poorer outcome in a retirement portfolio?

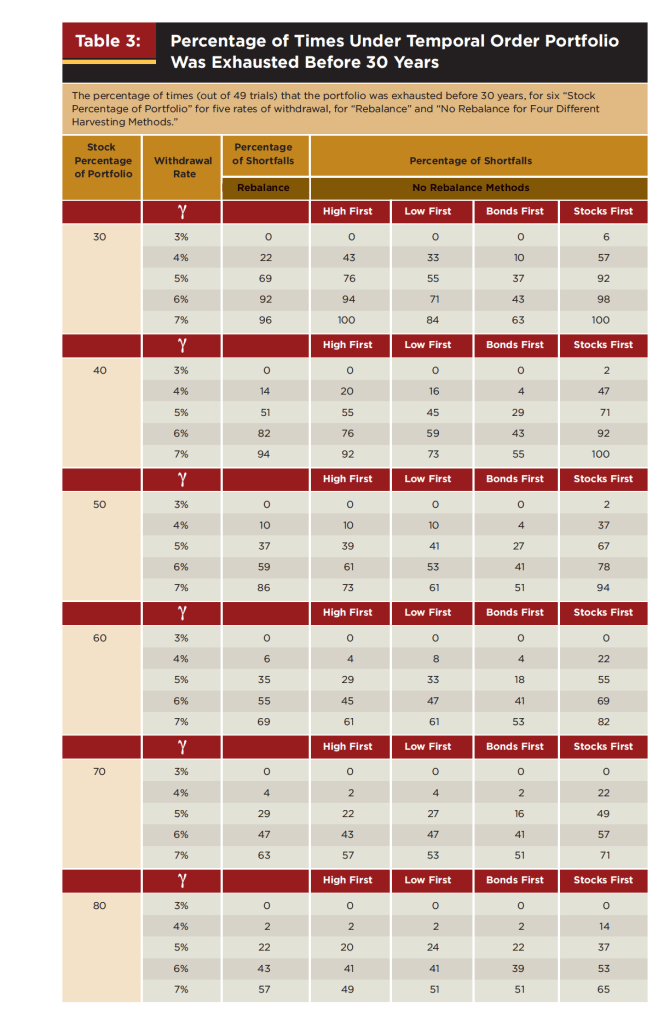

This a question that John Spitzer and Sandeep Singh tried to answer in their paper titled Is Rebalancing a Portfolio During Retirement Necessary? which was published in the Journal of Financial Planning. The modelled the following 5 liquidation strategies, across different asset allocation (30%, 40%, 50%, 60%, 70%, 80% equity) and inflation adjusted withdrawal rate (3%, 4%, 5%, 6% and 7%) assuming a retirement period of 30 years;

- Withdraw money from either stocks or bonds and then rebalance the portfolio annually to the initial stock/bond proportion. This harvesting rule will be referred to as “Rebalance.”

- Withdraw money from the asset that had the highest return during the year and do not rebalance. This will be referred to as “High First.”

- Withdraw money from the asset that had the lowest return during the year and do not rebalance. This will be referred to as “Low First.” To the extent that historical rates of return on bonds tend to be lower than historical rates of return on stocks, the following two additional methods of harvesting withdrawals will be referred to as “Bonds First” and “Stocks First.”

- Take withdrawals from bonds first and do not rebalance.

- Take withdrawals from stocks first and do not rebalance.

Spitzer and Singh modelled these strategies using both historical market data between 1926 and 2003 (which included 49 overlapping 30-year retirement periods for example, 1926–1955, 1927, 1956…1974–2003 as well bootstrap simulations.

The Result!

The result of the of the historical simulations presented below, shows that time-diversification does have a remarkably positive effect on portfolio longevity (but only if you spend bond allocation first) compared to a rebalancing strategy. In virtually all the scenarios, it pays to eat your bonds first, equities later.

For instance, using 60/40 equity/bond allocation and withdrawal rate of 5% (of the initial portfolio, adjusted for inflation) over 30 years, time-diversification improved the failure rate from a whooping 35% to 18%! In other words, time diversification improved the probability of success from 65% to 82!

They noted that…

While the wisdom of rebalancing in the accumulation phase of the life cycle is widely accepted, the wisdom does not appear to extend to the withdrawal phase. In both the bootstrap analysis and the temporal order analysis, Rebalancing during the withdrawal phase provides no significant protection on portfolio longevity. This conclusion appears to hold for withdrawal periods of 15, 20, 25, and 30 years. The temporal order ( i.e historical) analysis suggests Rebalance increases shortfalls and, in fact, is harmful.

The conclusions on the efficacy of depleting bonds first (and hence not rebalancing) may seem risky. Suppose that an investor has a 50/50 stock/bond portfolio at the onset of retirement. If the bonds are withdrawn first, over a period of, say, 12 years, the stock component of the portfolio has had 12 years to grow undisturbed by withdrawals. Even though stocks are more volatile, this 12-year hiatus could have allowed a significant increase in the stock part of the portfolio. Both of the shortfall analyses demonstrate that one is no more likely to run out of money using this strategy than if one rebalances. While one can argue that the retiree’s portfolio will get more and more volatile over time as fewer and fewer bonds remain, the evidence does not suggest that shortfall is less likely with rebalancing. It then becomes a matter of how risk is viewed—as portfolio volatility (return variance) or as shortfall risk

The Caveat

Of course, this is not to say rebalancing a retirement portfolio in itself in bad; only that it’s likely to produce sub-optimal outcomes when compared to an effective time-diversification strategy. The caveat is that, adopting time-diversified withdrawal will invariable increase the equity allocation within the portfolio. As you spend down the bond allocation,you end up with more and more equity, as a percentage of the overall portfolio. This in turn increases the volatility within their portfolio, which the client may find uncomfortable. This also goes back to the conversation about how we measure risk, particularly in retirement; is volatility the real risk or is it running out of money?

In addition to all this, we have to take account of the regulatory environment that we operate in, FOS is unlikely to look kindly on a 60% equity portolio that ended up being 90% equity portfolio 10 years later. I was horrified (yet again) few days ago when FOS upheld a complaint against an adviser in spite of the client suffering no financial loss whatsoever, because they had too much equity allocation!

This constant battle between empirical evidence, client’s behavioural biases, established industry norms and incompetent/overzealous regulatory bodies makes a planner’s job more difficult. Yet, I recently had a discussion with a planner who told me they view their job primarily as a behavioural coach to clients; and will specifically encourage, educate and seek informed consent from clients to take more equity risk than their ‘risk tolerance’ might suggest, provided the client has the capacity and/or requirement to take such risk. This is no path for the fainthearted!

So what do you think? Would you dare tread this path or just stick to conventional wisdom?

Enjoy reading this stuff? Then join us for more at the Science of Retirement Income Conference 2016!

.

Hi Abraham.

The problem with this analysis is that it assumes that there are only two asset classes – shares and fixed interest stock. The analysis seems to have forgotten about cash and property (and they seem to have forgotten that fixed interest stock isn’t one homogenous asset class).

Logically, the analysis could be extended, so that you treat cash as being a very low risk form of fixed interest stock, whilst property and higher risk bonds are like equities. But, just assuming that wouldn’t be very scientific. If you expect similar returns from property and equities over the long run, which one do you harvest first?

I’m guessing that Spitzer and Singh didn’t use UK data in their analysis (most of this type of research seems to be based on US data). There seems to be an assumption that the results for the UK and the US would be the same. Again, that’s bad science. Particularly when you consider the lack of choice (industries, sector and quality companies) available in the UK stockmarket, and the lack of choice in the UK fixed interest market (loads of gilts to choose from, but the corporate bond market is small); UK investors are forced to invest overseas to get proper diversification, whilst US investors don’t have to.