Or why clients don’t see risk the same way as you do.

One question that keeps popping up over the last few weeks is whether volatility as a measure of risk is flawed. This is due, in part, to massive surge in the number of risk-targeted multi asset funds. There are now over 225 funds in the newly created FE Analytics Risk Targeted Multi Asset Solutions category, with the vast majority of them using volatility as a measure of risk. Also, most risk profiling tools use volatility as their measure of risk.

This widespread approach to define risk as volatility, which is determined using statistical measures of variance a (standard deviation) is a real concern. Standard deviation is simply a measure of absolute volatility that shows how much an investment’s return varies from its average return over time. The problem with this is that it is a vast contrast to how clients often see risk. Clients tend to view risk as the probability of a loss on their investment or likelihood of having a shortfall in the amount required to meet their objectives (i.e risk of a shortfall).

Accordingly, the volatility of a portfolio doesn’t tell you the full story. One way to think of volatility is to think about investing in terms of the journey and the destination. Volatility gives you an indication of how much of a roller coaster ride to expect along the way, but little or no indication if you will arrive (safely) at your destination within the given timescale. It tells you nothing about the chances of an accident on the way.

Don’t get me wrong, from a portfolio point view; volatility is a useful proxy for risk. But it is it only one measure. And the attempt, especially by fund managers and risk-rating agencies such as Distribution Technology, to link risk inextricably to volatility has resulted in proliferation of risk-targeted funds, mapping portfolios to client risk tolerance based entirely on volatility. While the intention to make life easier for advisers (and in the process sell funds) is noble, it does not give advisers with a meaningful framework to show what risk actually means to clients or recommend the most appropriate portfolios.

Take for instance, two clients with the same risk tolerance score of, say 5 out 10. One is investing for 30 years; with a high probability they are not going to meet their goal (say 60% replacement income in retirement). The other is investing to pay grandchildren’s school fees is 5 years and based on the sum invested, there’s a good chance of meeting this goal. Do they get the same portfolio?

Using volatility as the measure of risk would suggest that they do. Both clients get Portfolio 5, assuming they have both have the capacity to withstand potential losses. After all, the result of the risk tolerance test suggests that both clients are prepared to accept similar level of risk. However, using other measure of risk, specifically the probability of a nominal lost in capital or the risk of a shortfall, you may well arrive at a different conclusion and different portfolios for those clients. My point is this idea of mapping risk-targeted funds to clients risk tolerance based on volatility, doesn’t give advisers a meaningful framework to make this decision.

Is volatility is a useful proxy for risk within a portfolio? Yes, but it’s not the only thing we look at. I prefer to take a far more holistic view of risk and there are three key measures that may be prove more useful.

- Probability of loss and its potential magnitude

What many clients are really interested in is ‘how likely is it that I’m going to lose money?’ and ‘how much am I likely to lose?’ The table below shows back-tested data of worse and best returns for our ßetafolio 50 portfolio over specific timescales.

|

1 Year |

3 Years |

5 Years |

10 Years |

15 Years |

|

| Worse Annualised Return |

-12.83% |

-1.93% |

3.03% |

4.72% |

5.86% |

| Best Annualised Return |

40.77% |

21.72% |

15.65% |

12.85% |

10.38% |

Source: Dimensional Returns Program 2.0. (Data since 1989)

So in our scenario of two clients, using volatility as a proxy for risk means that these clients end up in the same portfolio but ultimately different risk profiles, given their investment horizon.

On the contrary, using the probability and magnitude of losses to engage in meaningful conversation with clients is a far more meaningful way of bringing risk to live, not just when the investment is being made but in difficult market periods when client might want to bail.

- Portfolio Drawdown (peak to trough)

‘If have one foot in boiling water and one foot in blocks of ice, on average, your body temperature would be normal.’

Or so goes the saying. Volatility shows how much an investment’s performance varies from its average return over time. The problem with this is failure to take account of fat-tail risk – these potentially extreme, yet possible negative returns that are outside of the normal distribution.

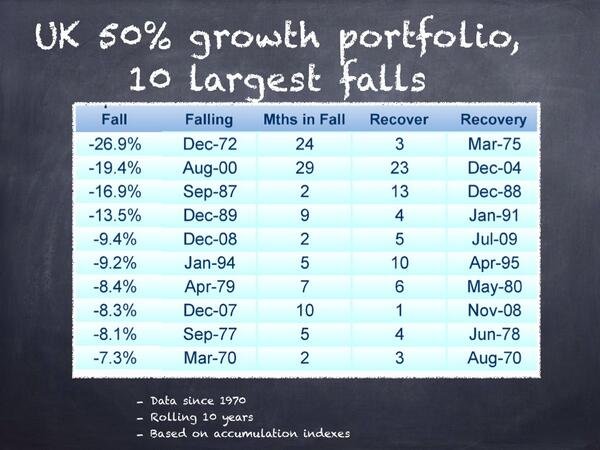

If you are on Twitter, you might have seen the table below, which I nicked from Paul Resnik

Showing clients the drawdown from a previous high – peak to trough, is a great way to demonstrate potential downside within the portfolios and prepare clients for the worse. To quote Paul Resnik, ‘clients should never be surprised.’

- Shortfall Risk

From a financial planning point of view, risk of shortfall in required capital or income gives the clients an idea how likely they are to meet their goals, with a given portfolio. Again, this information is never reflected in your volatility. It is essentially a financial planning metric and not an investment metric as such. Cashflow modelling to the rescue!

The resulting conversation may well be that client is willing to save more, work for longer or choose a different portfolio but the key is to have a meaningful framework that allows planner/client make the best decision.

Conclusion

I think the industry’s obsession with volatility, as the only measure of risk is largely unhealthy. And the idea of risk targeted multi-asset funds relying predominantly on volatility as a proxy for risk is even more worrying. Interestingly, I think we’ll see more and more risk targeted ‘solutions’ in the near future. Well, at least until we see a major industry-wide incidence around mismatching of risk! Anyone else remember with-profits funds? Risk targeted multi asset funds may be the new with-profits. They are great until they stop being great.