The overwhelming conclusion of The Great Guide to Risk-Rated Multi-Asset Funds is that multi-asset managers have no asset allocation, manager selection or risk management expertise worth paying for. Judged against simple low-cost equity-bond portfolios constructed by a novice investor (dubbed ‘Brainless Portfolios’), most multi-asset funds systematically damaged returns on a risk adjusted basis and reduce the chances of an investor meeting their return objectives.

To unpack a little bit more, we compare the performance of the Standard MyFolio range to the Brainless Portfolios and the Vanguard LifeStrategy. As discussed extensively in a previous post, the return obtained by investing in our ‘Brainless Portfolios’ is the return that the market ‘freely’ gives to the clients for accepting the corresponding risk (or volatility). These portfolios make no active asset allocation or manager selection decisions.

- To request a free excerpt of the report, please complete the form below

We’ve selected the MyFolio range because it’s one of the most prominent risk-rated multi-asset fund ranges in the marketplace with well over £10 billion of clients’ assets. According to the documents on Standard Life’s website

‘MyFolio aims to maximise returns for your selected level of risk through our innovative asset allocation approach using the range of selected asset classes… a strategic asset allocation benchmark is designed to generate the highest expected return for the given level of risk in each fund’.

There are 5-ranges, each consisting of 5 funds representing one of the 5 risk profiles. So there are 25 funds in total.

- Standard Life MyFolio Market range is constructed using underlying and there are 5 funds, one in each of the 5 risk profiles.

- Standard Life MyFolio Managed range is constructed using SL’s own funds and there are 5 funds, one in each of the 5 risk profiles.

- Standard Life MyFolio Multi-Manager Income range is constructed using SL’s own active funds with a particular focus on creating income through equity dividends, bond yields and property rental income. There are 5 funds, one in each of the 5 risk profiles.

- Standard Life MyFolio Multi Manager range invests in ‘carefully selected actively managed funds from some of the leading managers in the market’. There are 5 funds, one in each of the 5 risk profiles.

- Standard Life MyFolio Managed Income invests in ‘carefully selected actively managed funds from some of the leading managers in the market’ with a particular focus on creating income through equity dividends, bond yields and property rental income. There are 5 funds, one in each of the 5 risk profiles.

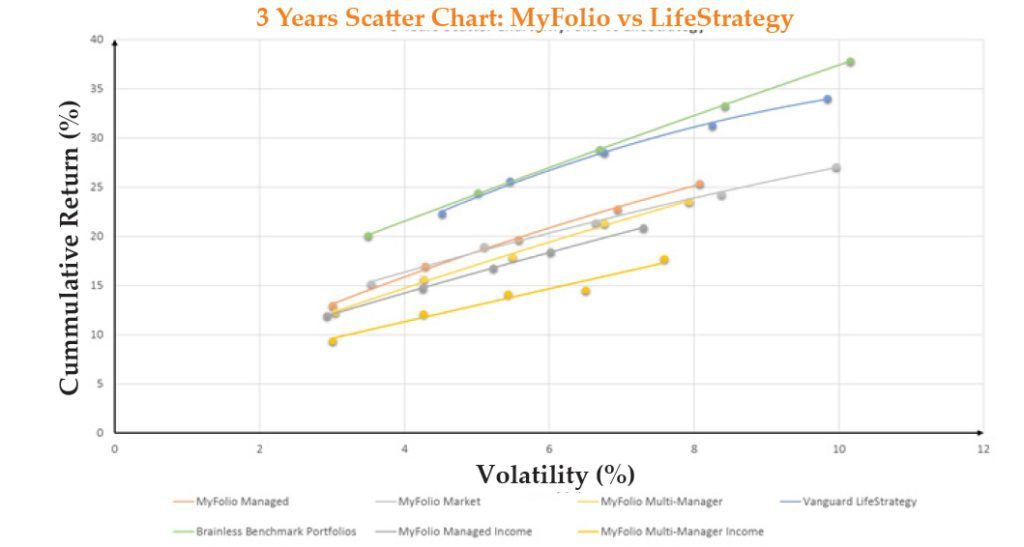

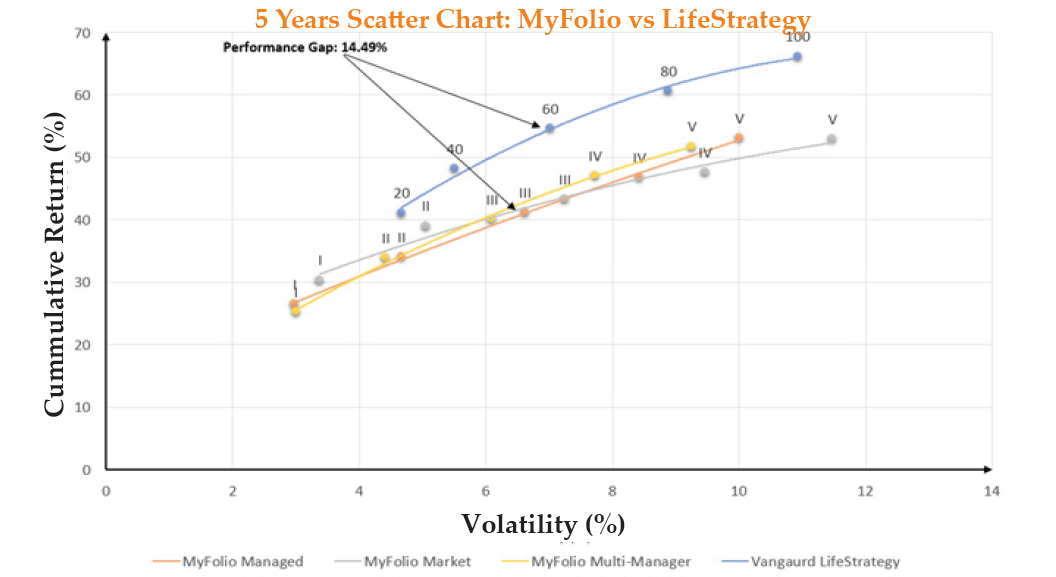

The scatter charts on below show the MyFolio ranges pitched against our ‘Brainless Portfolios’ and the Vanguard LifeStrategy funds over a 3 and 5-year period. The MyFolio Managed Income and Multi-Manager Income ranges were launched less than 5 years ago so don’t have 5 years’ performance data.

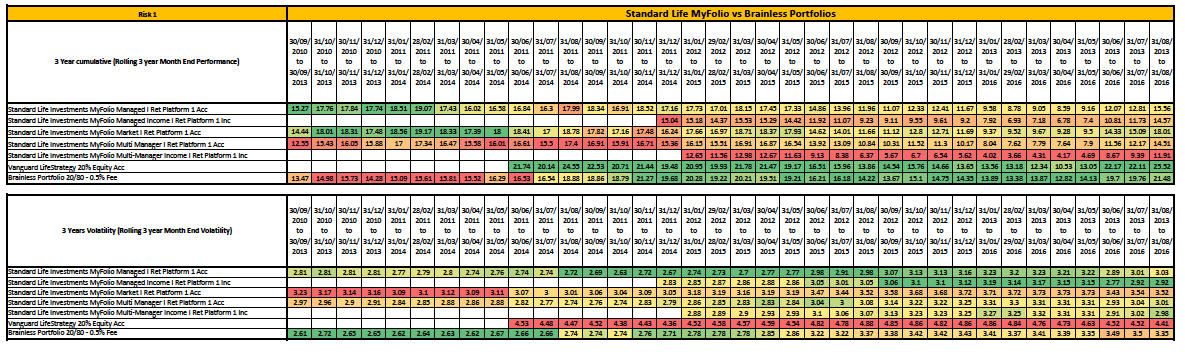

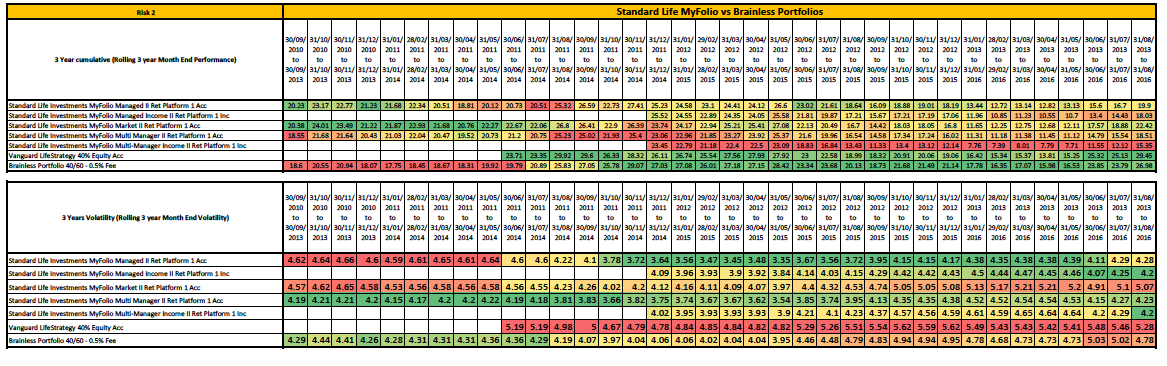

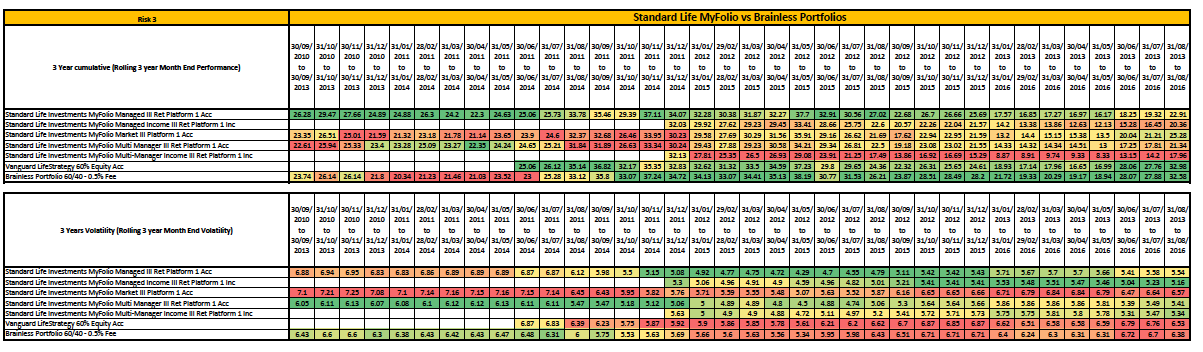

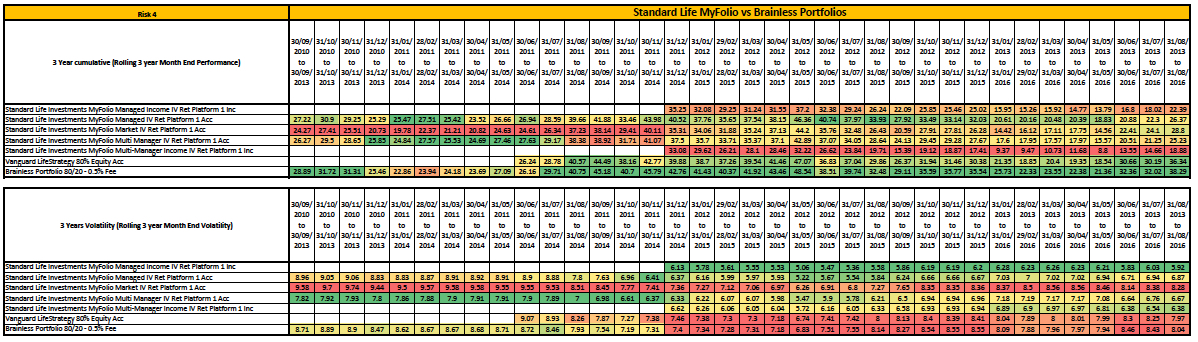

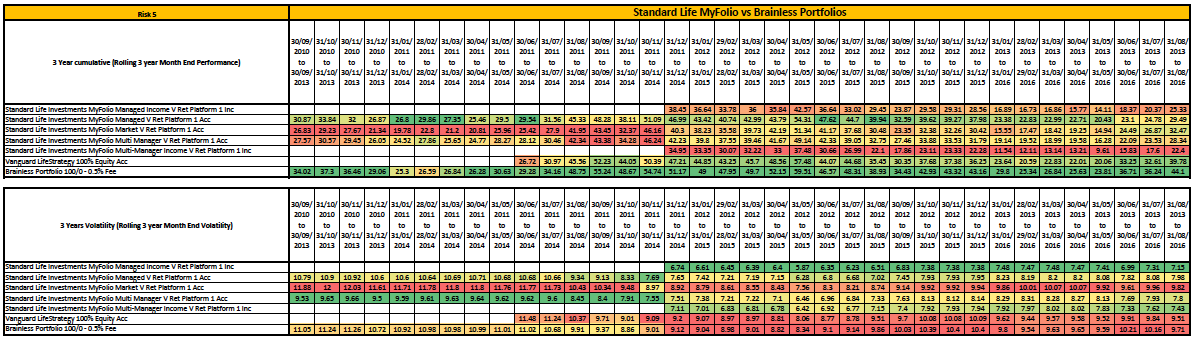

If like me, you are a data junkie, please see the bottom of this post for 3 year monthly rolling returns and volatility at the bottom of the post.

Moving investors away from their goals

These results demonstrate that without exception, all Standard Life’s Myfolio ranges consistently deliver poorer outcomes than our ‘Brainless Portfolio’ and its real life implementation Vanguard LifeStrategy over 1, 3 and 5-year period. The implication is that MyFolio funds do not adequately compensate clients for the risk they are taking. Instead the MyFolio range detracts from the ‘free’ return achieved without much effort by a skill–less investor. It significantly reduces a client’s prospect of achieving their goals.

Effectively, clients are paying MyFolio to move them away from their investment return goals.

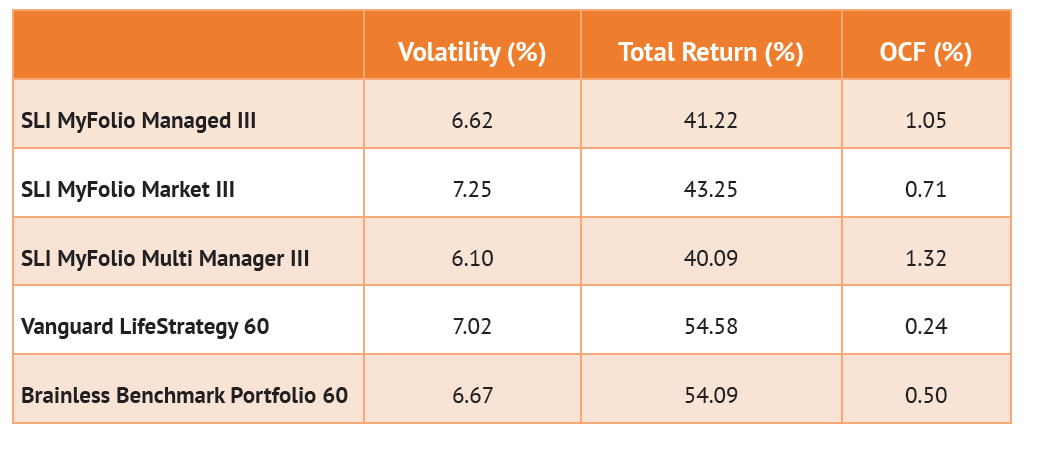

Suppose after a risk profiling process and in-depth questioning, an adviser establishes that a client is willing and able to accept a 6-8% volatility in their investment portfolio. This puts the client in risk category 3.

[bctt tweet=”Are investors in MyFolio paying the manager to move them away from their investment return goals?” username=”AbrahamOnMoney”]

The client could either invest in MyFolio Managed Fund III, MyFolio Market III, MyFolio Multi-Manager III , the Vanguard LifeStrategy 60% or the ‘Brainless Portfolio’ 60. The corresponding cost, volatility and returns over a 5 year period are as shown in the table below.

Over a five-year period, accepting a broadly similar level of risk (volatility), clients invested in the MyFolio range receive between 11.33% to 14.49% less in return than they would have had they invested in Vanguard LifeStrategy or the Brainless Portfolio. Put another way, clients invested in the MyFolio range sacrifice up to 2.27%pa to 2.9%pa return, but accept the same level of volatility. Some of this 2.9% pays the high fees that the Standard Life MyFolio range charges. But the lion’s share of it is lost, no thanks to asset allocation and manager selection by Standard Life MyFolio.

[bctt tweet=”Investors in the MyFolio range sacrifice between 2.27%pa to 2.9%pa return, but accept the same level of volatility.” username=”AbrahamOnMoney”]

But as the high fee doesn’t adequately explain underperformance, we conclude that not only are MyFolio managers genuinely unskilful, they actually systematically damage returns. Clearly the MyFolio range fails in its aim ‘to maximise returns for your selected level of risk through our innovative asset allocation approach’ and ‘generate the highest expected return for the given level of risk in each fund’. Across the entire range, the failure to deliver any tangible value through asset allocation and fund selection couldn’t be any more obvious.

*****

- To request a free excerpt of the report, just complete the form below and we’ll email you a copy

3 Yr Rolling Returns/Volatility – SL MyFolio Vs Brainless Portfolio Vs Vanguard LifeStrategy

Click on the images to enlarge.

Risk Category 1: 3 Yr Rolling Returns/Volatility

Risk Category 2: 3 Yr Rolling Returns/Volatility

Risk Category 3: 3 Yr Rolling Returns/Volatility

Risk Category 4: 3 Yr Rolling Returns/Volatility

Risk Category 5: 3 Yr Rolling Returns/Volatility

Hi Abraham

Enjoying this series and have been waiting for someone with a bit of clout to come along and say the obvious to the providers/fund managers.

Are you getting much flak from the providers? Be interesting to hear what they have to say.

That’s what iw as thinking too…

P.s. playing devil’s advocate, would it be fair to say that the market conditions over the period you have measured naturally favour a ‘brainless’ approach and that come a falling/bear market the brainless/vanguard approach may suffer? I suppose only time will tell as the vanguard LS portfolios haven’t gone through a large market correction (like 2008/09). How did the brainless portfolios do when you measure them over a period including 2008/09 compared to the multi asset ranges?