We’re beyond thrilled to publish the second edition of the Platform Profitability Guide (2015)!

When we first published the report last year, some of you thought we are barking mad…. and you’re probably right, but the recent events in the platform market has demonstrated why profitability and long-term sustainability must be front and centre of the platform selection process.

One year seems like a long time in platform land; since our last report, a raft of events have brought the importance of profitability and the long-term sustainability of platforms to the fore. We think this is a good thing. Seven IM was sold to Caledonia and Parmenion sold to Aberdeen. L&G reportedly put Cofunds up for sale but then took it off the market and Axa is apparently looking to flog Elevate. Praemium acquired adviser back-office technology provider Plum and Alliance Trust’s management had to fight off a shareholder revolt, which was fuelled in part by worries over losses in the platform business, ATS. All of this happened in just one year and points to a struggle for survival in the rapidly changing platform ecosystem.

We know that the FCA is conducting its long-awaited thematic review into adviser due diligence, so advisers must leave no stone unturned. The purpose of this report is to help advisers assess the long-term sustainability of platforms. Profitability is crucial and should play a key role in adviser due-diligence and selection because deep pockets of a parent company just aren’t enough. The fact is, big providers with deep pockets won’t continue to fund loss-making platform subsidiaries forever. Eventually, shareholders ask questions; big businesses get reviewed; bean counters are called in; ‘restructuring’ happens and loss-making platforms are at risk of being axed by their parent company. And only when the tide goes out do you discover who’s been swimming naked.

[bctt tweet=”Big providers with deep pockets won’t continue to fund loss-making platforms forever. “]

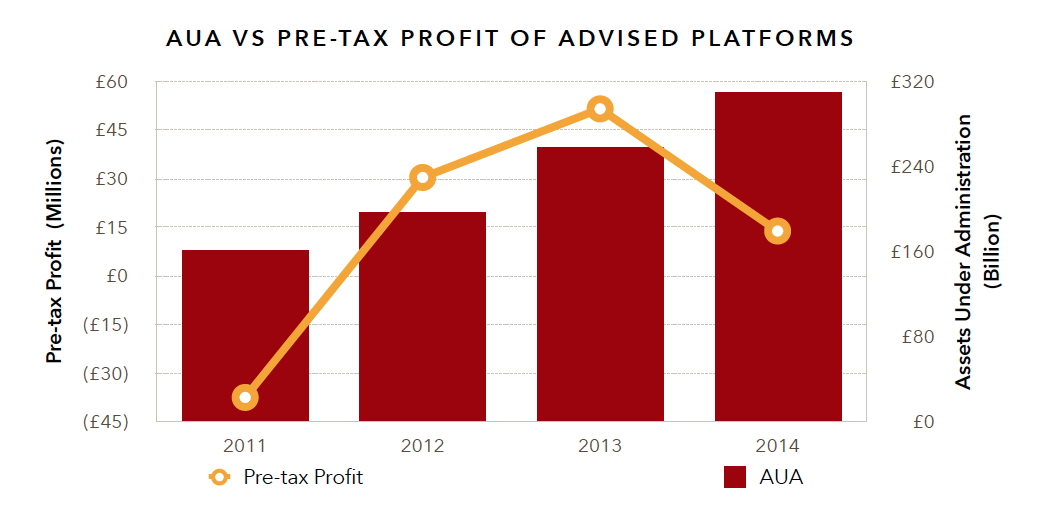

Our latest report shows that, based on accounts filed in the year ending 2014, adviser platforms reported a total pretax profit of £13.87million on total revenue of £1.02billion, a margin of barely 1.5%. This compares to a profit of £51.5million on revenue of £1.05billion, resulting a profit margin of 5% in 2013. The implication of this is that while AUA is 57% up on pre RDR levels, profit is actually lower than pre-RDR levels. This is a clear indication that the platform industry is cracking under pressure; the impact of RDR, PS13/1 and re-platforming is being felt in platform pockets. Add to that falling yield on AUA, and the spiralling cost of re-platforming, the picture ain’t pretty!

This year, 9 out of the 23 advised platforms we examined are loss-making, compared with 7 loss-making platforms in the previous year. While AUA increased by 20% on the previous year, pre-tax profit actually fell by a whopping 72%!

This guide is a detailed analysis of profitability of advised platforms over the last 4 years, including key metrics such as assets under administration (AUA), revenues, profits/losses, yield on assets and profit/loss margin over the last 4 years It covers 23 major adviser platforms, who together account for more 90% of the total AUA in the adviser market.

- To request a free excerpt of the report, just complete the form below and we’ll email you a copy ;

Platform Profitability (Twitter) Award Event – 10am on Thursday, 15th October

Join us on Thursday on Twitter as we name the Best And Worst Platforms in terms of profitability in 3 categories (Large, Medium and Small platforms).

Here’s the details of the event:

DATE: Thursday, 15th October, 2015

TIME: 10am – 10.30am

VENUE: Twittersphere

ASHTAG: #profitableplatforms

DRESSCODE: Come in your pyjamas, if you like

See you then!