They say time flies, but in financial services, it does so at the speed of light!

And what a difference a year can make! This time last year, the FCA introduced new capital adequacy requirements (PS14/12) for SIPP providers.

As we anticipated in our last SIPP Financial Stability Report report, not everyone made it to the other side in one piece. Some providers fell by the wayside in the run-up to September 2016 and the months after it.

- European Pensions Management went bust in June 2016. It was then acquired by Suffolk Life, which is part of Curtis Banks Group.

- Brooklands Pensions entered into administration and accepted a buyout deal from Heritage Pensions.

- London & Colonial has been acquired by Isle of Man based financial services business STM Group.

- Rowanmoor was acquired by Embark Group.

- Wensley Mackay was acquired by platform provider Praemium.

- Mattioli Woods acquired MC Trustees.

Like a ranging storm that wrecks havoc with everything in its path, PS14/12 orchestrated the demise of ‘mom and pop’ SIPP operators.

Many SIPP providers made it to the other side, even if not unscathed. So how life for providers who survived?

The latest SIPP Financial Stability Guide for 2017, titled ‘Life After PS14/12’ sheds some light on this. Written in conjunction with industry veteran John Moret, the report benchmarks the top 16 bespoke Sipp providers, who together account for more than 90% of the non-insured bespoke Sipp market.

Here are some of the key themes in the report;

- The SIPP industry is unraveling under the regulatory spotlight.

For years, many SIPP operators have effectively flown under the regulatory radar. The sector was riddled with sub-scale providers, under investment in technology, poor service standards, and management oversight. A year after PS14/12, this appears to be changing.

There are indications that some providers are still having a difficult time post-PS14/12. At least three Sipp providers have failed the Financial Conduct Authority capital adequacy requirements and 14 firms wrongly reported their capital to the regulator.

The impact of the FCA crackdown on providers’ retained interest is starting to feed through to the bottom-line. However, many providers are still overly reliant on interest margins.

For instance, Curtis Banks banked £4.5million revenue in nterest margins from clients’ assets, accounting for 64% of its pretax profit in 2016.

In the consultation paper CP15/30, the FCA stated that some providers were not following the rules on interest margin disclosure and thus charges comparisons between providers could be misleading. Subsequently, in PS 16/12, the FCA confirmed that from April 2017 SIPP retained interest charges should be included in projections and charges information.

[bctt tweet=”Curtis Banks banked £4.5million revenue in interest margins from clients’ assets, accounting for 64% of its pretax profit in 2016. ” username=”AbrahamOnMoney”]

- Sipp providers are better capitalised than they have ever been but there’s a wide variation between providers

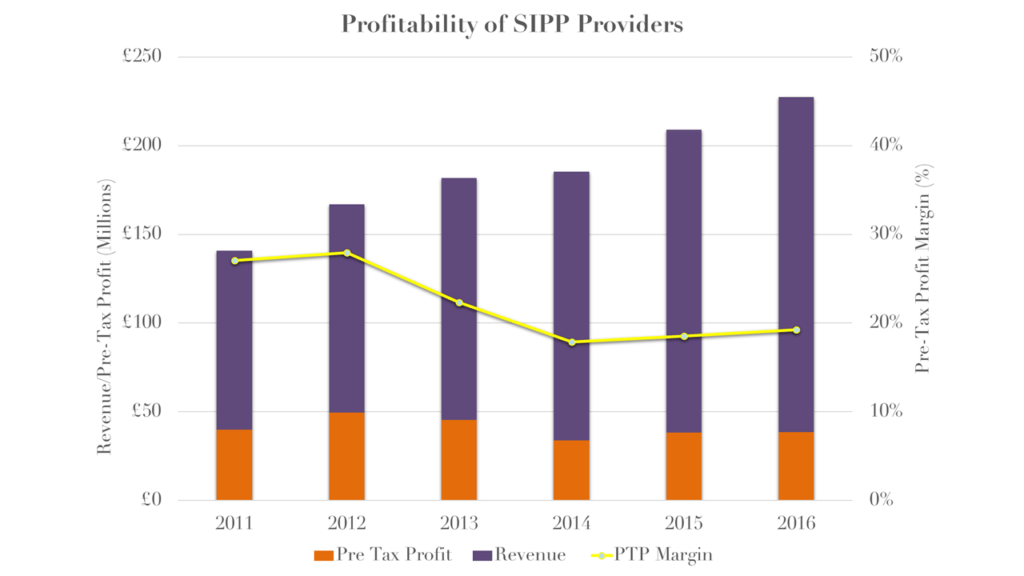

Collectively, Sipp providers reported a total pre-tax profit of £40.3 million on their revenue of £227 million, a profit margin of 18% for the year ending 2016. Revenue grew by 8.6% and pre-tax profits by 3.9%, compared to the previous year.

We’re beginning to see signs that profit margin is stabilising at just below the 20% mark and is unlikely to return to the circa 30% we witnessed pre-2013.

13 of the 16 providers covered in this report posted a profit in the year ending 2016. In part, this is the product of natural selection, as weak providers are taken over, leaving a cohort of providers that are financially healthier.

- Potential legal claims in relation to poor investment advice and failed investments pose risks to some providers.

There is growing concern about the possible impact on SIPP providers of legal claims relating to failed or poorly performing investments.

One example of a problematic investment that has entered the public domain is Elysian Fuels. James Hay has confirmed that some of its clients have invested a total of £55 million in this investment and it is known that several other SIPP providers have clients holding this investment. Close to £200 million may have been invested via SIPPs into Elysian Fuels which suggests there could be over 2,000 investors involved.

What of course is unknown is the extent of the SIPP provider liability and the redress that may be required. What is clear is that the risk posed to some providers as a result of potential legal claims is a ticking time bomb with severe implications.

[bctt tweet=”The risk posed to some providers as a result of potential legal claims is a ticking time bomb with severe implications. ” username=”AbrahamOnMoney”]

In summary, these themes point back to why it’s crucial that advisers conduct proper due diligence of the providers they recommend. The regulator expects it, clients deserve it, and your business is better for it.