Avoiding pound cost ravaging in a retirement portfolio is a bit like running an egg-and-spoon race. It’s a big balancing act. With the markets constantly throwing tantrums like a toddler deprived of her toys, it can be quite challenging for clients stay on track, especially as they are making withdrawals from their portfolios at the same time.

Managing a retirement portfolio involves making several decisions in relation to the withdrawal, such as what proportion of portfolio (if any) to keep as cash buffer, in what order to liquidate asset classes and tax wrappers, when to alter withdrawal amount in line with market conditions and how to deal with one-off lump sum withdrawal over and above normal income needs.

Often these decisions have to be made in client meetings, and sometimes in the heats of market tantrums. They can be unsettling and stressful for clients; at worse, it creates an impression that the planner is simply making these up as they go along.

Having a Withdrawal Policy Statement (WPS) enables advisers and clients to have a pre-agreed framework in place to deal with these decisions. While it’s impossible for a planner to anticipate every possible market conditions in advance, having a WPS provides a touchstone for both clients and advisers in the midst of a rapidly changing world. Just like many planners have adopted an Investment Policy Statement (IPS) as a set of guiding principles for decision making around asset allocation, re-balancing and discipline in the face of market turbulence, a WPS sets guiding policies around withdrawals in a retirement portfolio.

[bctt tweet=” A Withdrawal Policy Statement provides a touchstone for both clients and advisers in a rapidly changing world.”]

Financial planner Jonathan Guyton, one of the early proponents of WPS, notes

A withdrawal policy statement specifies the goals, policies, and parameters that the client and adviser agree to adopt to guide future decision-making regarding the use of the client’s financial capital to help fund their lifestyle during their retirement years

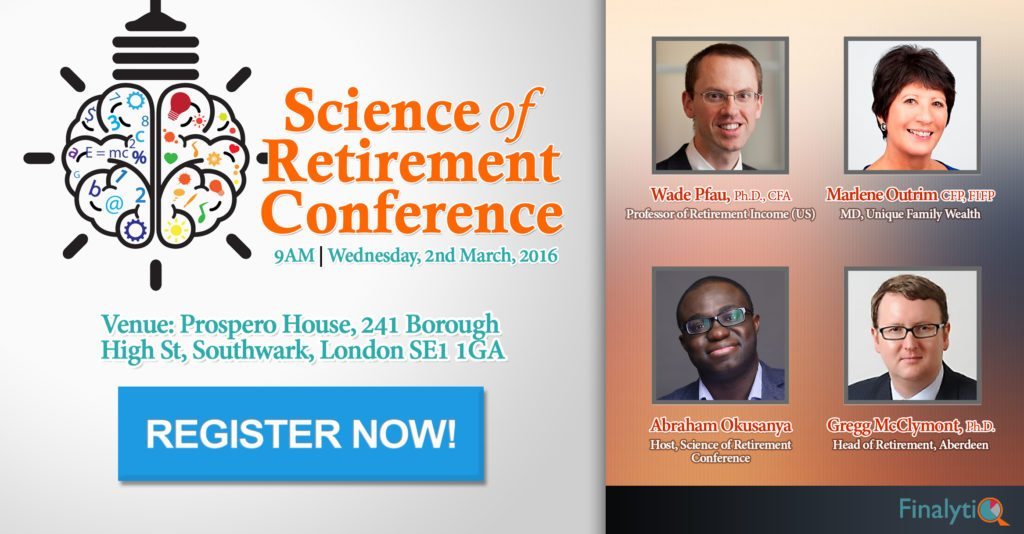

Join us for more in-depth discussions about how to craft a Withdrawal Policy Statment at the Science of Retirement Conference 2016!

Guyton list the essential components of a WPS as the following:

- The client income goals to be met via withdrawals

- The client assets to which the WPS applies

- The initial withdrawal rate

- The method for determining the source of each year’s withdrawal income from the portfolio, and

- The method for determining the withdrawal amount in subsequent years, including both the trigger points for adjustments other than an inflation-based increase and the magnitude of the adjustment itself.

It’s important to bear in mind that a good WPS isn’t a financial plan but rather it should be a set out guiding principles as to how to manage clients withdrawal in line with their income objectives. The policy should be broad enough to encompass unexpected events as they arise and specific enough so that we are rarely in doubt as to what action to take in response to changing event.

[bctt tweet=”A Withdrawal Policy Statement helps avoid the impression that the adviser is making things up as they go along.” via=”no”]

Of course it’s possible to implement a withdrawal strategy without a WPS, however, as many of these strategies often have a direct impact on clients lifestyle – such as freezing withdrawals (rather than increasing in –line with inflation) or even slight reduction in withdrawal rate in extreme market conditions – having a WPS that the clients have consented to makes the process a lot more manageable. Crucially, getting clients to consent to a Withdrawal Policy Statement in advance of turbulent market conditions helps avoid the impression that the adviser is making things up as they go along. It’s a bit like saying to the client ‘ we always knew that something like this might and we agreed what to do if it did. Hey, look, you even agreed to it!’

For instance, suppose a client agrees to a plan to;

- Withdraw £10,000 pa from a starting portfolio of £250,000, with the plan to increase withdrawal amount with inflation each year, unless the previous year’s portfolio total return was negative and caused the current withdrawal rate to exceed the initial withdrawal rate.

- Reduce spending 10%, if current withdrawal rate has risen by more than 20% above the initial withdrawal rate (e.g., if the initial withdrawal rate was 5%, then the threshold is 6%)

The plan sounds all reasonable, except that the clients do forgot what’s discussed in meetings, as they get on with their daily lives. It;’s why they hired an adviser in the first place. But when, not if, that times comes where market conditions dictates that withdrawals have to be frozen or even cut by 10%, clients may not take too kindly to that idea in the absence of a written withdrawal policy statement. The opposite of this of course is when markets are throwing its usual tantrums but not bad enough to dictate cutting expenses, clients might be unnecessarily anxious in the absence of a written withdrawal policy statement.

WPS is neither a financial plan nor suitability report; just a one page document stating the client income goals and the guiding principle for managing withdrawal. Here’s a sample here from Guyton

What do you think? Do you thing a WPS has a place in your work with clients around managing draw downs?

.

For some clients this sounds like a good idea. It depends on whether they are people who like formal agreements and plans, not all clients do.