How much cash should you hold in a drawdown portfolio?

In the light of recent market declines, we’ve seen more and more discussions around the effect of sequence risk and pound-cost ravaging for clients in pension drawdown, and specifically on the benefits (or otherwise) of holding some cash in retirement portfolios.

Cash flow reserve strategy (CFR) is a common method used by planners, supposedly to manage pound cost ravaging in retirement portfolios. The strategy involves holding typically between 1 to 3 years’ worth of income in cash to avoid being forced to sell down portfolio holdings to pay income during protracted market declines.

The question is, does cash flow reserve really enhance portfolio longevity, as opposed to a ‘fully invested’ portfolio which sells down holdings monthly to pay income? And with varying practices among planners, what is the ‘optimal’ amount of cash holding in drawdown? I have seen 1, 2, 3 and even 5 years’ worth of income held in cash reserve! The concern is, holding lots of cash in the portfolio can ultimately be a drag on performance in the long run. For instance, based on 5%pa withdrawal rate, holding 2 years of income equates to 10% of the portfolio (ignoring inflation of course, and cash held to cover platform and advice fee), which could have been invested.

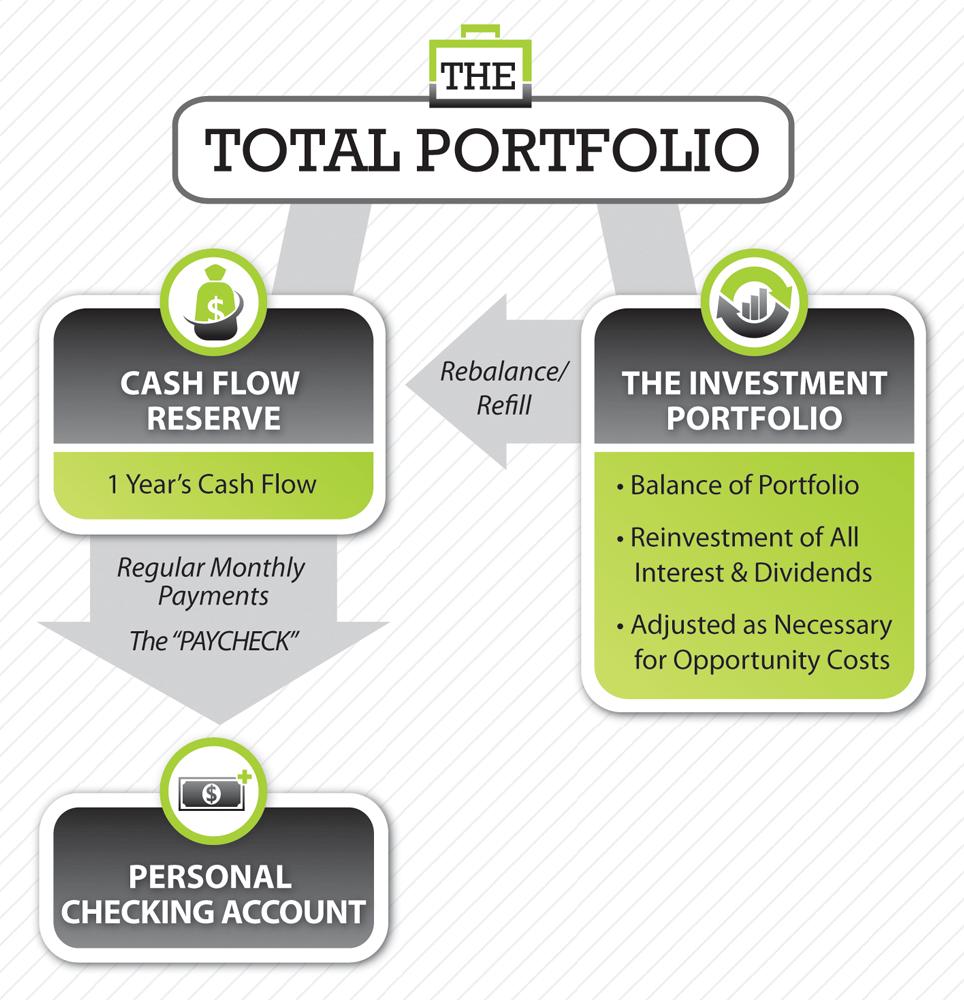

US based legendary financial planner Harold Evensky and his partner Deena Katz are perhaps the most prominent architects of the CFR strategy; they have written extensively about their eponymous strategy (Evensky-Katz Cash Flow Reserve Strategy), which they implement for clients in their own firm for many years.

Evensky- Katz Cash Flow Reserve Strategy (Photo Credit)

But does CFR strategy really work?

In a 2013 paper titled The Benefits of a Cash Reserve Strategy in Retirement Distribution Planning, Evensky et al used Monte Carlo simulations to compare a 1 year CFR strategy (where income is paid from the cash reserve and replenished if the cash reserve dips below 2-months of income) to a ‘fully-invested’ 60/40 portfolio with no cash reserve, rebalanced annually with the monthly income taken directly from the portfolio.

Based on a 4% withdrawal rate, they found that the ‘fully invested’ portfolio is slightly superior to the cash reserve approach, assuming that there are no transaction cost and taxes. However, when transaction cost of selling down portfolio monthly to pay income is taken into consideration, the cash reserve approach produce a better outcome (around 5% improvement in the success rate). Accordingly, where there no cost and tax drag for selling down the portfolio ( which is the case for pensions and ISAs on most platforms), it appears the cash reserve method doesn’t help reduce pound cost ravaging. Add to this, the practicalities of holding cash on most platforms, which results in negative return once the platform fees are taken into account, the effectiveness of cash reserve is diminished even further.

This finding is consistent with similar but more extensive research by Walter Woerheide and David Nanigian, which used 83 years of historical data to test the success rate of 1, 2, 3 and 4 years cash reserve Vs fully invested portfolios, across several asset allocations and withdrawal rates. In the CFR portfolios, they assumed that withdrawals were taken from the portfolios when return was positive and from the cash reserve when the portfolio was down. The overwhelming conclusion is that the fully invested portfolios produced better outcomes that corresponding cash reserve portfolios in about 80% of scenarios.

What these studies appear to be telling us that, cash flow reserve don’t necessarily help with pound cost ravaging and sequencing risk, as it produces sub-optimal outcome when compared to a fully invested portfolio. The reasons for this are obvious – markets tend to be up more than down, so trying to avoid the volatility entirely or being overly conservative does not compensate from the drag on returns. In any case, with consistent rebalancing strategy, more of the withdrawals during market declines are taken from the asset class that has fallen the least or performed better, assuming the withdrawal is prorated based on the portfolio allocation.

Sequence Risk Vs. Stupidity Risk

While cash reserve may not help with mitigating sequence risk per se, it could be very effective in reducing ‘stupidity risk’ 🙂 One advantage of cash flow reserve strategy I find hard to argue against is that it helps manage the cognitive and behavioral biases that tend to damage returns because clients tend to panic during market stress. The knowledge that they always have 6 to 12 months income in cash, which is not subject to the whims of the market, is an effective ‘framing’ and ‘mental accounting’ technique that could go some way to help client stay invested and sleep better at night during market declines. To quote Wall Street Journal columnist Jason Zweig, when markets falls, “an investor who has courage but lacks cash is as powerless as one who has cash but no courage”

[bctt tweet=”When markets fall, an investor who has courage but lacks cash is as powerless as one who has cash but no courage – Jason Zweig “]

Yet, it’s important not to be overly conservative, as lower allocation to equity invariable reduces the portfolio longevity. Keeping beyond 1 to 2-years of income in cash does more harm than good and the tradeoff in lost return is too high.

This tradeoff can be offset partly by taking the cash reserve from allocation to bonds (and other defensive assets), rather than the equity (and risk assets) allocation. For instance, suppose a 60/40 (equity/bond) portfolio is recommended for a client, if they keep 5% of the total portfolio in cash and invest £95K in a 60/40 portfolio, the overall allocation to equity is 57%. Instead, consider keeping 5% of the £100K pot in cash, with the remainder (£95,000) invested in a 65/35 equity/bond portfolio, resulting 61.8% overall equity allocation.Woerheide and Nanigian‘s research indicates that if the cash reserve is taken from the bond allocation, no real harm is done (although no significant advantages are achieved), meaning the cost obtaining the behavioural benefits of cash flow reserve is effectively negligible.

Also, think carefully about how frequently the cash reserve is replenished. Starting out with 1 year’s income and replenishing the reserve every 6 months (or starting out with 18 months’ worth of income in cash reserve and replenishing annually) means client will always have at least 6 months worth of income in cash reserve.

So, what do you think? Do you use cash flow reserve in your retirement portfolios? Does it work or is it a mirage?

The results are dependant of the return the clients get on cash. If that is 0.30% per annum you do not need to do a stochastic simulation to work out that the client will be highly disadvantaged.

Not disadvantaged, but highly disadvantaged, because after fees at 1.3% per annum, this asset class produces 1% negative return. If you add to that RPI at 1% per annum, the net real return of the asset class is -2%. That is a high drag for a 5% allocation to cash.

I suggest another three options to be considered: choosing income paying share classes. That will generate a 3-3.5% natural yield paid over the year which generally matches withdrawals and fees. Different funds pay their income in different months, so it will work pretty well. It does not generate trading cost.

The second one is rebalancing. In rebalancing you will generally take profits from different asset classes and sub-classes every quarter. Why don’t pay withdrawals quarterly in the same time and only re-invest the difference.

Not last, there is the asset dedication portfolio instead of asset allocation portfolio: using ladders of index-linked gilts and strips expiring whe the income is needed. It is worth noting that asset dedication beats asset allocation when inflation is higher than 2.5% per annum over the 5 years period. There is an Morningstar Ibbotson study somewhere. However if inflation is low as now, asset allocation seems to be “king”.

I will not comment too much on the behavioural issue. In my opinion only weak financial planners will focus on that and address it by using high cash allocations. Good financial planners are educators and challengers of clients behaviour, they do not take orders from their clients. Good financial planners are aware of investment behaviour, but not give in and let their clients behaviour to play a part in their investment experience.

re the article “The overwhelming conclusion is that the fully invested portfolios produced better outcomes that (sic) corresponding cash reserve portfolios in about 80% of scenarios.”

Being pedantic, I think that is a result rather than a conclusion, but in any case there is not enough information given on this key point in order to draw a conclusion, i.e. how much better are the outcomes in these 80% of scenarios and how much worse are the outcomes in the other 20%; if it is only slightly better in the 80% but quite a bit worse in the 20% then a conclusion may be that the cash reserve strategy produces better outcomes on average.

re comments by Eugen – net real return of -2% on 5% of the portfolio equals -0.1% on the portfolio as a whole, which isn’t a high drag.

To get that level of natural income requires a bias towards higher yielding investments which a) may not be tax efficient and b) may deliver lower total returns.

I don’t know how much cash should I hold in a drawdown portfolio. I think that this article is very helpful for me. This is very informative and I learned a lot from this.