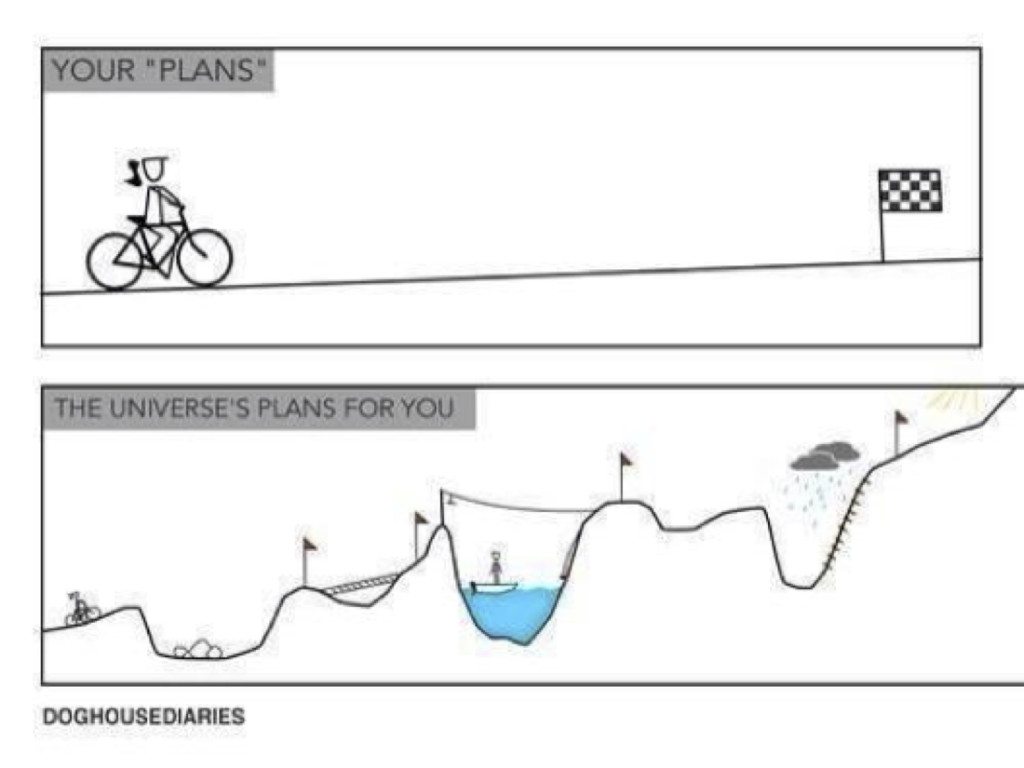

I saw this interesting image on Twitter (via @farnamstreet) the other day that I think financial planners should share with their clients.

It’s a graphic image of how clients think about their investments growing over time versus how their investments actual grow or if you like, Client’s Plans Vs The Market’s Plans for their money!

What worries me is that financial planners (and I mean that in the true sense of the term) may actually be contributing to this inaccurate perception of how investing works.

Case in point is the use of cashflow models. Many financial advisers have adopted cash flow modelling to guide in making decisions on a ‘safe’ withdrawal from their portfolio but I hate be the one who breaks it to all the cash flow modelling evangelists out there, the way these tools are used by vast majority of UK planners means the outcomes are far too rudimentary and risk misleading clients. Many planners rely on deterministic models, which treat returns as linear (i. e. average annualised returns over time) and ignore randomness of returns. One problem with this is that it underplays the dangers of negative sequence-of-return, and risk misleading clients.

To get a better understanding of sequencing risk, let take a look at Portfolio A with the yearly return in the table below. Imagine a second, Portfolio B, with the yearly return of 5.73%. Portfolio B represents what adviser model in their deterministic cashflow-forecasting tool by assuming average annualised return. If client has £100,000 in both portfolios and withdraws £5,000 a year from these portfolios starting from their 60th birthday, they’ll run out of money with Portfolio A on their 83th birthday, although Portfolio B continues to support the level of income withdrawal indefinitely.

The point here is that while average annualised return on both portfolios is exactly the same i.e. 5.73%, in reality the outcomes for the client couldn’t be more different under these scenarios. This drives home the point that, when in a drawdown the order in which returns occur is perhaps more important that the average return over a period of time.

Pound Cost Averaging In Reverse Gear

A negative sequence of market returns early in retirement can cause funds to erode to the point where what seemed like a reasonable income level quickly becomes unsustainable, even if portfolio performance recovers in later years. This is because taking income from a portfolio in a falling market leads to ‘reverse pound cost averaging’, where a client is essentially forced to sell units in their portfolio when prices are falling, in order to pay the required income.

Deterministic modelling tools hide the danger of negative sequence-of-return, especially in the early years of retirement.

Financial planners need to tread carefully as these tools ignore the fundamental principal of how real-life portfolio work – randomness of return. The reality is that with the new pension freedom, we are in unchartered territories as people who would have been advised to buy annuities in the past would now end up in drawdown.

For starters, we need better tools to model potential outcomes in retirement. The problem is that deterministic cash flow models treats expected outcomes as linear and do not consider the range of possible outcomes that client may experience. Deterministic models have approximately a 50% success rate; meaning that there is a 50% likelihood that client could run out of money. This is not good enough!.

For starters, we need better tools to model potential outcomes in retirement. The problem is that deterministic cash flow models treats expected outcomes as linear and do not consider the range of possible outcomes that client may experience. Deterministic models have approximately a 50% success rate; meaning that there is a 50% likelihood that client could run out of money. This is not good enough!.

Stochastic models (such as Monte Carlo simulations) are a major improvement on the deterministic models, which most planners currently use. Monte Carlo models accounts for randomness (not just of returns but other factors such as life expectancy, inflation, etc.) and expresses potential outcomes in terms of probability of clients meeting their objectives. This is valuable information for planners to consider, and communicate with their client. This goes right to the heart of communicating and demonstrating clients’ capacity for loss.

Table: Portfolio A Vs Portfolio B

| Portfolio A (Return) | Portfolio B (Return) | Age | Portfolio A (£100K Invested) | Portfolio B (£100K Invested) |

| –5.90% | 5.73% | 60 | £89,100 | £100,730 |

| -13.30% | 5.73% | 61 | £72,250 | £101,502 |

| -22.70% | 5.73% | 62 | £50,849 | £102,318 |

| 20.90% | 5.73% | 63 | £56,476 | £103,181 |

| 12.80% | 5.73% | 64 | £58,705 | £104,093 |

| 22.00% | 5.73% | 65 | £66,621 | £105,057 |

| 16.80% | 5.73% | 66 | £72,813 | £106,077 |

| 5.30% | 5.73% | 67 | £71,672 | £107,155 |

| -29.90% | 5.73% | 68 | £45,242 | £108,296 |

| 30.10% | 5.73% | 69 | £53,860 | £109,501 |

| 14.50% | 5.73% | 70 | £56,670 | £110,775 |

| -3.50% | 5.73% | 71 | £49,686 | £112,123 |

| 12.30% | 5.73% | 72 | £50,798 | £113,547 |

| 20.80% | 5.73% | 73 | £56,363 | £115,054 |

| -5.90% | 5.73% | 74 | £48,038 | £116,646 |

| -13.30% | 5.73% | 75 | £36,649 | £118,330 |

| -22.70% | 5.73% | 76 | £23,330 | £120,110 |

| 20.90% | 5.73% | 77 | £23,206 | £121,993 |

| 12.80% | 5.73% | 78 | £21,176 | £123,983 |

| 22.00% | 5.73% | 79 | £20,835 | £126,087 |

| 16.80% | 5.73% | 80 | £19,335 | £128,312 |

| 5.30% | 5.73% | 81 | £15,360 | £130,664 |

| -29.90% | 5.73% | 82 | £5,767 | £133,151 |

| 30.10% | 5.73% | 83 | £2,503 | £135,781 |

| 14.50% | 5.73% | 84 | £138,561 | |

| -3.50% | 5.73% | 85 | £141,500 | |

| 12.30% | 5.73% | 86 | £144,608 | |

| 20.80% | 5.73% | 87 | £147,894 | |

|

|

Good article and sensible comments Abraham, I have also been ranting similar points for a few years. However, I still feel cash flow modelling is the future and better to have a sketchy plan than no plan at all I guess it’s a case of regularly revisiting and tweeting that plan as the market and other forces conspire against the advisers hard work 🙂

Read this article with interest and liked the graphic! However, there is nothing new to planners in the points you are making re: drawbacks of producing a financial plan. My question to you Abraham, is simply this; rather than writing about known drawbacks to common convention what is your alternative solution to plug these gaps? Now that would be an interesting read!

Thanks for reading and for your comments Gareth.

Going by the responses – phone calls, emails and on Twitter, I have received about this post, I’m not sure this ‘common convention’ is as widely understood and appreciated as you suggest.

You also might have missed the part where I suggest we need better tools – stochastic models – to help improve the ‘accuracy’ of cashflow forecasts.

In the end, models are statistical approximations. My point is that some are less accurate than others, and planners need to be aware of the weaknesses of their own approach.

The lack of decent stochastic modeling tools available to UK planners is worrying. Voyant has Monte Carlo model (although in my opinion, it’s could be improved on), which can be used along the default deterministic model.

eValueFE also has one, although again limited in my view. I know one or two other providers planning to come up with one.

There are some portfolio management practices to help mitigate the sequence risk but that’s for another post!

In reality, clients, with advice from their planners, would keep a cash buffer to avoid drawing down income during a period of market correction – and may also be able to reduce their income requirement for a period (capacity for loss).

Agreed, cash flow planning can be dangerous if you slavishly follow the model, but good professional financial planners will provide wise counsel and keep clients on track through all the market twists and turns.

@Alan

Cash buffer would not earn anything (0.35% per annum on Transact, or -1.1% per annum after Transact fees and advisor fees. It would only increase the problem by unnecessarily reducing the return of the portfolio. Not to say that by withdrawing cash, this will increase the overall risk of the portfolio to levels where it could be not acceptable by the client.

@ Gareth

There was an answer in this article: Monte Carlo simulation, not that I agree with it entirely.

There are answers and solutions and I have described a few below:

1. The most important is to reduce the total drawdown of the equity portfolio allocation, by using beta solutions: low volatility and ‘equity income’ solutions and global diversification.

2. reduce correlation in the portfolio between equity and property by avoiding overlapping / investing in financial stocks and property related stocks.

3. use a small allocation to emerging markets (it does not correlate perfectly with developed markets) but avoid allocation for deep value large cap and value small cap stocks.

3. use a good allocation to index-linked gilts to hedge inflation (to some extent) in the bond allocation.

4. plan in advance, using liability matching bond strategies. This allow to collect a higher yield/return than cash.

5. avoid investments which don’t pay anything for investing in them (gold) or short duration bonds.

6. plan in advance to buy a small pension annuity to cover (together with the State pension) the essential expenditure. Adjust the duration of the earmarked bond portfolio to match the timing for this. This allows the planner and client to focus on the discretionary part of the expenditure where there is more elasticity.

7. postpone claiming the UK State pension – this is a very valuable strategy when markets are highly valued as now and expected return is lower. However advisors tend to fail in their fiduciary duty to consider this, because of conflicts of interest by charging 1% per annum on funds under management.

8. time portfolio rebalancing only for times when it makes sense. You avoid unnecessary transaction fees and helps the client harvest the momentum premium. We use a rebalancing based on the volatility of the equity portfolio allocation, we would not rebalance until the equity allocation increases/decreases by 9% – our target for annual volatility in the equity portfolio allocation.

Have I missed something?

Very useful list right there Eugen! While I don’t necessarily agree with everything, I think it’s useful way to think about potential solutions to sequencing risk.

I’ll pretend not to be offended that you might have just listed some of the key ideas I was planning to write about in my next post!

Sorry about this. I don’t claim copyright on any of these ideas. I have learned them from other people and eventually improved on them.

I am preparing a paper on volatility and ‘sustainable rates of withdrawal’. From my initial research, it seems that using active management targeted at volatility as opposed with high investment return results in a good increase in the sustainable rate of withdrawal.

I do not name them ‘safe’ rates of withdrawals, nothing is ‘safe’.

Please tell which you do not agree with?

Abraham

Can some of this be covered off if you use a cashflow

modelling tool that allows the integration of a series of poor investment returns/black

swan events e.g. Voyants “Major Loss” events???

Duncan

It cannot sort the problem. Yes, you can introduce a bad sequence of returns at the start of withdrawal. However investment returns will continue to remain volatile after this.

Modelling using Monte Carlo could be useful if the right data is used. However when you use leptokurtic distributions for equity return, you get scared – the sustainable rate of withdrawals for a 30 years timescale gets as low as 2.5% per annum.

The solutions are elsewhere: level annuity purchase, postpone UK State pension, good investment strategy for the portfolio in drawdown combined with a variable withdrawal for discretionary expenditure.

Some may ask why a ‘level’ and not an indexed linked annuity. Because this allow starting with a lower withdrawal from the portfolio in drawdown.