Update (Friday 18/10 @ 13.00) – Since writing the original article, the accuracy of the FE data for the No Trail/Z Share Classes has been questioned. It appears to be down to FE not pulling the correct data through on those share classes using the ‘Total Return’ tab. (Please read FE’s announcement on their attempt to link the data of share classes) Unfortunately, I have been unable to get a satisfactory explanation from FE on this.

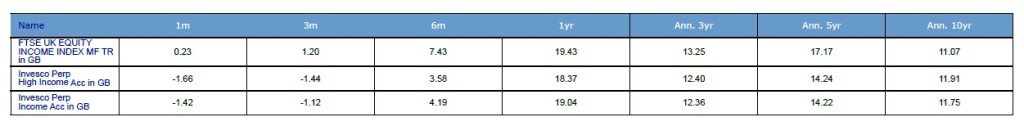

Even then, using the annualised performance of the bundled share class below, Woodford underperformed over 3 and 5 years, although he did outperform over 10 years by 0.68%pa – 0.84pa!

On Tuesday, I did something that you are absolutely NOT permitted to do in financial services – question established thinking and accepted wisdom. I nearly got punched in the face on Twitter in the brawl that followed, which is OK, ’cause I’m quite tough 🙂

Many people in financial services will nod in agreement to following statement; Neil Woodford is an outstanding manager who consistently outperformed, runs the some of the largest funds in the country and he created wealth for his investors over the years. He even has a CBE to show it. Right?

So, why would anyone question his impeccable record? I’m still trying to come up with a really good answer for that one…. But, as the entire financial services have got their heads stuck up their bum-bums because this man resigned his job, I thought I’ll just check the records again for myself.

So, I simply compared Woodford’s performance with the Vanguard UK Equity Income fund and the FTSE UK Equity Index. And here’s the result;

When I tweeted something similar to this on Tuesday, Woodford fans were all over me like a rash, which was absolutely expected (to be honest, I did enjoy all the attention). I was told this was complete ‘rubbish’ as ‘5 years was too short-term.’ This was ‘not a good period for Woodford because of the dash for trash’ (what?) and if I looked ‘longer term,’ more specifically ‘over 20 years, he would have outperformed’

I was accused of ‘selectively’ choosing a ‘convenient’ starting point. In actual fact, there was nothing selective about the time frame. It’s simply driven by start of data for the Vanguard fund. (I blame you Vanguard, why didn’t you come into the UK 20 years ago?)

(Update 21/10: Using the more accurate bundled Share Class of the funds actually underperformed at 84% Vs 116% over a 5 years period)

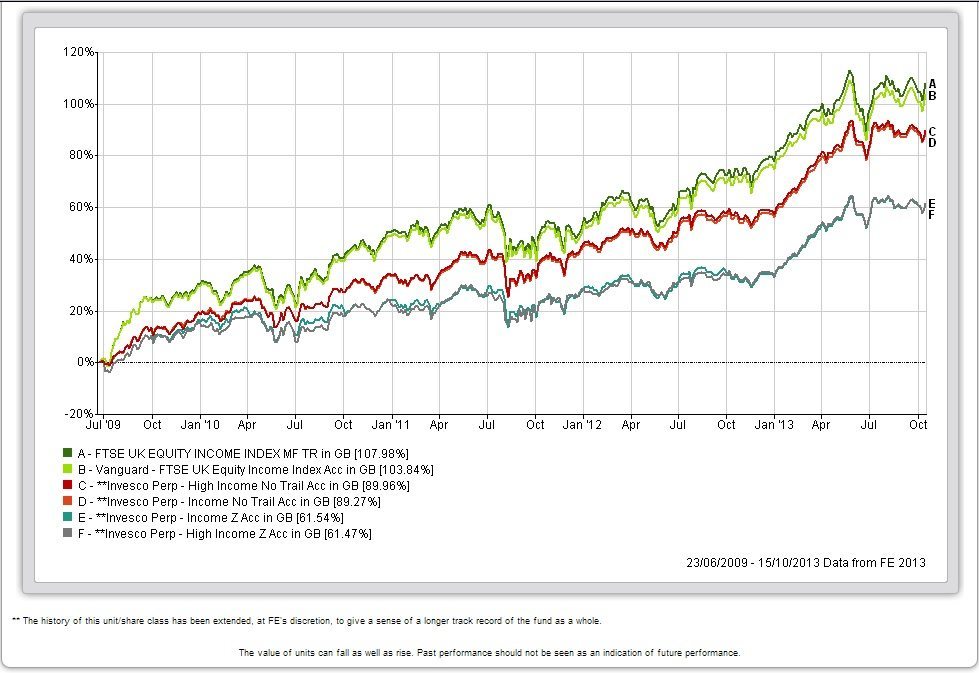

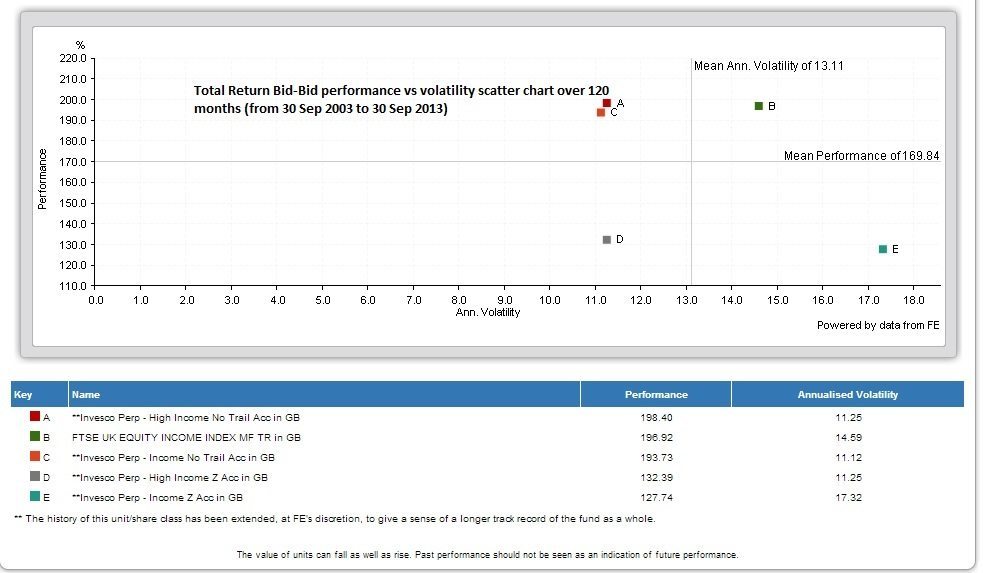

And before you say anything about the volatility or risk adjusted return, I’ve done that too…

Ok, so the FTSE Equity Income (which the Vanguard fund tracks) was a bit more volatile but investors were rewarded for it.

When I asked Woodford fan club what the holding period of an average UK investor is, I didn’t get any answer. So I had to check for myself. It turns out that according to the IMA, it’s around 4 years. So, all these people telling me to go back 20 years assumed investors stayed in Woodford funds for 20 years? That doesn’t reflect the experience of a real fund investor.

To be fair to Woodford fans, there seems to be an acceptance than he probably lost his mojo 5 years ago but what does it matter, ‘you need to look long term’ they said. OK then.

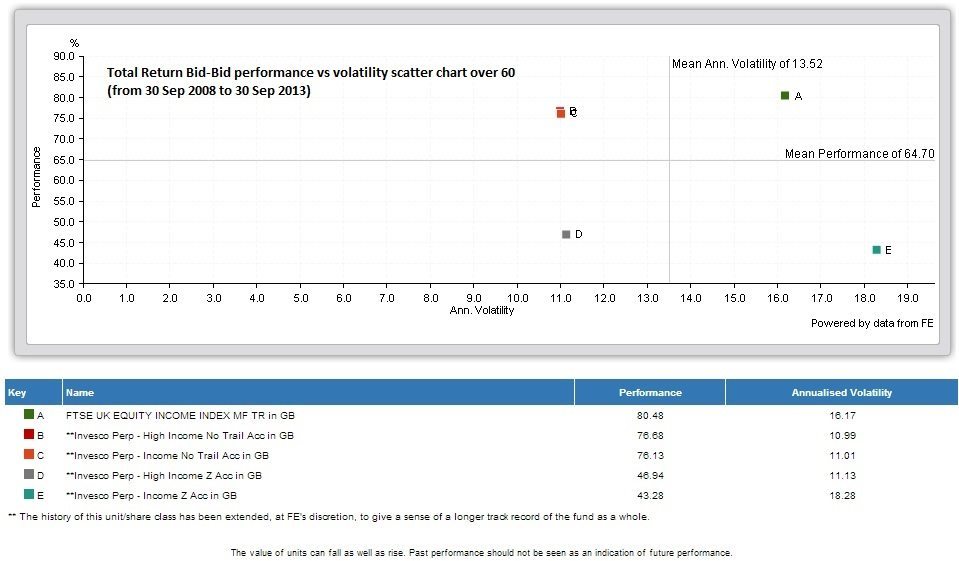

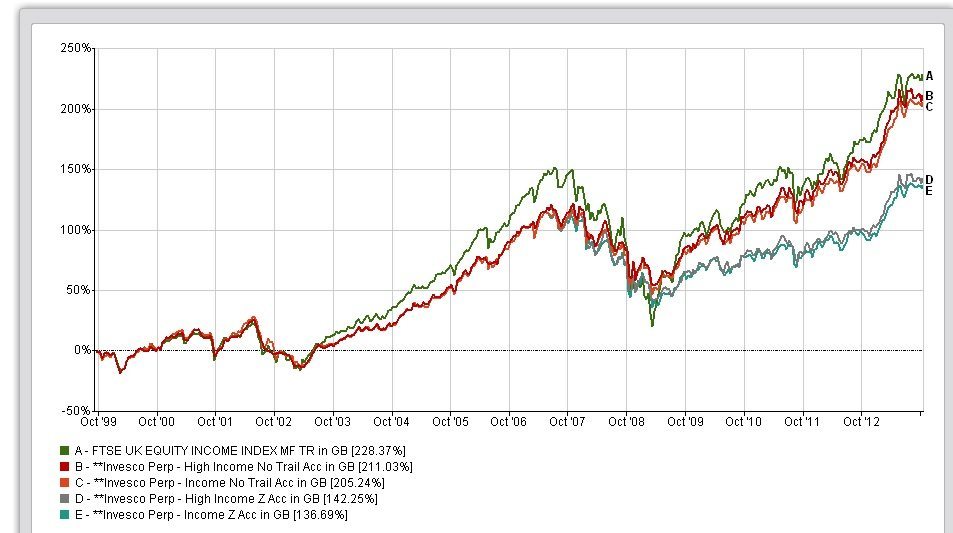

So I thought I’ll take the advice of an esteemed industry figure who told me on Twitter to ‘do some proper work than rubbish like this’ and I compared Woodford funds with the FTSE UK Equity Income Index for the last 10 years and boom….

So he did outperform there a little bit but not by much.

(Update 21/10: Using the more accurate bundled Share Class of the funds actually outperformed at 211% Vs. the index at 189% over a 10 year period)

And the risk adjusted return for 10 years…

So one of the funds is slightly better on risk-adjusted basis, big deal?

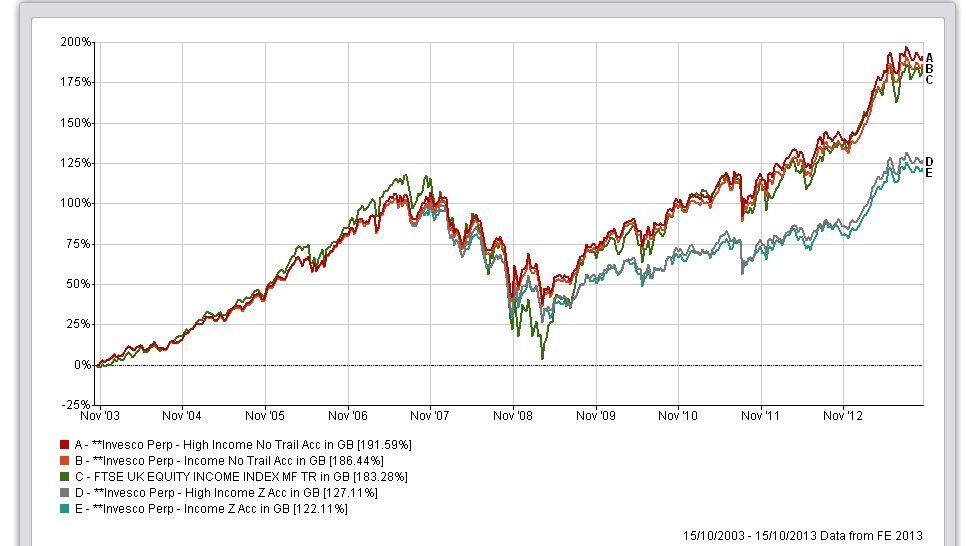

OK, let’s cut the crap and use the longest history we can find since the inception of the FTSE UK Equity Income….

That’s what, 14 years? Is that long enough for you? Sorry, I can’t do the Scatter Chart over 14 years, FE doesn’t let me 🙂

(Update 21/10: Using the more accurate bundled Share Class of the funds significantly outperformed at by 284% Vs the index at 234% over a 14 years period!)

Warning: Now is really a good time to explain to me what all the hoo-hahs’ really all about, I am about to go on a rant.

I guess if you compared him to his peers, he’s quite remarkable. But that’s because far too many of them destroy so much value, which drags down the average. What I’m doing here is to find out the value add over and above the market (less 10bps charged by an index manager) and I didn’t really see much in the last 5 years.

And all these journalists and experts saying Woodford outperformed, in relation to what exactly? I think these people are making the wrong comparisons by using the likes of FTSE All Share or FTSE 100. Given Woodford’s mandate, I just don’t think these are the most accurate. This also explains, why I can’t make any comparison over 20 years, because the FTSE Equity Income has only been around 14 years and there is really no other accurate index to compare him to. But 14 years should be long enough for most ordinary folks right?

For me, this isn’t about active Vs passive, it’s about questioning the received wisdom in our industry. While we run Evidence-based portfolios here at FinalytiQ, I happen to sit on a few investment committees of IFAs firms, two of which run entirely active portfolios with over £60M fund under advice combined. Do I believe that these firms are doing the right thing for their clients, given what they know and believe? Absolutely! Why will they have someone who is a bit of an evangelist in evidence-based investment on their team? Well, they tell me that….. beyond all the benefits that come with having a young skinny lad like me at the table, it’s the ability and willingness to question accepted norms; to challenge established ways of thinking, even if all it does is make them come up with really good explanations for whatever it is they are doing. Apparently, you can make a living these days by asking silly questions 🙂

I think this is something lacking within many adviser businesses and the industry at large. We are often far too quick to accept whatever we are told by fund managers and industry publications (who, by the way, are completely independent and NOT at all propped by the massive advertising budgets of providers and fund managers). But, to my mind, if you are a good adviser, you will do your own homework (and no reading industry publications doesn’t count as ‘research’) and won’t ever get tired of questioning your own assumptions, let alone others’.

Never mind me, I’m only a tiny annoying little fish (with a blog and a Twitter account) in this deep blue sea. It’s not my intention to change anyone’s mind about Neil Woodford, let alone the entire fund industry, because ‘those convinced against their own will, are of the same opinion still.’ Ben Franklin’s words, not mine.

Brilliant! Where you see conventional wisdom being loudly defended when subjected to criticism or analysis, always look for the vested commercial interests in maintaining the status quo.

Thanks Martin. You put it in fewer words and far better than I did.

Very interesting. Well done for digging a bit deeper and fighting your corner on this. Good to see the “value” premium emerge over time…

Thanks Nick. Much appreciated.

Really like this piece of research and the way it’s presented. Why active proponents can’t just confess that their clients like a bit of ‘fear and greed’ I’ll never know. Many privately admit that it’s all a crap shot anyway.

My feeling is that active vs passive is down to the client’s profile and sure, firm’s can be one or the other, but that should also polarise their client segments. Also the sooner advisers move towards asset allocation that truly takes account of the client’s circumstances, the better. Should an entrepreneurial business owner with 80% of his entire net worth tied up in his business ventures, have a medium risk asset allocation and risk-rated model portfolio. Alarming how often I see this kind of thing presented as ‘best practice’ on my travels.

Best Practice – there’s another area that needs unpacking a little further…

Thanks Rob. Can’t argue with much of what you said… you see much of the stuff going on within firms and how people respond when they are challenged.

“On Tuesday, I did something that you are absolutely NOT permitted to do in financial services ”

You mean you used facts *and* numbers?

Yup, turns out it’s a crime! Thanks Luke

Another great article Abraham. You’re definately my favourite Twitter writer on finance.

Thanks Julian

Just got around to reading this Abraham, nicely put together, and answers all the twitter criticisms levelled at your first piece of research. There are some aspects that are worthy of additional research, and ought to be featured in the trade press/blogs; particularly the comment about the choice of indices used by managers when comparing their funds.

Thanks Dennis for the kind comments and ‘standing up’ for me on Twitter. Would like to get it into the trade press but not sure their sponsors would like that 🙂

Yeah , I guess you’ve revisited that statement. I don’t think you want to damage your credibility even more by doing that.

The thing is, if you are going to write an article based upon extremely limited quant analysis alone, only to discover that those very numbers that form the entire base of your argument are completely incorrect, you put yourself right in the headlights. And to be shot at. Your entirely passive bias shows through clearly and that in itself is no stance for a self proclaimed investment analyst. I’ve told you time and time again not to dismiss WOM due to the fashionable view of many that you obviously court attention from; this is symptomatic of that ignorance and blinkered view. Do the honourable thing and at least admit your mistakes in an open fashion as opposed to throwing in “well he underperformed the last 3 years”. Really? Is that the basis of your entire argument because it is the only truth in there.

I think you are getting completely confused. I relied on data from a credible source, which turned out to be not entirely accurate.

My initial premise is that I don’t understand all the hoo-hahs are all about given that he underperformed over the last 5 years, although I also said he did outperform over 10 years. That is a balanced view and I stand broadly with my overall assessment. If you don’t like it, then that’s your problem!

We’ve swapped views Abraham and I’m not going to get into it all again here but I felt a bit of counterpoint was needed amongst your comments. Suffice to say that I think your piece is well-written – provocative is indeed good – but where I do take issue is in your suggestion that a custom index devised by/on behalf of Vanguard for the sole purpose of shifting their fund is a valid comparator for a different fund which has never been asked to or tried to match or beat the comparator you propose.

Peer group competition often adds little, there we can agree, but NW has beaten them all over 10 years with lower volatility and lower maximum drawdown than nearly all of them (Source: Citywire/Lipper to 30/9/13). And he’s significantly ahead of the FTSE All Share too. Yes, he’s missed some upside over the last couple of years, but there are many funds in the income space that haven’t and that have easily beaten your proposed index, that doesn’t mean they are better funds than IP or Vanguard, just (very) different. Apples with apples.

And that ignores the fact that NO fund has benchmarked against your proposed comparator for 14 years, as you have acknowledged it was only launched in 2009 and the data you use is actually reconstructed for the previous 10 years. So I for one will treat it with great care, even if the ‘data’ is in FE.

And I’m not a holder of NW!

And to one of your other correspondents, no way is it a crap shoot. It may be if you don’t have the expertise, but many fund managers do. Including NW. And so do many active investment managers when it comes to picking funds. Or do you think all of our careers are just down to luck?

All the best, Abraham, seriously.

A superb piece Abraham. One of the conventional pieces of wisdom is that talented managers can be ‘identified’. The major problem is that this nearly only ever happens after the fact i.e. after they’ve delivered good performance. The actual returns that investors receive are down to luck with these managers – mainly luck as to when they invest and because of the industry’s publicity machine it will normally be after a period of exceptional performance and more than likely just as they enter into a period of more mediocre performance. In answer to Jeremy Dufton – yep success or failure in the active management industry probably has more to do with luck than you’d like to believe. Personally I don’t want my clients to have to rely on luck.

Nonsense Richard! But I’m not going to persuade you and vice versa.

Love your website though! 🙂

All the best.