Unless you’ve been hiding under the rocks in the last few days (in which case, hello and welcome back!!) you’ve probably seen Paul Resnik’s new paper which suggests that ‘sequence risk for retirees may not be the danger claimed.’ A UK version of the paper is published in New Model Adviser.

Paul notes;

At least historically, the conclusion we would draw is that sequence risk seems to be an unnecessary anxiety.”

It’s probably worth mentioning that I have a great deal of time for Paul and he’s one of the (very few?) people whose opinion on the investment world I value greatly. I have actively called on his views and advice more than a few times. Paul first sent me his data about 5 months ago and again we chatted about it over coffee in London around April/May, with his co-author Peter Worcester. Paul and I agree on many things but on this one, I’ll have to disagree, which is a wonderful thing. Life would be far too dull otherwise.

Before I explain why I disagree with Paul, first let me explain Paul’s methodology and how he came to his conclusions. Paul dataset is based 45 year period between 1970 and 2014 inclusive. Paul constructed 2 portfolios; we’ll call them Portfolio 40 (35% UK Fixed Interest, 25% International Fixed Interest, 25% UK Equities and 15% International Equities ) and Portfolio 80 (5% Fixed Interest, 15% International Fixed Interest, 45% UK Equities and 35% International Equities)

Paul ran his data based on 10 year rolling period (monthly data); so he would have had 421 dataset for each portfolio. The best way to visualise this is to think of 421 retirees; each of them starting to draw income from their portfolios in Jan 1970, Feb 1970, March 1970……, with the latest retiree starting to draw income in Dec 2004. So again, 421 retirees but there’s one important point, Paul’s data only actually looked at what happened in the first 10 years of their retirement.

The table below summarises their balances at the end of 10 year periods, if the retirees invested in Portfolio 40, depending on their withdrawal rate as a percentage of initial invested amount, indexed with inflation.

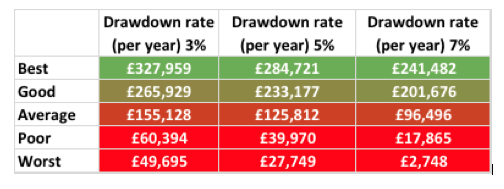

Paul was kind enough to provide me the data equivalent for Portfolio 80. The table below is a summary of balances after 10 years if our retirees invested in Portfolio 80, depending on their withdrawal rate as a percentage of initial invested amount, indexed with inflation.

Fuzzy Logic?

Paul’s logic is that, if sequencing risk is really an issue, the Portfolio 40 should produce higher balances than Portfolio 80 at the end of the 10 year period, especially for retirees with poor and worse outcomes. Clearly, this dataset didn’t really support that hypothesis, so Paul concluded that since Portfolio 80 performed better than Portfolio 40 in virtually all but the very worst cases, sequencing risk therefore isn’t an issue.

This is where I disagree with Paul. There’s a fundamental flaw in the research but I’ll return to this later. For now, let’s take the data and methodology on its own merit.

What the data actually shows is that sequencing risk IS indeed an issue, potentially a major one. Otherwise, how would you explain why retirees with exactly the same asset allocation and withdrawal rates have markedly different portfolio balances at the end of the 10 year period? So for instance, how do you explain the difference between the Good and Poor outcome for portfolio 40 – the initial balance, asset allocation and withdrawal rates are exactly the same for our 421 retirees but some of ended up with a lot less real income and account balances at the end of their 10 years than others. One plausible explanation I can think of is that, it must be down to the specific period in which their first 10 year period falls i.e the month they started drawing from their own portfolios! So, within the 421 ten-year rolling periods, some 10-year periods were bad, some were good. Over a 25 -30 year retirement, those who started with good first decade will most likely have better outcome that those starting with a bad first decade.

Paul’s logic is that sequencing risk applies only to equities and that lowering equity content permanently should result in a better outcome. I disagree with this view; sequence risk is how the order of total portfolio return, not just equity return, impacts the longevity of the portfolio. I agree that equity is a key driver of sequence risk, but it’s not the decades that bonds compensate for the poor equity returns that you have to worry about, it’s the decades that total portfolio returns are mediocre. This view is supported by some work by my friend Michael Kitces…

Instead of those “black swan” events, that ultimately are just a short-term distraction, what’s far more destructive to client portfolios are the extended periods of merely mediocre returns, such as the entire decade from 2000 to 2010, or from 1966 to 1976. And notably, these results are not black swans; the examples here are all simply -2 standard deviation events, such as having a balanced portfolio that loses 1.5%/year and is down 14% after a decade. The bottom line is that when we talk about the impact of adverse markets and return sequencing on retired client portfolios, the point is not the risk of short-term volatility. It’s the risk of extended periods of time that generate merely mediocre below-average returns.

If pound-cost ravaging could be so easily dismissed, because as Paul says ‘rolling 10-year real return for a 80% growth portfolio over the past 40-plus years has been 6.4% per annum’ why is it then that a significant number of retirees in Paul’s data set invariably ended up with less than their initial invested amount (£100,000) with only 5% withdrawal rate? Surely, it stands to reason that those clients, for all intent and purposes are technically ‘buggered’, even if their portfolio did recover in last two decades of their retirement? Off course, they could spend less or just die sooner 🙂

Paul’s revelation is that a portfolio with higher equity content fared better over 10 year rolling but this no evidence that sequence risk is overstated. The question is, will this hold up over, say 25 or 30 years?

Flawed Methodology?

The main flaw in Paul’s methodology is extrapolating 10 year rolling period to judge how long the portfolio will last.

- This assumes that the portfolio will likely perform in a 30-year period in a very similar way to how it did in the first 10. Other studies on sequence risk and sustainable withdrawal rates have been over a longer period, typically 30 years, to mirror how long retirement is likely to last. I realise that since Paul only used 45 years historical data (rather than say 100 years in other similar research) running 30 years rolling return will have left Paul will minimal dataset for each portfolio. Yet, making such a bold statement about what is likely to be 25 – 35 year retirement for most people, based on 10 year rolling data sits uncomfortably with me.

- Paul’s simply divided the real balances at the end of 10 year period with the annual withdrawal amount, thereby grossly exaggerating portfolio longevity. Based on Paul’s data, on average, Portfolio 40 will last 31.8 years at 5% withdrawal rate. Research by retirement income professor, Wade Pfau shows that at 5% withdrawal rate, a portfolio with similar asset allocation will last less than 30 years in 55% of the dataset i.e less than half will last 30 years.

One thing we agree on, probably?

There’s one thing Paul and I agree on; permanently reducing equity allocation is probably not the answer to sequencing risk. Except in the very worse outcomes, Portfolio 80 fared better than Portfolio 40, based on the 3 withdrawal rates. This actually corroborates the initial research on Sustainable Withdrawal Rate by Bill Bengen (1994), which showed that an ‘optimal asset allocation’ for retiree would be as close to 75% in equities as possible, but no less than 50%, based on the client’s risk tolerance.

I exchanged emails with Paul after the first draft of this piece and if there one thing we agree on, this is an area for much further research and debate. I think Paul and his co-author Peter have done an excellent job presenting an alternative point of view. I wish their findings hold up and sequence risk is, as someone suggested, only a figment of imagination. Then, our lives would be a lot easier and we can all pack up and go home. But it’s not and so we won’t, which is a good thing, ’cause I really do need this job 🙂

I can only agree with Abraham in this and disagree with Paul.

Sequence of returns cannot be researched over the last 45 years as you cannot claim that interest rates will normalise to their last 40 years average. There are too many issues that were overlooked in that study: default risk, black swans etc.

I had a look recently at a graph with the interest rates over the last 3,000 years and it is very interesting to see it. Obviously there were big defaults along the way, and guess which was the first default (Athens in Antic Greek). These Greek people seem to have a history of defaults!!

I think I’m with you Abraham, though I suspect Paul is really trying to simply suggest that with a sensible withdrawal rate and ongoing reviews, the risk can be managed well.

However what a terrifyng prospect for the most investors who perhaps have little understanding about a sensible withdrawal rates and proper portfoio construction.

This merely serves to underline the importance of getting good advice and reviewing progress. I don’t think most investors would appreciate the enormous damage that a couple of poor years at the start of “retirement” can have. Its our collective challenge to get out there and help them.

Elephant in the room could be the risk from religious extremists. Personally at 50 now, I am just planning on either taking up more extreme sports as I move in to retirement or enlisting in a Foreign Legion (not the French)