With Vanguard’s latest round of cost cutting across its fund and ETF range, we edge closer to a world where the cost of accessing equity market is ZERO!

Now that Beta is officially almost free, chasing the elusive alpha has become even more expensive!

LifeStrategy: The New Benchmark for YOUR Clients’ Portfolios.

Paul Resnik made an interesting point on Twitter recently

The investment suitability test might soon include: "What's the benefit in my recommendation compared to Vanguard?" https://t.co/413k1VugTz

— FinaMetrica (@paulresnik) August 28, 2014

I agree with Paul entirely. Vanguard LifeStrategy range poses a challenge for everyone managing client’s portfolios. It is the new benchmark for risk-based multi-asset portfolios! If clients can access global asset allocation portfolio for less than 25bps, what is the value add for paying any more than that?

If you run risk rated multi-asset portfolio, do me a favor, will you? Benchmark them against Vanguard Lifestrategy on a risk-adjusted basis. I am not talking about simply comparing your current portfolio allocation with LifeStrategy, make sure all the historical changes (asset allocation/fund changes, rebalancing) are reflected and then benchmarking your historical portfolios against appropriate LifeStrategy funds. The result might surprise you 🙂 All that tactical changes to asset allocation and funds, is it really worth it?

And for those outsourcing to DIMs, I dare you to benchmark those cleverly designed DIM portfolios against LifeStrategy. You’ll be very surprised 🙂

Vanguard Vs Fidelity

Earlier this year, Fidelity announced cost cuts on its Index range. We were delighted at the news but we made the decision to stick with Vanguard.

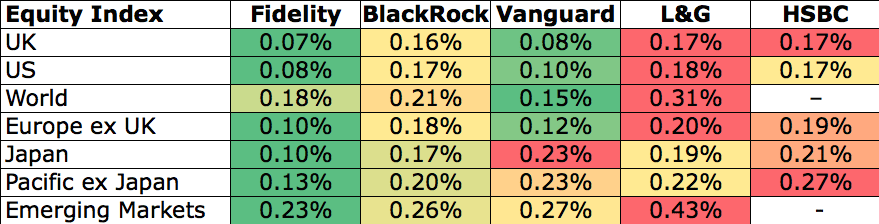

This is how the main providers stack up on equity index funds, following Vanguard’s announcement;

As you can see, Vanguard isn’t necessarily the cheapest across the range shown here. However, we think that Vanguard is better at indexing than Fidelity, at least in the UK. Now, that’s a very bold statement to make, isn’t?

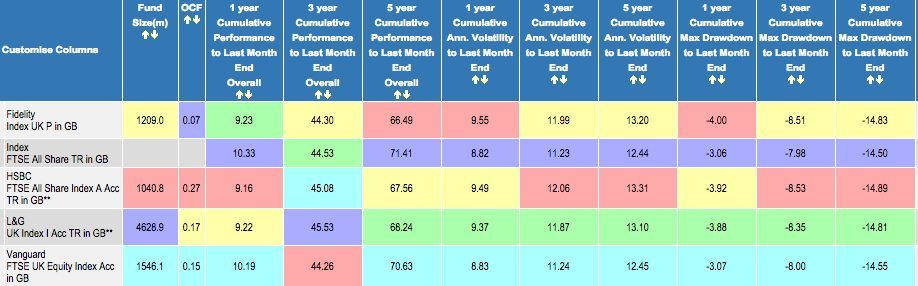

So we pitched the UK Equity funds from major players against each other, looking at performance and risk parameters.

Source: FE Analytics, Performance till 30/07/2014

This shows Vanguard as the clear leader in terms of tracking the FTSE All Share Index. Over each time period, bar one (3 year) Fidelity delivered worse returns than Vanguard, but it did so with higher volatility and drawdowns. Over a 5 year period, the performance difference is a whooping 4%! While it has to be noted that Vanguard charges 0.4% in Preset Dilution Levy, this needs not be a concern for longer term investors, as the money is paid back into the fund.

Note that the data shown was before the cost cutting exercise and we’ll have to wait and see how this reflects on fund returns on both sides.

You could do the same thing for other asset classes but most of Fidelity index funds were launched only this year and so have no track record to enable any meaningful comparison.

Fidelity has recently made some changes to their index funds. Until recently, they have managed the Index range internally but this has now been outsourced to Geode Capital, who will manage their index funds going forward. Clearly, they expect that this will reduce tracking error and improve performance, but we’ll have to wait and see.

The press is calling this a price war, so let go with that. If there’s a price war going on between Fidelity and Vanguard, I know whose side I’d be on! Both organisations are equally scaled and resourced but here’s the thing, Vanguard is owned by its (US) fund investors! No conflict of interests between its shareholders and its clients. In fact, Vanguard deliberately runs its business at cost, and passes any ‘profits’ to investors by lowering fund costs. ‘Although its non-US-domiciled funds are not client-owned, Vanguard applies the same client centred philosophy and practices throughout all of its businesses around the world.’ So, inspite having £40bn of asset in the UK as at Dec 2013, the company made a profit of £1.55M, which I estimate to be 0.0038% on its asset!!!

Vanguard’s mutual structure is a rarity in UK fund industry. I know of no other fund group that works entirely for the interest of its fund investors. Most fund groups ultimately works for their owners, and fund investors invariable come second.

Fidelity is privately owned and needs to make profits for its shareholders (nothing wrong with that, even I am a capitalist!) But if there’s a price war between the two organisations in providing low cost index funds for investors, I’m pitching my tent with Vanguard!

It seems that my comment was deleted. Interesting, I thought that a debate of ideas will be welcomed here.

Hi Eugen, hope you are well.

No comments has been deleted. I don’t recollect seeing any comments from you on this article.

Debates are indeed welcome. In fact, we crave them! So try again please, shoot!