Since I attended a press launch of a new report titled No Small Change – Benchmarking The Adviser Business – put together by Clive Waller a few weeks ago, I have not been able to get the word ‘Rainmaker’ out of my head. I am now worried that this is an ‘ear-worm’ of a different kind. Thanks Clive!

The idea is simple: the scarcest resource within ANY financial planning business is the ‘Rainmaker Adviser’ – the guy or girl, who not only goes out to bring in clients but also forms a deep relationship with the client so that they keep paying, year in, year out. This isn’t about selling products, it about selling the proposition.

Often, when I talk to owners of advisory businesses, they tell me how hard it is to recruit a ‘good’ adviser. In fact, at this particular event last week, I spoke to one adviser business owner who told they have interviewed 35 people and couldn’t find a single one to bring on board! (You don’t need to go back and read that last line again, it is 35! Thirty Five! XXXV!)

Yet, I meet firms who tell me their advisers do their own research and report writing. Apparently, it feels much better that way – a single person doing most of the work. They know the client really well and so it’s easier if they do all the non-client facing work as well.

Am I missing something here? If the ‘Rainmakers’ are the scarcest resources in a business, why would any business have them doing exactly the opposite of that?

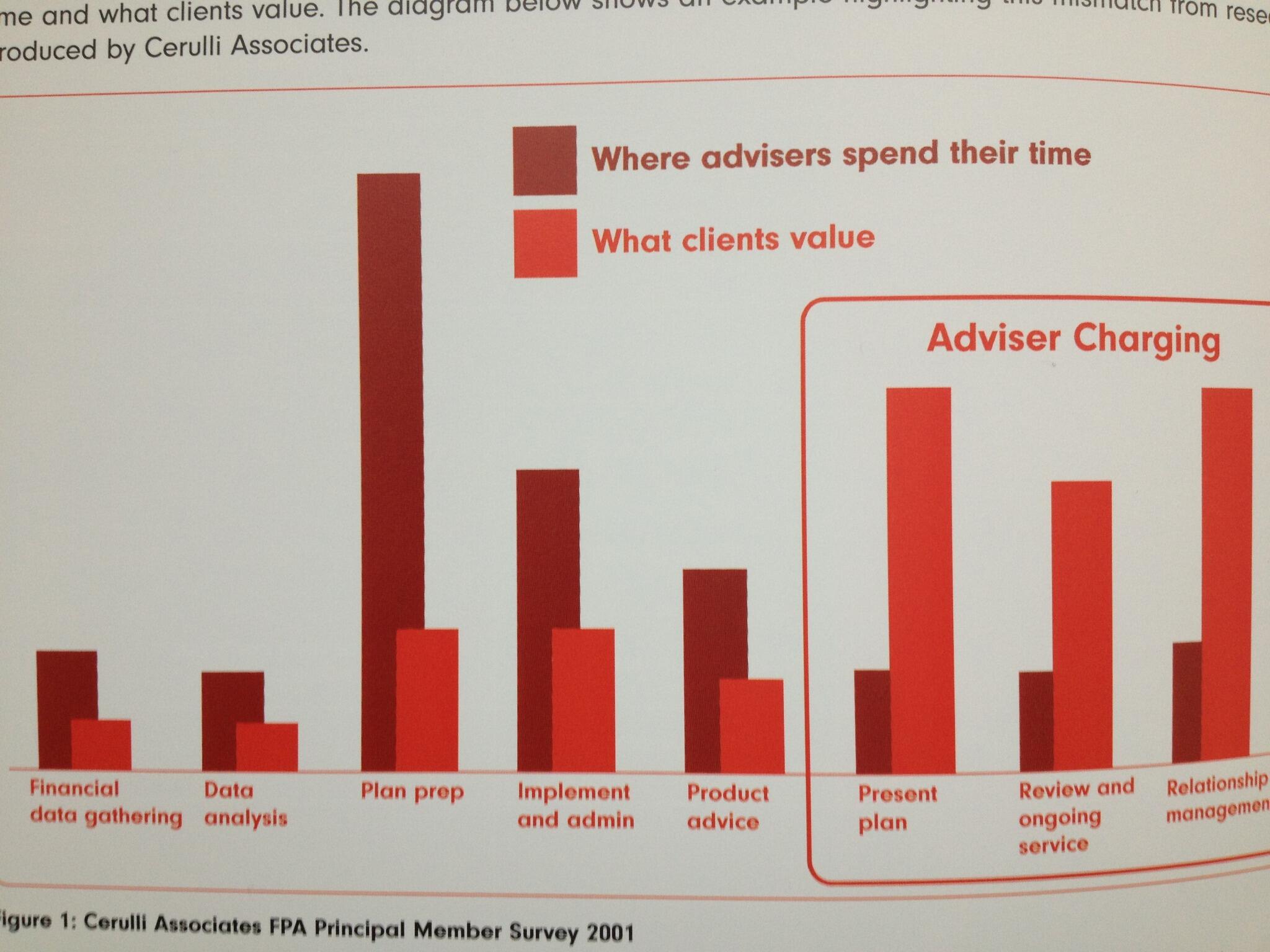

There is another issue. According to this report, average adviser hourly rate is £250 – £350. Let’s be clear, most advisers don’t bill on an hourly basis but if they did, this is what they said they’ll charge. So, from a client point of view…, does anyone really want to pay their adviser’s hourly rate for 3-4 hours, to do pension comparison and a report when a specialist can do an equally good job (may be even better?) at a third of the cost? Will clients be happy paying their adviser’s full hourly rate, for him/her to do admin-type tasks? Apparently not. According to some clever folks at Cerulli Associates, if you plot the time we spend doing various activities within financial planning against what clients actually values, here’s what you get;

That survey is 12 years old now and a new one is long over due. However, my guess is, with the additional burden of meeting the test of ‘independence’ post RDR, clean share classes, tax on rebates and all the other dramas going on platformland, tasks are much more time-consuming that they used to be.

According to Clive’s report, in the ‘ideal’ financial planning firm of the future, a Rainmaker-Adviser will serve 100 – 150 client and won’t do ANY non-client facing work! Amen to that brother!

So this is something that should happen in the future, is it? In the meantime, perhaps anyone can shed some light on why it makes ANY sense to keep our scarcest resource doing non client-facing activities TODAY. Perhaps it’s my naivety, which you must forgive as I have only been in this business less than 5 minutes. I welcome thoughts from people who have been around a lot longer than I have. Help, am I losing my mind?

The problem is it can take as long to download what is in your head and what has happened in the client meeting to a paraplanner than doing the research oneself. Using a paraplanner for some but not all back office and research work is wise however.