Our SIPP Financial Stability Guide has been generating a bit of hoo-ha in the industry publications, with providers who scored poorly grumbling about how we assessed them. It is exactly the response I anticipated and what’s funny is that, none of these providers have offered a shred of evidence or data in their comments to substantiate their claim that their businesses are healthier that we suggest. No financial statements. No specifics on their capital resources. None. Nada.

This goes back to what the FCA referred to in its paper TR 16/1 on due diligence as facts vs opinion;

When firms carry out research and due diligence they should consider whether they can rely on the information supplied by the provider, such as marketing material. Firms can rely on factual information provided by other EEA-regulated firms as part of their research and due diligence process, for example, the asset allocation. However, they should not rely on the provider’s opinion, for example, on the investment’s risk level. (TR16/1 – 1.5)

In other words, for many providers in financial services, in the absence of hard facts, it’s safe to assume that they are telling porkies if their mouth is moving! 🙂 Financial statements are facts. Provider’s comment on their own financial standing is an opinion.

A few providers are wondering how we could have assessed them, if they have provided no data. What the appear to be missing is that our assessment is based primarily on statutory data, using accounts filed at the Companies House. Our attempt to ask them to verify this data in the first place is only a matter of courtesy but they seem to think we were seeking their permission.Our overall premise is that providers with a track record of profitability, surplus capital resources (over and above the regulatory requirement), above-average profit margins, and growing market share can be expected not only to survive but to thrive in the increasingly competitive landscape. Providers who are consistently loss-making or operating on very thin margins and holding the bare minimum capital requirement will struggle to absorb competitive and regulatory shocks; they’re vulnerable to acquisitions by stronger players.

[bctt tweet=”Financial statements are facts. A provider’s comment on their own financial standing is an opinion. ” username=”AbrahamOnMoney”]

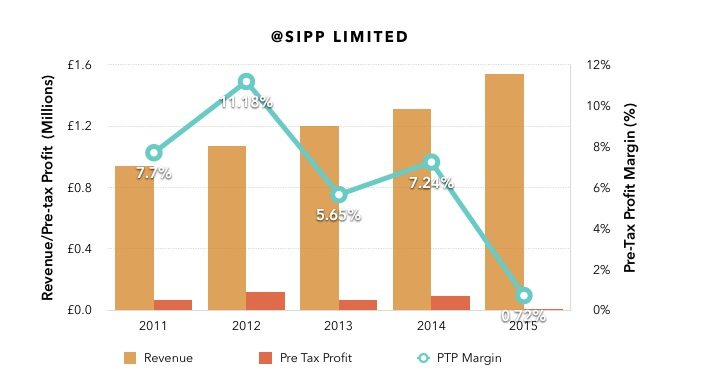

Take @SIPP for instance, one of the providers who scored poorly in our assessment; with around £0.62 million of assets under administration, it is one of the smaller providers in the market. @SIPP claimed in its media comments that they have a ‘new business entity’ and the ‘old’ business entity no longer exists. What we actually see is that the business structure changed from a Plc to a private limited company, 3 of the directors left and a new Chief Executive was appointed. The business is now owned by 5 shareholders, with founder and majority shareholder owning around 60%. These are the facts. We don’t buy the argument that these changes make the historical data of the business irrelevant. In fact, @SIPP used the same data in its own due diligence material published in Feb, 2015.

The latest published accounts for the year ending March 2015 show a small profit of £11K on a turnover of £1.54 million, a margin of 0.72%! Historically, while revenue has grown steadily, profit margins are thin and been way below the industry average. The accounts shows a P&L Reserve (cumulative retained earning) of £129K and Net Asset of £0.87million.  Ignore my assessment of this provider and apply your own professional judgement to the state of the business. Bear in mind that this is in a market where the top 3 providers account for 85% of the AUA and growing, consistently maintain significantly higher level of profitability and stronger balance sheets, and are on the look out to acquire weak ones who might struggle in the overcrowded marketplace. I’ll like to hear your assessment.

Ignore my assessment of this provider and apply your own professional judgement to the state of the business. Bear in mind that this is in a market where the top 3 providers account for 85% of the AUA and growing, consistently maintain significantly higher level of profitability and stronger balance sheets, and are on the look out to acquire weak ones who might struggle in the overcrowded marketplace. I’ll like to hear your assessment.

A few providers also seem to confuse regulatory capital requirement with financial stability. Capital adequacy requirements is only one of 9 criteria we used in our assessment. And we awarded no brownie points to a provider for just meeting the minimum common denominator i.e holding the minimum regulatory capital requirement.

What I see in our dataset is that strong providers operating healthy businesses hold way, way more than the regulatory capital requirements. Providers like AJ Bell, James Hay and Matiolli Woods hold over 300% of their regulatory capital requirement. Accordingly, we only award points for going over and above the regulatory requirement (>150%), which is considered as simple good business practice.

What I see in this sector is far too many subscale SIPP operators — many with no particular unique offering — who are already struggling to compete in the increasingly intense market place. These providers have got the signs of acquisition written all over them. With a typical SIPP client facing 30 to 40 years in retirement and the costly and inefficient pension transfer market, it’s crucial that advisers select providers who have the best chance of being around for the long term. This is the essence of due diligence, i.e for advisers… ‘to assess the provider to establish whether they believe it appropriate to entrust the provider with client assets.’ (FCA TR16/1 – 1.3ii)

[bctt tweet=”Too many subscale SIPP operators with no particular unique offering are struggling to compete in an intense market place” username=”AbrahamOnMoney”]

I totally understand that SIPP operators are not used to this level of intense scrutiny. They want to be entrusted with the huge job of administering people’s retirement wealth, yet it seems that these providers prefer their financial standing to be shrouded in secrecy. So when we came along and informed them we’ll be spreading the disinfect – that is sunlight – over their financials, they kicked up a fuss. My advice is, if you can take the heat, get out of the freaking kitchen!

- To request a free excerpt of the report, just complete the form below and we’ll email you a copy