Since the introduction of pension freedoms, providers have talked about ‘innovation’ until they, and we, are all blue in the face. Thankfully, it appears that’s starting to change!

Royal London has put its money where its mouth is. It recently launched a new Drawdown Governance Service (DGS). And there’s a lot to like about it.

It’s not quite in the same class as Frank Whittle’s invention of the Jet Engine or Tim Berners-Lee’s invention of The Internet, as RL’s marketing brochure seems to suggest. But considering how unimaginative providers have been on the subject of retirement income till date, DGS deserves some accolades.

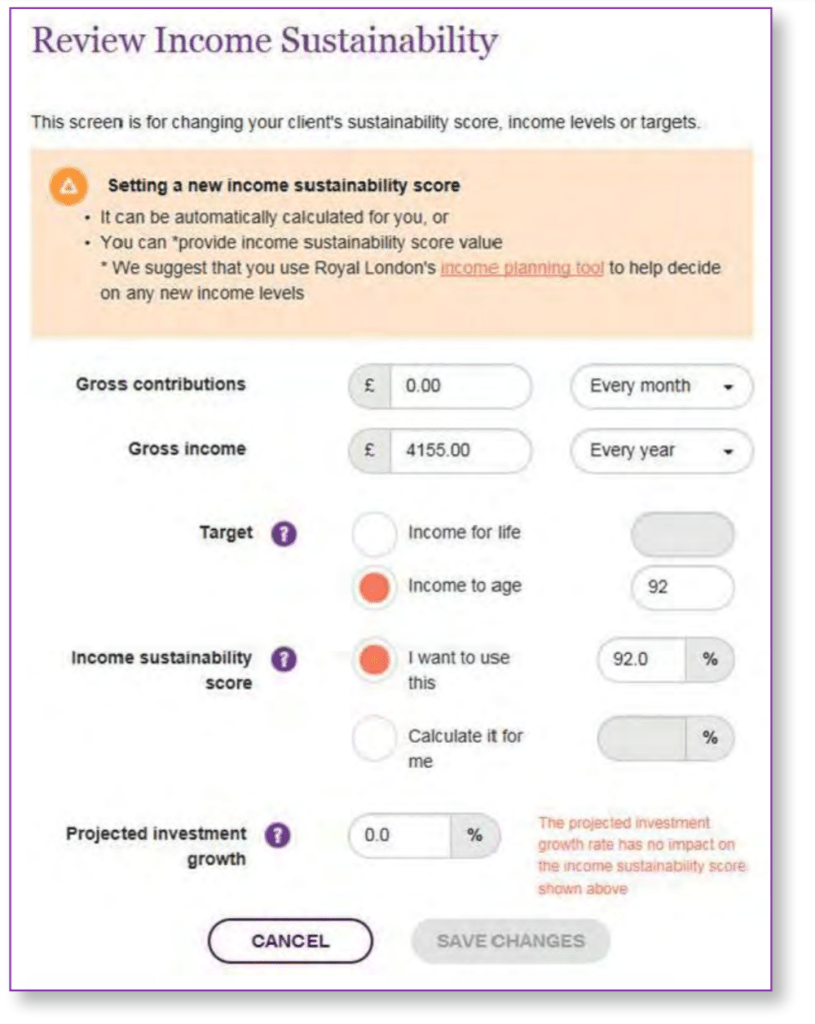

DGS uses Monte Carlo simulations to project 1,000 scenarios for income drawdown, based on variables including investment performance, product and adviser fees, and income withdrawals.

It calculates an ‘Income Sustainability Score’ (ISS), otherwise known in the English Language as ‘probability of success’ for the plan. The ISS is calculated based on the percentage of scenarios that leaves sufficient amount in the portfolio at the end of the target period, to secure a single life, level annuity with no guaranteed period.

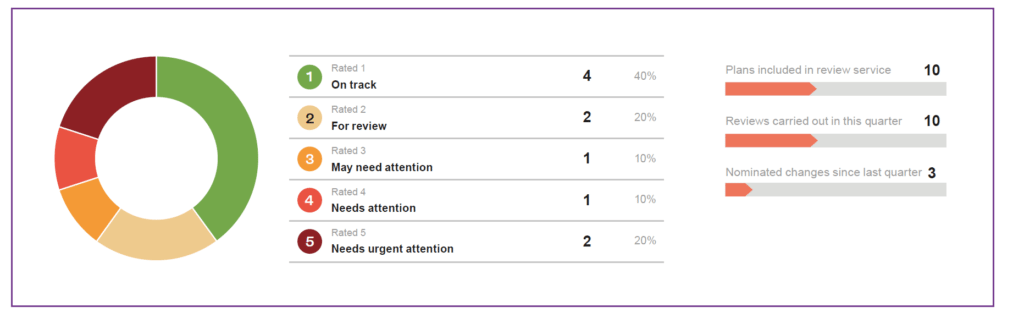

The ISS is then used to assign an outlook rating, on the scale of 1 to 5. 1 is green and means that the plan is on track, while 5 means that the plan needs urgent attention! The Monte Carlo simulations are automatically repeated on a quarterly basis, and advisers can track how the sustainability score changes over time.

Strengths

- The thing we like most about DGS is that it isn’t a product! It’s simply a service overlaid on RL existing drawdown products and investment proposition (governed portfolios et al). It can be added to a new and existing RL drawdown plan, at no additional cost.

- DGS integrates with RL product system, so that much of the data is automatically pulled through. This saves advisers having to rekey data. Big thumps up there!

- Clean and intuitive dashboard. When you log in, you’re presented with a list of all your clients on the service and a colour coded doughnut chart of their latest ratings. That way, you know which plans/clients need your attention.

- Simple, user friendly client report with adviser logo

Weaknesses

- Limited to RL drawdown products

Ultimately, DGS suffers the same handicap as most provider tools – it’s limited to their own products!

If you put all your drawdown clients with RL (I hope not), then this isn’t a problem for you. But as much as RL would love that to be the case, most firms have drawdown clients with other providers, using in-house or third party portfolios.

The reality is that firms should have a consistent drawdown review process across all their clients, regardless of the provider.

I understand why RL limits DGS to its own products but this problem could be easily resolved if there was an independent version of the tool that advisers can use for non-RL clients. But there isn’t.

[bctt tweet=”Advisers need a consistent drawdown review process for all clients, regardless of the provider” via=”no”]

- Static non-inflation adjusted income withdrawal

DGS projections work only on the basis that the income withdrawal is level and NOT adjusted for inflation. It doesn’t enable advisers to consider and show clients the likely impact of inflation on their income.

The danger with this is that clients starts with a high income withdrawal, which is supposedly sustainable, only to realise that the spending power of their money is diminished progressively. Worse, their adviser hasn’t prepared them for the chances of this happening.

The danger with this is that clients starts with a high income withdrawal, which is supposedly sustainable, only to realise that the spending power of their money is diminished progressively. Worse, their adviser hasn’t prepared them for the chances of this happening.

Personally, I think it’s a missed opportunity that RL didn’t even enable advisers to consider one or two rule-based withdrawal strategies. This is something built into the Timeline app because being able to adjust income in a dynamic way is key to sustainability.

- Lack of in-depth visualization on range of outcomes

Another obvious shortcoming of the tool is that the range out possible outcomes for the 1,000 simulations aren’t displayed at all.

The income sustainability outlook tells adviser whether the plan is on track or off track, and when the money might run out, presumably in the worst-case scenario. But that’s half the picture, how bad or how good things could actually get along the way remain unknown to the adviser and the client.

Indeed, when it comes to the review process for actual vs. expected investment growth, the tool reverts to a deterministic projection! No! No! That’s a big letdown for what is otherwise a very good service!

An alternative way to deal with this is simply to show the 1,000 Monte Carlo simulations, and then to overlay the actual portfolio performance over the projected scenarios. That allows adviser to track clients actual experience, against a range of scenarios to get a clearer sense of the direction of travel.

Kudos, RL boys and girls!

Having built Timeline, the sustainable withdrawal rate app from scratch, I know the amount of work that must have gone into a project like this. So, regardless of the shortcomings, RL should be commended for doing something none of its competitors has managed to do, yet 🙂

I don’t know any drawdown product, on and off platform, that provides this type of support for advised drawdown, let alone non-advised drawdown!

Every drawdown needs one!

They say babies don’t come with an instruction manual but every drawdown product – advised and non-advised, should come with a sustainable withdrawal tool bolted on!

No, I’m not out of my freaking mind for saying that. It’s actually one of the key criteria of Retirement Quality Mark, the best-practice standards for drawdown products set out by the Pensions and Lifetime Savings Association (formerly NAPF)

[bctt tweet=”Babies don’t come with an instruction manual but drawdown products should come with a sustainable withdrawal tool!” via=”no”]

Section 4a(v) of the RQM Standard states that, to qualify for the kitemark for drawdown products:

‘Initial communications from the provider at the point of sale must be given to customers and include guidance on an appropriate amount of initial

drawdown income.’

And Section 5b sets out further requirement for drawdown products to;

‘Provide communications in special circumstances and for particular products. These include:

- When the customer appears to be taking too much from the scheme for income to be sustainable

- When markets are particularly volatile and customers could reduce their income.

- When the customer’s pension ‘pot’ has grown for some time and they could take more’

So, RL have thrown down the gauntlet. The question is, will other providers and platform beat them or join them!

.