This post was inspired by a presentation by Paul Resnik of FinaMetrica in London a few days ago. Following the FSA Guidance Paper published in March of last year, providers of risk profiling tools claim to have improved their tests. Many advisers have also made changes to how they use these tools, largely with regards to the discussing the output with clients. But are these changes enough or do we need a paradigm shift in matching clients risk profile to an investment portfolio?

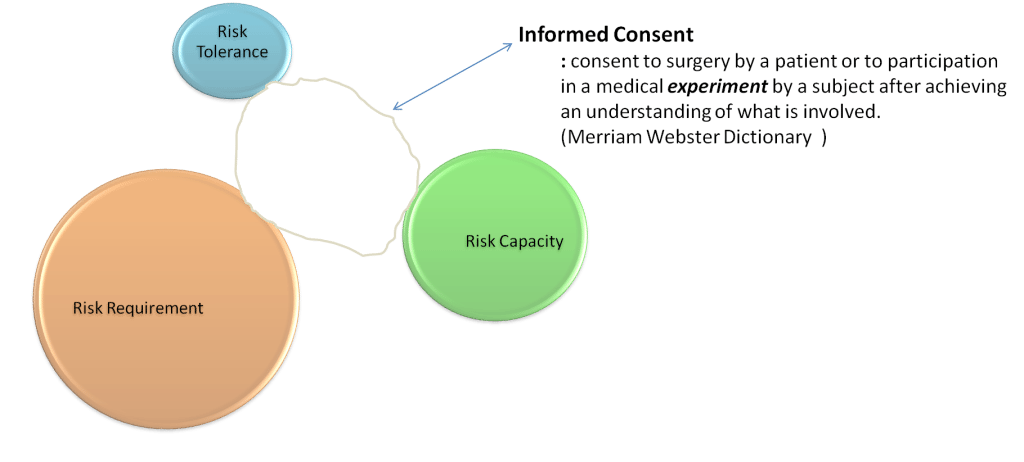

If we start from what makes up a client’s risk profile: risk tolerance, risk capacity and risk requirement.

In an ‘ideal’ world, you want a perfect match between all these three elements as shown above. The problem is, rarely do we find clients who live in an ‘ideal‘ world. They may go there on holidays but their permanent address is in the ‘real‘ world where there are often conflicts between these aspects of risk. A client might have a moderate risk appetite but their capacity for loss is quite low while the risk they need to take to meet their goal is relatively high.

This is where the adviser needs to get an ‘informed consent’ from the client. This term was coined in the 1950s and is commonly used in the medical profession but more and more in the financial planning world.

Getting informed consent is NOT always about persuading the client to take more risk than they prefer to. Sometimes the clients just has to settle to less – less income in retirement, less ‘posh’ public school for their kids etc,. In my view, measuring risk tolerance, capacity and requirement is a science, getting informed consent from clients is the art!

So, risk tolerance, capacity and requirement…. without all the three measures being in place, it’s impossible hard to ‘proof’ investment suitability. So there are a number of questions to consider.

Which of these 3 aspects of client’s risk profile does you tool measure?

It is worth digging deeper into what the tool actually measures and how? Is the methodology consistent and defensible?FinaMetrica, in no unclear terms, say their tool only measure 1 of the 3 – risk tolerance. And if you are one of the people who thinks that sample asset allocation in FinaMetrica is meant to be some ‘guide’ or ‘model’ for corresponding risk scores, then YOU ARE WRONG! Yes, you are but don’t shoot the messenger! The man told me!

Many of the tools on the market produce asset allocation but are you certain they have measured all these three aspects?

If your tool only measures risk tolerance, how do you measure risk capacity and risk requirement?

A hunch? May be fine, but then maybe not. At the conference, I put it to Paul and he agreed, than cashflow analysis is the ‘ONLY’ way to measure risk capacity and requirement because these two measure depends on the client’s plan. This is a little statement but it turns everything on its head.

If we agree that,

- To demonstrate investment suitability, you need to have a detailed and robust methods of measuring risk tolerance, capacity and requirement, and

- Cashflow analysis is the ONLY way to measure risk requirement and capacity

Then you have to agree that it’s hard to EVIDENCE investment suitability without cash flow plan!

Now, that is tough to swallow, but I think it has some merits, unless off course you believe there are other ways of measuring risk capacity and requirement. I’ll love to hear it.

Risk tolerance is an enduring trait and tends not to change (although a major life event may cause a shift.) Risk capacity and risk requirement on the other hand, vary depending largely on clients’ plan and circumstances (goals, asset, liability, income, expectations etc) which may change from time to time.

So then, where a client has multiple ‘pots’ for different life goals e.g retirement, school fees, etc., it is perfectly possible (and sensible?), that the asset allocation within each pot will vary. This is because while risk tolerance is the same for all the posts, risk requirement and capacity for risk may vary.

In the end, investment advice is a bit like surgery. Sometimes, despite doctors best efforts, the patient dies. Despite advisers best efforts, investments take unexpected turn. Having a robust process in place to build a full picture of client’s risk profile reduces the chances of investment mismatch – it doesn’t stop the market from doing what the market sometimes does but it demonstrates that adviser has done all they can to ensure clients achieve their objectives.

I’ve written for years as well about the difference between risk tolerance and risk capacity, and state it rather simply: risk capacity is what you figure out when you DO a financial plan! The financial planning process is a fantastic and thorough way to evaluate the risk capacity of a client’s goals. Notably, in terms of Resnik’s framework here, it’s also a great way to determine risk required.

Which means simply put, a good risk tolerance questionnaire plus a thorough financial plan gives you the information you need to make appropriate recommendations!

Respectfully,

– Michael Kitces

Blogger, Nerd’s Eye View, http://www.kitces.com/blog

Thanks for your comments Michael! I completely agree. The challenge is getting more planners on board. I guess that would take time.

Splendid article Abraham – very well put