Welcome our blog. This is where we share thought-provoking, no-holds-barred opinions and commentaries on all things retirement income, financial planning and investing!

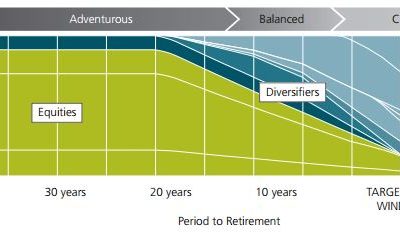

Are Target Date Funds Complete Hogwash?

Target Date Funds are becoming increasingly popular in the UK. The UK market is still very small (only around 0.5% of the DC market) but its expected to top £10 billion by 2018, with products such as BlackRock LifePath, State Street Timewise and Alliance Bernstein's...

IFP/CISI Merger: A marriage made in heaven?

Last week the board of the Institute of Financial Planning started a 4 week consultation with its members in view of its proposed merger with the Chartered Institute of Securities and Investments. The board will decide on the 4th of September. Talking to financial...

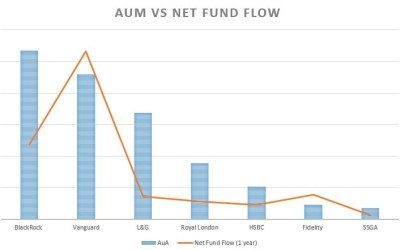

BlackRock’s Big Bonanza

Just as I'm about to head off on holiday after wrapping up our Evolution of Passive and Strategic Beta Investing Report, folks at BlackRock's padded City offices hit us with a price cut across a number of their passive fund range. This is great news for investors of...

Client Reporting: are platforms winning the battle and losing the war?

Why is it that very few clients log into their platform online accounts at all? It’s all easy to put this down to the fact that clients trust their advisers and don't bother to look at their investments on a regular basis. This excuse hides one important fact;...

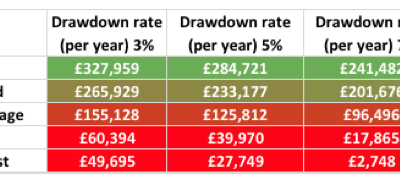

Why I disagree with FinaMetrica’s Paul Resnik on Sequence Risk

Unless you’ve been hiding under the rocks in the last few days (in which case, hello and welcome back!!) you’ve probably seen Paul Resnik's new paper which suggests that ‘sequence risk for retirees may not be the danger claimed.’ A UK version of the paper is...

Cofunds up for sale: possible implications for advisers

Word on the street is, platform behemoth Cofunds is up for sale. The parent company Legal & General apparently appointed Fenchurch Advisory Partners to find a buyer for the platform. Cofunds is the largest platform in the UK with over £76b of assets, presumably...

3,000+

Avid Subscribers