A version of this article first appeared in New Model Adviser

What I want to do here is to look at a real life case study of how we worked with Oyster Wealth Management to design their model portfolios.

It is easy to believe because of the amount that has been written about the retail distribution review (RDR), that every IFA firm has now settled on its investment proposition. However, my experience of firms with between two and five advisers has revealed the exact opposite.

We were excited when Steve Gordon, managing director of Oyster Wealth Management approached us to help design their model portfolios.

This is what Steve Gordon, MD, Oyster Wealth Management Limited had to say;

Historically, as advisers we would spend too much time with clients justifying funds and investment returns (or lack of them, given the layers of cost involved) and gradually we were forgetting what we are about, we are financial advisers and our role with clients is to offer simple solutions to their financial aims, to help them retire earlier because of our involvement, to pay less taxes because of our involvement, to leave their family better off should they die, because of our involvement, and most importantly to help them gain control of their money and form a proper financial plan that’s kept under constant review.

We are not fund managers, and fund picking based on last years’ star performers isn’t right either, we felt it was time to have a firm based investment solution for our clients, that we can hang our hat on and say, this is who we are and what we believe in, this is where we invest our own money too.

Engaging with Abraham has allowed us to build our own portfolios that we believe will stand out for our clients, so we can plan ahead with confidence and get back to what we do best, which is helping our clients push themselves to greater financial wellbeing.

So this is the step-by-step process we went through;

Firm-based approach

A clear and robust investment proposition is essential for success in the RDR world. Most of FinalytiQ’s IFA clients run their own portfolios in-house and we position our offering to support them accordingly. Our involvement ranges from complete design and construction of evidence-based portfolios to providing ongoing support, documentation and governance.

The first thing we do is understand who the clients are, but we do not call this exercise ‘client segmentation’.

What we want to understand is what the firm’s clients are like in terms of their typical wealth, investment sophistication and risk appetite, and what stage they are at in their financial planning journey.

As with many firms with more than one adviser, it is not unusual for advisers to have different approaches to choosing investments. This leads to a situation where investment selection differs from adviser to adviser at the same firm, or even from client to client for the same adviser.

This inconsistency is a big regulatory risk for firms, and Oyster wanted to eliminate this from its business by having a firm-based approach, rather than one based on individual advisers.

So we sat down with the firm to ask some key questions as to how investment markets work:

-

Do markets work?

-

Where do investment returns come from?

-

Can you beat the market on a consistent basis over the long term with a degree of skill rather than luck?

We worked through a pile of academic research to answer these questions, and once we had debated them, we agreed on Oyster’s investment proposition.

Tailor-made solution

Oyster uses Distribution Technology’s risk-profiling tool and we are guided by Distribution Technology’s asset allocation. However, we felt the tool is overly prescriptive and far too UK-orientated, so we made some alterations in our portfolios.

For instance, rather than having specific allocations to the US, Europe-UK, Japan and the Pacific, we simply merged all these into developed markets ex-UK. This ensures the portfolios are more global in outlook and far more diversified.

Academic research tells us that value and size effects appear, not just in the UK, but in other international markets. There is strong evidence risk factors are systematic across the globe. Therefore, we designed the portfolios to include value and small companies’ equity allocation to capture the higher risk-adjusted return in this asset class.

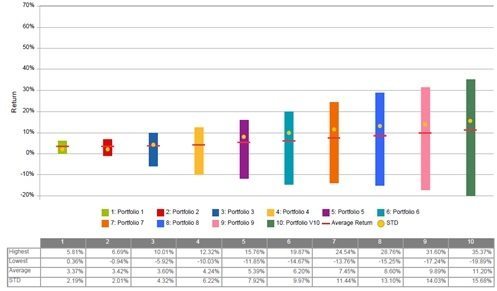

We then back-tested the portfolios using a historical data series of appropriate indices. This enables us to ensure the portfolios are in the specified risk-return parameter and deliver expected outcomes, albeit from a historical viewpoint.

We are also able to show clients the best and worst returns over one, three, five and 10-year periods of the past 40 years. This means clients understand what they are getting into and there should be fewer surprises.

Fund modelling

The final step is to populate the models using funds. We considered the whole of market, including OEICs and unit trusts, exchange-traded funds and investment trusts, and screened out funds that did not meet the criteria we set, including cost, investor protection and fund track record.

Client Engagement

One important thing we see missing in many investment process is materials designed to educate and engage clients on the firm’s investment approach. We have already produced short and colourful client-friendly version of the investment proposition and slides to help advisers in presentation meeting. We have plans to add other materials such as videos and client seminars to the mix in due course.

We have established an investment committee for Oyster, which is expected to meet twice a year to review the portfolios, and we anticipate rebalancing will take place accordingly.

A lot of research has been done on virtually every area of investment. The challenge is in reading it all and coming to a conclusion. We need to go over all of this with Oyster to decide what it is we agree on and believe in. But not all these discussions have to reach firm conclusions: we can agree on something now and review it in 12 months’ time.