Asset allocation is a key factor when deciding sustainable withdrawal rate in a retirement income portfolio. And one of the most important decisions is what proportion of a retirement income portfolio should be allocated to equities.

The received wisdom is that allocation to equities should be lower during the retirement income stage. The rational behind this include the fact that retirees tend to have lower risk appetite and reduced risk capacity.

Yet, the common practice in the industry isn’t supported by cold hard empirical evidence. Indeed, in his seminal 1994 paper, Bill Bengen recommended

…a stock allocation as close to 75 percent as possible, and in no cases less than 50 percent. Stock allocations lower than 50 percent are counterproductive, in that they lower the amount of accumulated wealth as well as lowering the minimum portfolio longevity. Somewhere between 50-percent and 75-percent stocks will be a client’s “comfort zone.”

Other research, including mine corroborate this view. Higher equity allocation tend to support higher sustainable withdrawal rates.

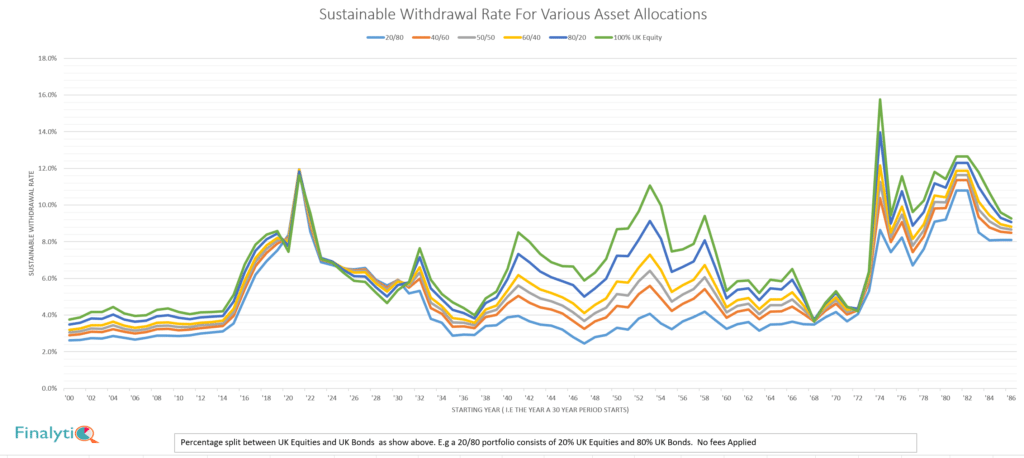

The chart below show the historical sustainable withdrawal rates for every 30 year period since 1900, using various asset allocations.

This shows higher equity allocation tends to support higher withdrawal rates, and this is consistent through most histrocal periods. Even in some of the most severe economic and market conditions (WWI and WWII) an equity-heavy portfolio resulted in higher sustainable withdrawal rate over a 30 year period.

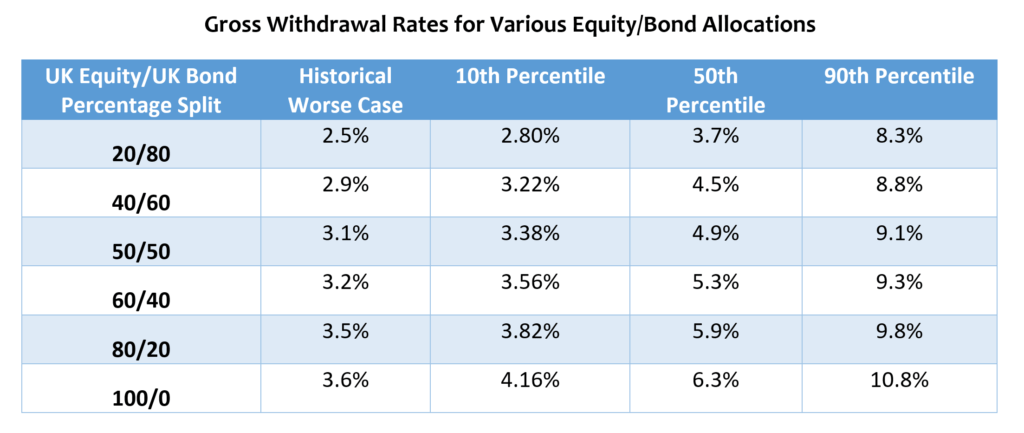

This table below shows a summary of the historical worse case, 10th, 50th and 90th percentile withdrawal rates for varying degree of allocation to equities, based on a 30 year horizon.

[bctt tweet=”Higher allocation almost always resulted higher withdrawal rates. ” username=”AbrahamOnMoney”]

Success Rates

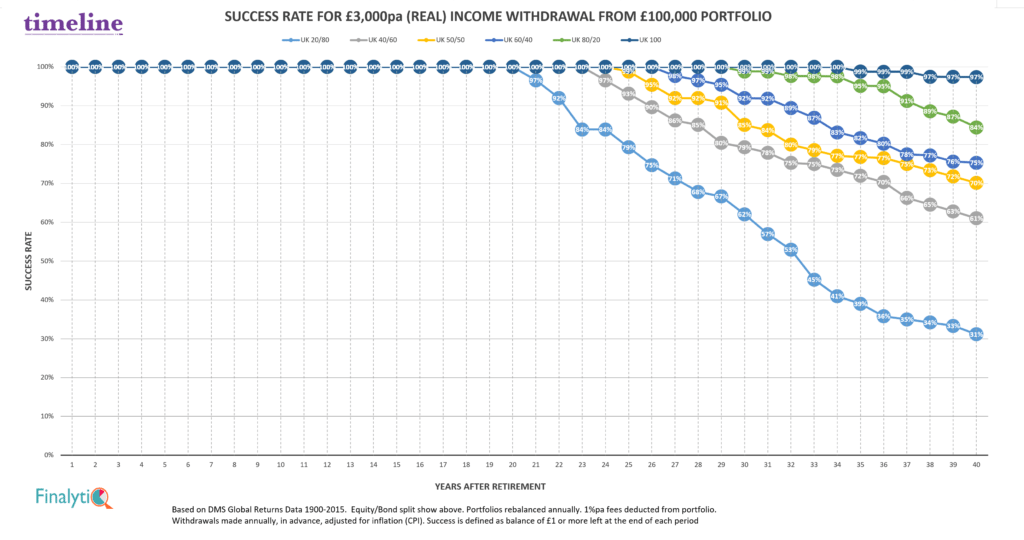

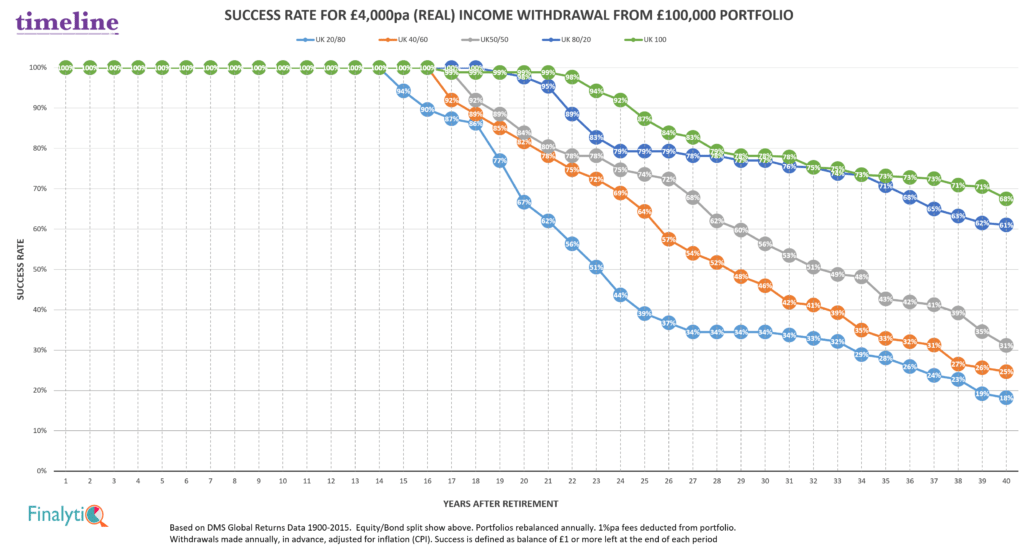

Another way to view this is to look at the success rate of various asset allocations for a given withdrawal rate over multiple retirement periods. The charts below show the success rate over all time periods between 1 to 40 years.

First, for a £3,000pa inflation-adjusted withdrawal, net of 1% portfolio fee.

And then £4,000pa inflation-adjusted withdrawal, net of 1% portfolio fee.

The conclusion here is that higher equity allocation is almost always associated with higher success rates and sustainable withdrawal rates. Amazingly, this holds true even for retirement lasting shorter periods.

Put diferrently, for a given withdrawal rate and time period, the lower the equity allocation, the greater the chance of running out of money!

This raises an important question about how we define risk in the context of meeting a retirement income goal? Why is higher equity allocation deemed to be higher risk, when in actual fact, it has higher success rate? Is volatility the risk, or is it the risk of actually running out of money?

[bctt tweet=”The lower the equity allocation, the greater the chance of running out of money!” username=”AbrahamOnMoney”]

Higher equity allocation is obviously associated with higher volatility and portfolio drawdown. In theory, this should matter less to a retiree, if the higher equity allocation gives them a greater chance of meeting their income objectives. Yet, in practice, thanks in part to the mis-education by the investment industry and the media, the investor has to contend with volatility on a day-to-day basis. And if the volatility of the portfolio is higher than the retiree is willing/able to stomach, there is a greater chance they might cave in and abandon the investment strategy. Frankly, it no good if a retiree stays awake at night, worried sick about their portfolio, even if that portfolio provides a higher sustainable income and greater chance of success than a less volitile one.

Accordingly, the problem with high equity allocation in retirement isn’t really an investment problem, it’s an investor problem. Working with a financial planner can be of huge benefit here. An adviser can help reconcile the conflict between a client preparedness to tolerate volatility and the chances of meeting their income objective. Moreover, a good financial planner provides invaluable handholding, particularly in extreme market condition.

Of course, this doesn’t mean that retiree should hold more equities than they are prepared to stomach. It’s more about setting realistic expectation. If retirees are not prepared to accept the volatility and drawdown associated with at least 50% equity allocation, they will need to be content with low withdrawal from their portfolio. And they ought to seriously consider annuitizing their retirement funds. Given mortality credits, an annuity will likely give a higher income than a bond-heavy portfolio anyway.

.

The problem I have with basing a sustainable rate of withdrawal on historical data is the level of bond yields. Abraham has done a great service to the advisor community by highlighting the importance of returns in the first decade where funds are in depletion: however, over the next decade we can take a pretty good shot at what the return from the bond component will be (namely the yield to redemption today, which net of AMC will be close to zero – and that might be a good outcome). When a very well-grounded measure is available for the most crucial period it seems to me that we should use it. Onto that would be grafted an estimate for the return from equities using, for example a dividend discount model.The outcomes we get over that crucial period should inform the rate of withdrawal.Beyond the first decade other estimates for return would be used, in turn informing a sensible withdrawal rate.

Basing a future withdrawal strategy on the past may not work post QE when bond yields are lower than they have ever been and many assets are richly valued.

I couldn’t agree more Abraham, especially when you say “Accordingly, the problem with high equity allocation in retirement isn’t really an investment problem, it’s an investor problem. Working with a financial planner can be of huge benefit here. An adviser can help reconcile the conflict between a client preparedness to tolerate volatility and the chances of meeting their income objective. Moreover, a good financial planner provides invaluable handholding, particularly in extreme market condition.”

A good example would be the Head teacher and hsi teacher wife I saw yesterday whose “risk questionnaire” gives a very low attitude to risk for their investable portfolio, which is only now in their 50s starting to build, but they are one of the most financially secure couple’s I have on my books with an unencumbered home and two very good Teachers pensions. As such, the invested monies can and should be using a much higher equity content than the risk quesionnaire indicates and we have to discuss this with them to see if they accept the logic (and document it to cover our backsides) or reject the logic and use the risk questionnaire (but again cover our backsides as we think the risk level WRONG for their needs).