The fear of dying is right up there on the list of top fears people have. But apparently, the fear of public speaking is even higher on that list. May be I’ve got this all wrong but if that’s true, then it seems to me that when the average person goes to a funeral, they’ll rather be in the casket than do the eulogy?

But I digress. Perhaps for many people, particularly those approaching retirement, the greatest fear shouldn’t be the fear of untimely death, but that of living too long! Planning for retirement is particularly challenging because we are planning for a finite, but precisely unknown period of time. And without the proverbial crystal ball, estimating clients’ longevity is rather tricky. Yet as part of the financial planning process, advisers are constantly called upon to make judgement/assumptions on how long clients are likely to live.

This excellent paper by Birmingham University academic Dr Paul Cox is essential reading on longevity assumptions in retirement planning. The ensuing discussion is my take on the paper and more on how we approach longevity assumptions within the context of retirement income planning.

Life Expectancy Is A Flawed Measure for Retirement Income Planning

One common but flawed approach for estimating life expectancy is to simply look at the life expectancy tables, based on the client’s age and sex. For instance, a 65-year-old man in the UK has a life expectancy of 19 years, while a woman of the same age has a life expectancy of 21 years.

This approach is flawed, for several reasons. One, life expectancy is the ‘mean’ number of remaining years and there’s at least a 50% chance someone in that age group will outlive their life expectancy! But more crucially, it fails to account for improvements in mortality as people get older.

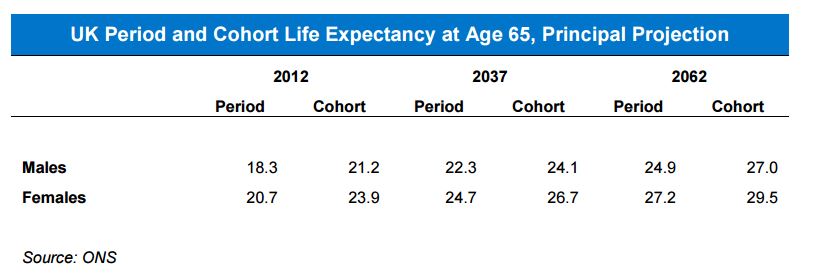

The ONS has two types of life expectancy measure;

- the period life expectancy which shows life expectancy at a given period an e.g for a 65 year in 2015, and

- the Cohort life expectancy which tracks a given cohort who share the same year of birth and takes account of improvement in mortality.

The table below is compiled by Dr Paul Cox, shows that mortality improvements add about 3 years to life expectancy.

Survival Probability

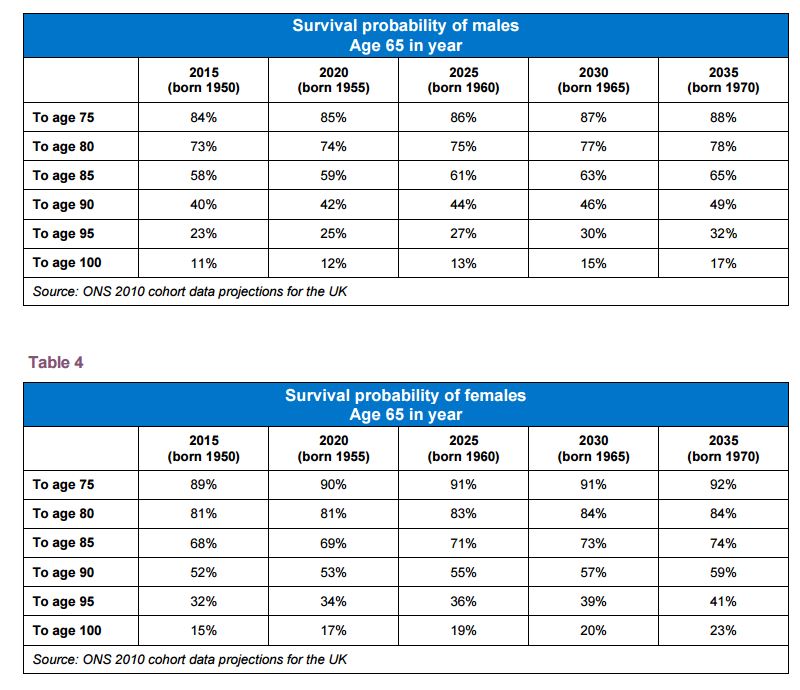

An obvious way to deal manage longevity is simply to use an annuity to insure against the risk of living too long. Short of using annuities, longevity in the context of retirement planning is best approached in term of survival probability. This gives us clearer idea of the chances that someone will live till a certain age.

This is one reason I believe that deterministic cash flow model are inadequate in retirement planning, because the challenge that we are dealing with is by its very nature uncertain and thus probabilistic. As this tables show, there is a there is a 11% chance a 65 old male will celebrate their 100th birthday and that rises to 15% for a female of the same age. The implication of this is that we need to bring the survival probability into context in retirement income modelling.

- Survival Probability in retirement income modelling: Survival probability can be easily feed into a Monte Carlo model to enable more robust discussions with clients about how long they are likely to live, what the likely success rate of their financial plan is and more importantly what financial resources they have in place in the event of extreme longevity. This enables the planner to calibrate the financial plans accordingly.

- Adjust for lifestyle: It’s important to adjust the survival probability to take account of client’s lifestyle. It’s unrealistic to assume that a obessed 65 yr old, who smokes 10 packs of cigarettes a week, with mild health conditions has the same survival probability as a health fanatic who goes to the gym 3 times a week and haven’t touched a fag in their life! Engaging in non-judgmental grown-up discussions with clients is vital.

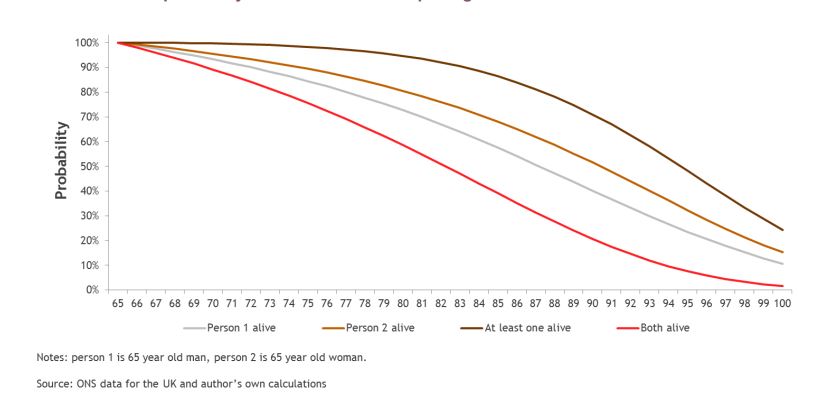

- Couples: And then, there are couples. It’s estimated that around 75% of people over age 65 live as couples and the chance that at least one of a 65 year couple would live to age 100 is whooping 24%!

Survival Probability at age 65

- Estimating the Real Probability of Success

Consider a case where a planner determines that a 3% inflation-adjusted withdrawal rate (net of 1% fee) from a 60/40 portfolio has a 90% probability of success over a 30 year horizon – which means a 10% chance of failure or more precisely a 10% chance that they will need to make some adjustment to their withdrawal in the event of poor return sequence.

Yet, since there’s only a 48% percent change that at least one member of the 65 year old couple is going to live to age 95, the overall probability of failure is actually 4.8% (10% X 48%) – i.e a whooping 95.2% probability of success! This is because there are two unrelated probabilities here –

- the probability of having a poor sequence of return over a 30 year period AND

- the probability that at least one member of a 65 year old couple is going to survive 30 year

The failure of this simple financial plan requires those two events to happen – i.e poor sequence of return that ruins a 3% withdrawal rate over a 30 year period AND at least one member of the couple to survive 30 years. Those odds are completely independent and unrelated, and the probability of both happening is actually less than the probability of either of them happening. This is in the realms of what math nerds refer to as ‘conditional probability!‘

- Have a contingency plan

My view is that working to success rate of 80% – 90% is reasonable in retirement income planning but it’s important to check that clients are comfortable with that. A key part of the planning is to consider the magnitude of failure – i.e if the very worse case scenario does happen, how do you manage it? Are there other assets such as the family property that they will fall back on in event of extreme longevity and poor return sequence?

I’ll avoid using the term ‘Probability of Success‘ or ‘Probability of Failure‘ with client, but rather framing it as the chances that client will have to make small adjustment to their portfolio withdrawal if they experience poor returns in the earlier part of their retirement. The key here is that sequence risk would need to be closely managed, so if the client is unfortunate to have poor returns in the first two or three years in retirement, them their withdrawal would need to be adjusted to mitigate against the risk of running out of money.

But if a client isn’t prepared to accept between 10% to 20% chance that they’ll need to make some adjustment to their income, than buying an annuity is the natural answer. Currently there aren’t any deferred annuities in the UK, and there’s very little signs of that changing soon. And it’s important to note that unless index linked annuity is purchased (and less than 10% of annuity bought are index-linked), inflation poses a significant risk in retirement, particularly in event of extreme longevity which the client is insuring against. Assuming 3%pa inflation, a £100 annuity income purchased at age 65 is only worth £35 in real spending at age 100!

- Dealing with declining financial capacity in retirement

Finally, one point worth thinking about when drawing up a retirement income strategy is that as people get older, their ability to make financial decision is impaired. It’s estimated that financial capability declines at a rate of 1% to 2% per year from age 60, so expecting that clients would understand the vagaries of managing a drawdown portfolio (or even provide their adviser with informed consent to do so) is unrealistic. One possible solution is to have withdrawal policy statement signed and pre-agreed with clients while they are still financially capable. Of course the use of Power of Attorney should be a given for any clients over the age of 65, particularly those in drawdown and the attorney could be involved in the planning process as early as possible.

[bctt tweet=”It’s estimated that financial capability declines at a rate of 1% to 2% per year from age 60.” username=”AbrahamOnMoney”]

The implication of all these is that longevity is a huge consideration in retirement income planning and it’s an area where financial planning can add real value. Managing longevity risk in the context of retirement is best approached using survival probability, rather than simply inputing a number, like say age 100 into the cashflow tool.

.

The average person may live the average lifespan, but the average IFA client is not the average person. They are almost certainly wealthier than average which means they are likely to be healthier too. We know life expectancy for those with pensions are much higher than for the population as a whole (CMI figures). It seems to me that using ONS whole population figures as the basis for probability calculations for a small subset of rich people is fundamentally flawed. A good follow-up article would be to look at how much longer IFA clients live than average and what the implications are for retirement planning. As long as it doesn’t make annuities look more attractive, of course… wouldn’t want that!