RDR is only a few weeks away and advisers are getting their businesses ready for the new reality. Many advisers are pretty much where they need to be in terms of qualifications, SPS, adviser charging and client proposition.

However, a weak link for many appears to be in their investment process.

If the vibes we have been getting from Canary Wharf in the last few months is anything to go by, no one should be in doubt that the regulator wants to see a robust and well documented investment process in place and more importantly, that this process is being followed to a Tee.

Write it down… ….in blood!

If it is not documented, it probably doesn’t exist! No joke!

If it’s not written down, your staff, the regulator and anyone else who cares can’t read it!

Audience? What Audience?

When documenting your investment process, give some thoughts to who your audience is. Is it the regulator or your research and admin staff or your clients (they probably won’t be reading it)?

If you can manage to speak to the three using the same language (and good luck with that), then you can probably have a single document in place for all three. Chances are, you can’t.

My suggestion is to consider having two separate documents in place; one for your staff and the regulator, the other (less gobbledegooky- version) for your clients.

What are your core investment principles and what informed them?

Here’s where we separate the men from the boys! Are you a fan of Efficient Market Hypothesis or do you think it is complete bonkers? Do you think stock selection and market timing add value? And why? It is not enough to just pooh-pooh all over an investment concept or principle, consider supporting your investment philosophies with evidence, ideally with academic references.

So here’s the plan….

Think through what you do when a clients the door. Is this in line with the expectations of the regulator? It is client-centric? If not, do you need to change anything?

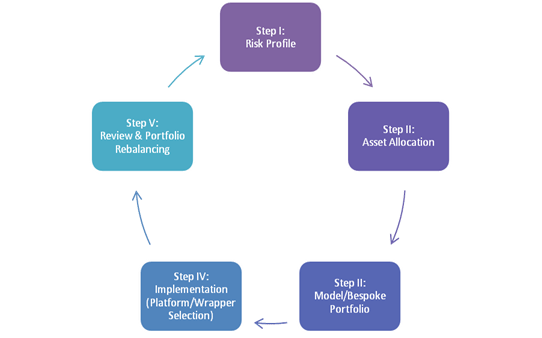

Think about your approach to each of the following critical aspects of the investment process…

- What is your approach on risk profiling, asset allocation and portfolio construction?

- Do you use a CIP? Is it in-house or outsourced? What due diligence do you conduct in selecting and reviewing the CIP? Is this properly documented elsewhere?

- Do you have an in-house investment committee? Who is on the committee and how regularly do they meet

- How do you use platforms and product wrappers?

- Review, re-balancing and performance measurement

What DON’T you do? Yes, really…

It is not just to what you do but also what you don’t do. Which product categories won’t you ‘normally’ consider as part of your recommendation for a ‘typical’ client and why? Your list will probably include all the following UCIS, EIS, SEIS and VCT.

Are you able to advice of these, for example where the client specifically request them or already has them?

Finally, consider if you need a helping hand. Even if you know what you are doing, you’ll be amazed at the value of having a fresh pair of eyes look at what you have put together, even if all they do is pay the proverbial ‘devil’s advocate’

Remember, having a well documented process is only a start! The process needs to be followed and reviewed regularly but that is a discussion for another day!