For the last few years, we have published an annual study of the multi-asset fund universe. The result of our latest study is as heart-wrenching as previous years; the overwhelming majority of multi-asset fund managers don’t add any value through their asset allocation and fund selection. In fact, they detract from value.

The 2019 installment of the FinalytiQ Multi-Asset Fund Report is an in-depth analysis of 89 fund families, consisting of 391 multi-asset funds, which collectively hold £125.7bn of client money.

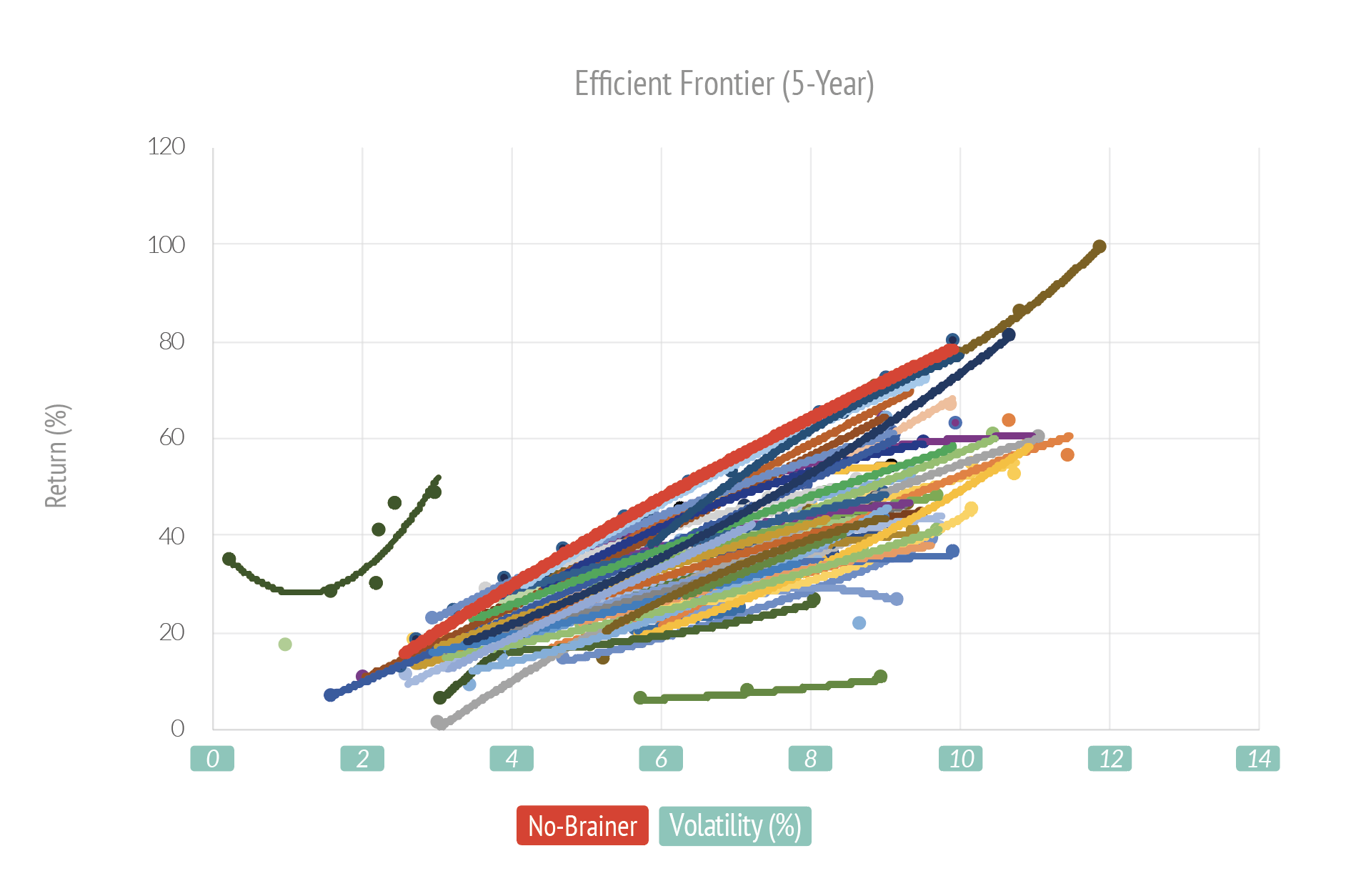

The vast majority of multi-asset funds continued to under-perform the No-Brainer portfolios on a risk-adjusted basis. Over a 5 year period, only 1 in 7 fund families delivered greater risk-adjusted return than No-Brainer portfolio benchmarks which made up of simple global equity/bond indices re-balanced annually.

In that regard, with a very few exceptions, multi-asset funds are a mug’s game. These exceptions only prove the rule. Low-cost propositions available through Vanguard, Blackrock and a few others tend to deliver better returns for clients.

The implication of this report’s findings is that advisers using multi-asset funds have to reassess their proposition. This is particularly the case where costs are meaningfully higher than the aforementioned low-cost alternatives. It’s clear that many investors in many of these high-cost multi-asset funds are being taken for a mug.

There is also a wider discussion about how advisers are inadvertently undermining their own value. There is a general consensus that advice is infinitely more valuable than investment management. Yet, the median cost of multi-asset funds (1.15% pa) is greater than what most advisers charge for their ongoing advice (1% pa, including financial and tax planning and behavioural coaching). If an adviser recommends that clients pay more for investment management than they pay for financial planning, what does this say about the advisers’ perception for their own value?

Given that high-cost multi-asset funds systematically underperform simple, low-cost equity/bond benchmarks, we have to ask why many advisers continue to recommend them. In a recent article, Wall Street Journal’s personal finance columnist Jason Zweig suggests that one reason advisers continue to value investment management over financial planning expertise, is that they aren’t confident enough in their own value proposition.

‘Meanwhile, advisers who charge for their services through an investment-management fee while appearing to give financial planning away have trained the public to believe investing is arcane and expensive, while financial planning is mundane and unimportant. The opposite is closer to the truth: Investment management is a commodity whose market price has dropped close to zero, whereas the advice and judgment of a good financial planner can do wonders for your net worth.‘ – Jason Zweig

We firmly believe that advice is infinitely more valuable than investment management, so advice costs should be more than product (including platform + fund) costs. Fund managers clearly don’t seem to recognise this. They continue to price funds higher than advice. But why do advisers continue to indulge them by recommending high-cost multi-asset funds? Advisers might want to give some thought to the message they are conveying to clients, if the cost of the product they recommend is higher than the cost of advice itself.

Download a Free Excerpt!

Telling it as it is. Take a bow!