This post is inspired by a new White Paper by BarcalysWealth, titled Overcoming The Cost of Being Human: (or, The pursuit of anxiety-adjusted returns, which sets out the framework for embedding behavioural finance into its investment management and advice process.

Most of what is done investment management today is based on the classical finance theory and the assumption that what investors want or need is risk-adjusted return i.e. the best possible return for any given level of risk. So we dedicate a lot of time and effort to finding the efficient frontier and understanding investors risk tolerance.

In theory, this works only for the so-called Homo economicus; that hyper-rational ideal investor who isn’t only perfectly comfortable with entering the market and staying fully invested but also able to remain focused on long term pay-offs, even in the face of (sometimes extreme) short-term market fluctuations. Only one problem, that investor really only exists in the imaginations of classical finance professors.

Thanks to the emerging field of behavioural finance, we have known for some time now that real investors are driven by emotions. They tend to be reluctant to invest, or too active when they do finally find a compelling reason to enter the market. They trade too frequent, buy-low and sell high, and forgo long term gain for short term comfort, all of which are the exact opposite of what traditional finance theorists assume they do.

The result of this is what is now commonly know as ‘Behaviour Gap‘ – the difference between what investors should get if they followed classical investment principles and what the actually get (because they don’t.)

Classical finance calls it ‘irrational,’ behavioural finance calls it being normal. Classical finance ignore it. Behavioural finance says it is the most important determinant of investor’s return.

The behaviour gap is the investment cost of being human; of being ‘irrational’; of being ‘normal.’

Behavior gap can be measured in a number of different ways and to a varying degree (typically involving the return forgone by staying in cash rather than investing, cost and under-performance as a result of excessive trading and market-timing) but the team at Barclays puts the overall cost at at around 3% a year, although it could be significantly more for some investors.

No doubt, classical finance, which has developed following decades of academic research and practices, has a lot of merits. So, rather than throwing away the baby with the bath water, behavioural investment management takes the best ideas of traditional investment theory and builds around it a framework that accounts for investors emotional biases. The result is what behavioural finance experts at Barclays call, ‘anxiety-adjusted returns’: the best possible returns, relative to the anxiety, discomfort and stress investors are going to have to endure over the volatile investment journey.

The idea being that by acknowledging investors’ need for short-term comfort and providing ‘emotional insurance‘ in a targeted, efficient and planned ways, rather than via the unplanned and expensive methods investors employ with knee-jerk responses along the journey, you are able achieve a much better long term results.

Off course providing this ’emotional insurance’ comes at a cost but the price is much less than investors will otherwise have to bear; the behaviour gap

In the past the behavioural finance has been criticised as being ‘too woolly’ and lacking practical application. Behaviouralists throw around fluffy anecdotes that make a nice reading but have very little practical application in the real world. For instance, they tell us about investor heuristics and biases but not how to deal with them. They also tell us that knowing about these biases doesn’t necessarily help us avoid them. However, I think the team at Barclays has done an impressive job in this seminal paper, distilling their research and ideas into a practical framework that advisers and investment managers can actual imbibe into their work with client.

Beyond Risk Profiling Tests

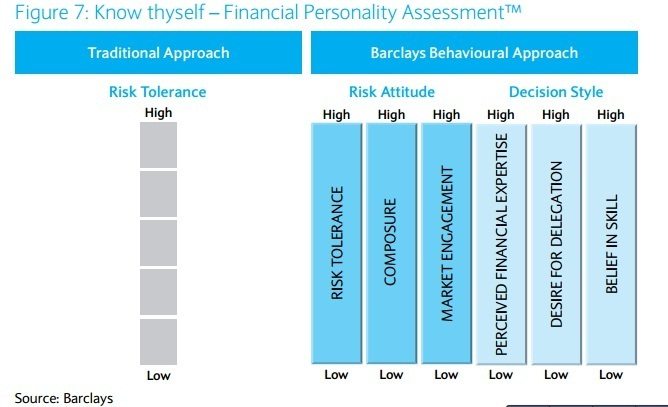

A big part of what the team at Barclays has done here to take risk profiling up a notch. In addition to the traditional risk tolerance tests, their proprietary Financial Personality Assessment™ (FPA) measures client’s decision-making style, specifically their Perceived Financial Expertise, Desire for Delegation and Believe in Skill.

The result of client FPA allows potential solution to be tailored to account, not just for clients risk profile but also their specific behavioural tendencies.

For instance, clients with high level of Composure and Delegation may well be better with discretionary management – i.e outsourcing the emotional burden of decision – making. This comes at a price, but the cost is much lower than the ‘behavioural gap,’ which the cost of ignoring clients need for emotional comfort. According to the authors of the report;

” For those with high Delegation scores, handing over the decision making to a professional manager can be a very good solution. However, the important observation is that these personality dimensions interact with each other in some subtle ways. For example, a discretionary portfolio can help the high Composure investor overcome inaction or apathy, and can do the same for a nervous investor who has low Perceived Financial Expertise. On the other hand, the greater emotional distance from the portfolio movements, decisions, and details that come with Delegation can also be useful in eliminating the short-term stress of a low Composure investor. For those with a low desire for Delegation, the solutions need to come from elsewhere, and be more direct’

For advisers, this provides a more scientific framework to support many of what we do already. For instance, evidencing why discretionary management is more appropriate for the client than other alternative solutions. This is not just valuable in reassuring clients that this is the best approach for them but also very valuable from a compliance point of view; to show that clients aren’t being shoe-horned into any particular solution.

It also pours cold water on the traditional practice of putting clients into discretionary management on the basis of their portfolio size or because that is the approach the firm has chosen. It’s a recipe for disaster if the client is a Non-Delegator with high Perceived Financial Expertise and low Composure.

Emotional Insurance

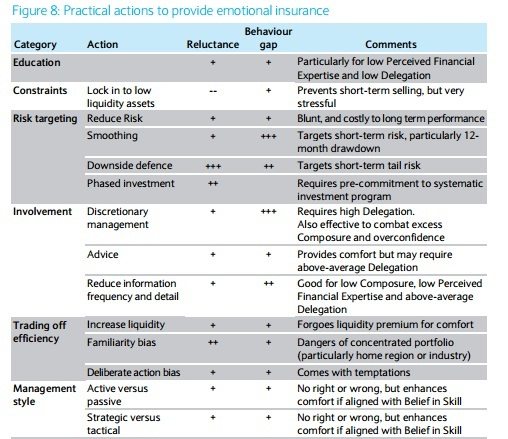

Another key aspect of the framework is the interventions, a list of actions aimed at providing emotional insurance to help clients overcome/manage their anxiety about investing. These interventions are effective, to a varying degree, depending on client’s personality. The result of the FPA helps target the best solutions to each client.

I have to admit, I’m puzzled by some of the suggested interventions, specifically risk-targeting strategies such as ‘smoothing’ and ‘downside protection’ (achieved by the use of derivatives). These strategies have less-than stellar records in the past; case-in-point being with- profits and structured products!

In summary, this is a neat piece of work and one that definitely moves us closer to practically imbibing behavioral finance into investment management and advice. Off course, the core of this work – the FPA is proprietary and isn’t available to advisers, nonetheless, it White Paper makes a useful reading with a lot of practical ideas.

NB: On Wednesday 8th May, Greg Davies, Ph D, the author of the report and the Head of Behavioural and Quantitative Investment Philosophy at Barclays will be my guest on the AdviserHangout to discuss this paper and how advisers can use these ideas in their work with clients. Details later on the blog.

Perfect Money Investment – 9000% After 1 Day

Make $90,000 PerfectMoney Money Profit with HYIPs For $3000 Investment in 24 hourss

Earnings are paid directly to your PerfectMoney account automatically.

Earn Money fast

https://www.mylibertyreserve.com

Make Money Quickly

https://www.payinghyiponline.com/MyLibertyReserve.html