Following a board reshuffle that resulted in the exit 6 of the former board members at Alliance Trust Plc including the Chair, the CEO and the CFO, and a new independent board for the platform business ATS, it’s reported that the Trust is considering putting the platform up for sale. What is amazing is that it took a completely new leadership for the Trust to really ask serious questions about the viability of ATS as a platform business.

- ATS is only a minute part of the Trust assets but a huge drain on its resources

Valued at £54m as at the end of Dec., 2015, ATS represents just 1.63% of the Trust’s £3.31b assets. Yet, none of the Trust other holdings has generated as much headache for the board as ATS, primarily due its loss-making nature.

The Trust invested £37.1m in ATS in 2015 alone, including the £14m for the acquisition of Stocktrade. This is a significant drain on the group’s overall pretax profit of £145m in the same year.

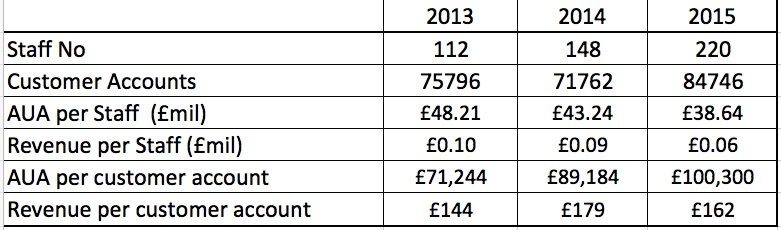

Of all the over 300 people that work at the group as at the end of 2015, 220 of them work in the platform business! Given the purpose of the Trust to focus on ‘maximising the capital and income return‘ for its shareholder by selecting good companies, rather than actually running them, it doesn’t take a genius to question if the end is nigh for ATS.

- Payback Period

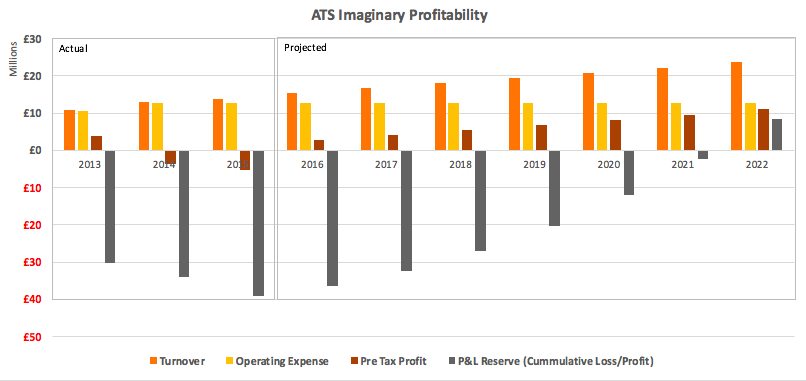

The Trust has invested a total of £92.9m in ATS since the platform was established in 1986. ATS now has a £39m in cumulative losses over the years in its P&L Account Reserve as at the Dec 2015. The management makes of big deal of the fact that ATS was ‘operationally’ profitable in 2013 and 2014 – the point of this is that if you exclude the non-reoccurring cost of RDR (circa £5m) and re-platforming to GBST (circa £4m), then the business would have been profitable in 2013 and 2014 – but this is just accounting gibberish because you can’t take ‘operational profits’ to the bank or pay it to your shareholders.

The Trust expect the business to become profitable in 2016, but how long would it take to recoup the accumulated losses?

Ladies and gentlemen, let’s play a game called ‘What’s Your Payback Period’ to work out how long it’s likely to take ATS to recoup its accumulated losses and actually stand a chance to contribute to the Trust’s bottomline.

To do this, we have to enter an imaginary world where there are no substantive cost of regulation beyond the normal course of business; no major technology spend to develop the platform for the digital age the we live in the real world and you can serve increasing number of clients (and advisers) without increasing your cost base. Got that?

In this imaginary world, I projected ATS revenue, based on revenue growth over the last 3 years (average of 12.7%pa ) but I kept the cost base completely static at the same level it was for the year ending Dec., 2014. As mentioned, I excluded the cost of RDR, major technology spend and acquisitions, yet I assumed the revenue will grow at the same rate it has in the last 3 years.

On that basis, ATS won’t be in a position to make any positive contribution to the Trust’s bottomline until 2022, assuming there are no major regulatory, technology and acquisition costs.

So, an additional 6 years, taking the total payback period to… wait for it… 36 years since ATS business was set up!

But it’s unrealistic to even expect that ATS (or any other platform) can grow revenue at a double-digit rate, while keeping their cost base completely static. So what if the cost base increases by a modest 5%pa? Then that date becomes 2025 (again ignoring the possible cost of major regulatory change and tech investment), taking the total payback period to 39 years!

Indeed ATS has been growing its headcount over the last 3 years, at a faster rate than its revenue. So while AUA and No of Accounts have increased, AUA per headcount and No of account per headcount have actually declined drastically! Revenue per account increased after in raised prices in early 2014, but the real cost of that it actually lost many clients in the process. AUA per client is growing but ATS does not benefit from that, since it’s fees are fixed, and not based of percentage of AUA!

May be 39 years payback period is fine for the Trust’s shareholders investing for the very log term – except that major regulatory changes are actually a norm in financial services and the need for platform to make significant investment in technology in order to remain relevant in this digital age has never been greater! The pace of re-platforming that we see in the platform world right now is primarily down to the fact that technology becomes obsolete faster than ever, so we expect that platforms are going to have to do the ‘re-platforming’ thing all over again in 7-10 years time!

Taking all that into account, the real payback period is looking like… ehr… ehr… never?

- Price alone is a bad differentiation

ATS key differentiation is its fixed price, which is actually rather nice for some clients. The trouble is that, when your only differentiation in a crowded market place is price, you’re are forced into a position where you can only really grow revenue by charging your existing clients more while at the same time trying to attract new clients! Technically speaking, you’re buggered!

ATS pricing has been unstable as its financials, having been forced to increase its prices twice in 2 years – in early 2014 and then again in March 2016. This happened in a period when most platforms have either kept their prices stable or even reduced prices a little. Remember what they say – buy cheap and buy twice!

[bctt tweet=”A key due diligence lesson is that the long-term viability of platforms trumps price, any day! ” username=”AbrahamOnMoney”]

But there’s also a much deeper problem. The flat fee is only really cost-effective at around £100K for ISAs/unwrapped assets and £200K for pension! Looking at ATS data, average AUA per customer account is around £100K, which means a significant proportion of their existing clients are actually overpaying!

And what’s the average asset size of a client on advised platforms again? Again, less than £100K! The point is that ATS fixed price model isn’t actually that competitive for a significant proportion of advised clients. And in any case, ATS tools and functionality are largely inadequate for clients with larger assets , where the adviser is likely to require top notch CGT and client reporting tools. On a positive note, upgrading the technology to GBST Composer means ATS can now start to address the issues around tools and functionality.

- So, what now?

Clearly, the board is considering the options, which includes a possible sale of the platform. The big question is who’s going to buy it? It’s hard to see an industry buyer being interested, given the challenge of integrating two different platforms but in the wake of Standard Life/Elevate deal, we’ve learned never to say never! Although, I’ll eat my hat if anyone fork out £54m for the business!

Around 21% of ATS £8billion of assets is held via advisers, the rest is D2C. So, a player with a foot in both adviser and D2C market would be ideal. It helps if the sit on the same technology (GBST Composer), with some element of fixed fee in their pricing structure. That kind of sounds like… ehr… AJ Bell, but this is pure speculation of course. In the absence of a decent offer, the Trust might be forced to keep the business but a major review of pricing and overall strategy would be necessarily.

For advisers, the key due diligence lesson here is that the long-term viability of platforms should trump price, any day! Not that those two thing are mutually exclusive because there are a number of keenly priced platforms that that profitable and viable in the longer term. With many client facing a 30-years retirement, advisers have a regulatory and professional obligation to select providers with the best chance of surviving the intensely competitive market place!

.