Just as we started collating data for our next Platform Profitability Guide, we’re hit with the news that Axa has apparently put the entire Axa Wealth business on sale – Elevate platform, SIPP, corporate pensions, Architas – the whole lot!

You probably didn’t that coming, did you? Well, you should have read our guide 🙂

Elevate now has well over £10billion AuA – after growing 20.6% year-on-year to June, according to data from Platforum. Presumably, things are really looking for up the business, so why would any provider in their rightful mind want to sell?

Well, we made the point in our last platform guide about how the industry’s obsession with AuA mask a much bigger problem with many platform – the neglect of the bottom line. In the report, we noted that…

The reality is that loss-making platforms, even if they are owned by parents with deep pockets, are more likely to suffer underinvestment in technology/ services in the future, be acquired or exit the market. If a provider exits or is acquired, it is the advisers (and potentially clients) who will be left to pick up the pieces.

Accordingly, advisers must put platforms under greater scrutiny about profitability. Advisers should be asking; Is this platform business making money? If not, when do they expect to become profitable? Where is future investment in technology going to come from? Is the platform business heavily reliant on its parent company and what’s to say the parent company won’t cut off the umbilical cord if they continue to be loss-making?

[bctt tweet=”Profitability and long-term sustainability should be at the heart of platform due-diligence.“]

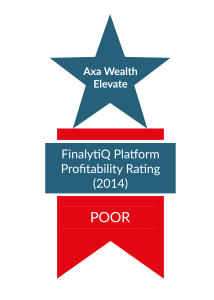

We handed Elevate ‘poor’ on FinalytiQ Platform Profitability Rating and made some very specific comments about the business;

Despite having the highest AUA in the mid-sized platform category, Elevate has failed miserably to make a profit and losses continue to mount. Going by its P&L Account Reserve, the business has spent well over £100M since getting the business off the ground, which is more than ten times the amount spent by its peers Nucleus and Ascentric, but there’s no evidence whatsoever that Elevate is any better in terms of service or technology. This begs the question: what are they spending this money on? Piling up loses with no end in sight in the name of ‘investing’ in the business is no way to run a platform.

Are we being a bit harsh on Elevate? Well we don’t think so. We do think advisers and platforms should have a grown up conversation about profitability and long term sustainability of platforms. In fact, Axa Wealth’s problem may be even much deeper than you think.

- Elevate platform operation sits with Axa Portfolio Services, which has accumulated £112 million in post-tax losses since the inception of the platform in 2008. That’s based on accounts filed y/e Dec, 2013. The accounts for y/e Dec 2014 hasn’t been filed at the Companies House yet – so if the folks at Axa could advise their auditors (PWC) to get their finger out on that one, it will speed thing up a little bit for our next report.

- Axa Wealth Limited, which is the pension and bond product manufacturer – turned a post-tax profit of £40 million in y/e 2014, the first since the re-organisation that saw Axa’s legacy life and savings book sold off to Friends Provident in 2010. But that business is still sitting of £131 million hole on its P&L Reserve, a result of accumulated losses over the previous years.

- Axa Wealth Service Limited, which is responsible for distribution of products and Elevate platform – hasn’t turned a profit, let alone paid any dividends to the group since 2010. That too is sitting on £28 million accumulated losses, as at year ending December 2014.

Now do the math, is it any surprise that the parent company might be looking to get rid of these businesses?

The argument is often made that lifeco platforms aren’t designed to make profits, but rather to serve as a distribution channel for the group’s products and funds. Elevate is the poster child for this point of view – you could buy Architas funds cheaper on Elevate platform. But has that given Architas a great deal of advantage that justifies plowing a quarter of a billion pounds into the platform and distribution businesses? We think not.

- Architas was set up in 2008 – about the same time as Elevate and has been profitable since 2012 but margins aren’t superior to those of other asset managers and definitely not high enough to justify that level of losses in the platform business. Latest account (y/e Dec 2014) shows a post-tax profit of £4.5 million on a turnover of £47.6 million – a profit margin below 10%. Hardly impressive!

The point is, if ownership of a platform is supposed to give the asset management business a competitive advantage, it’s not showing up in these numbers.

This highlights why, when looking at platforms, it helps to divorce the platform business somewhat from its parent company. Is this platform business sustainable in its own right? Does it contribute the bottom line of the parent company? The idea that insurers somehow have unlimited financial clout and can throw hundreds of millions of pounds at their platform businesses with no profit is sight is a complete and utter nonsense.

With Axa apparently looking to flog Elevate, L&G to flog Cofunds, and Alliance Trust’s shareholders making a big fuss about ATS’s losses, advisers have to take providers’ deep pockets at face value, and put profitability and sustainability at the heart of platform due diligence.

Good piece Abraham. To my mind there is a further complexity. Platforms are quick to point out their growing AUM, with some frankly “unsustainable” %growth in assets increases. There’s nothing wrong with celebrating these facts, but it would be prudent to remember that poor service, poor tech or uncompetitive charging structures will see assets leave just as quickly (perhaps more so) than they arrived.

Every platform is under the pressure to remain at the leading edge of development, to a tech user but non-specialist like me, this seems to revolve almost entirely around technology. This also means the ability to hook up seamlessly with other technology to enable adviser firms to provide improved service, with the client very much at the centre.

So whilst I agree, deep pockets are not compelling reasons enough, they remain important… but of course within normal business rationale (which in reality would not describe most of the industry, which historically relies on future revenues and inertia). To my mind, the days of inertia are largely over. At one time bank accounts were less likely to be changed than marriages, today I doubt that is the case… and certainly not for anyone that is being advised on their financial arrangements…. peering into the future I might suggest much more consolidation on platforms that integrate with adviser, employer and investor….

Meanwhile advisers remain between a rock and a hard place, attempting to guess who will stick, twist or fold….so I’d also advocate some attempt to understand the key people at each platform, who shape its culture and direction. It is very difficult to assess those that are designed with sale in mind or as the agenda…. as I assume every platform has its price.

Axa have been apologising for the low profitability and low return on capital employed (compared with virtually every other country in which they operate) in the UK at their annual presentation to share analysts in Paris since 2007. Despite the increase in AUA for the UK, profit and return on capital are still far from satisfactory. The wonder is that they lasted this long. Pity that more of the financial press haven’t been clued up on this. The last people to be worth asking about this, of course, are the incumbent management.

I suppose this is only the beginning of the consolidation process in this industry. You have to think Aviva is in the same position, they also spent £100m on the platform and they have nothing to show for those money. Yes, Aviva has a better fund management business than Axa, but it is not extraordinary.

I quite expect that Aviva after buying Friends Life may try to buy Axa UK’s investment and platform business. It could give them some economy of scale, but probably not enough to run a profitable business!

Myself I stick with A J Bell (it seems that the service level tends to improve), Transact, and the little Wealthtime, which is impressive.

We are also going to use Novia Global from the launch on 15 September. This is going to be a bit of fresh air, a proper multi-currency platform for Global mobile clients. Good that someone decided to innovate in this space and Novia was always an innovator. It will pay.