Latest news in the roboadvice space from across the pond is that Jemstep, one of the earlier online investment startup has been acquired by Invesco. This is coming months after BlackRock acquired FutureAdvisor for a reported $152million.

Nearly a year ago, Northwestern Mutual acquired online financial planning firm LearnVest, for a reported $250million,

Personal Capital one of the largest (and arguably the most viable) roboadviser with $1.6bn AUM is currently looking to raise additional capital, having already burnt through the $102 million it previously raised. In fact, it is reported that Personal Capital may actually be up for sale!

What is apparent here is that, while roboadvice startups have raised loads of venture capital money (well over $600million according to our Economics of Direct Platforms & Robo Advice Report due out in February), ostensibly to disrupt traditional wealth management ‘fat cats’, most of them are ending up becoming simply the distribution channel for the incumbents they sought to disrupt in the first place.

And let’s not forget that Vanguard’s own robo advice service, Personal Advisor Service has dwarfed the startup robos by gathering well over $31billion assets in just over 2 years, and is reported to be growing at a whooping $1.6billion a month!

Schwab Intelligent Portfolio (SIP), a robo advice service from online broker Charles Schwab has now gathered nearly $5billion of assets in just over a year. Oh, did I mention that SIP is free, as Charles Schwab makes money by using its own ETF products and creaming off interest from cash balances that investors are required to hold in their portfolios! Questionable practices, but that’s a discussion for another day!

And Fidelity is piloting its own roboadvice service, aptly named Fidelity Go!

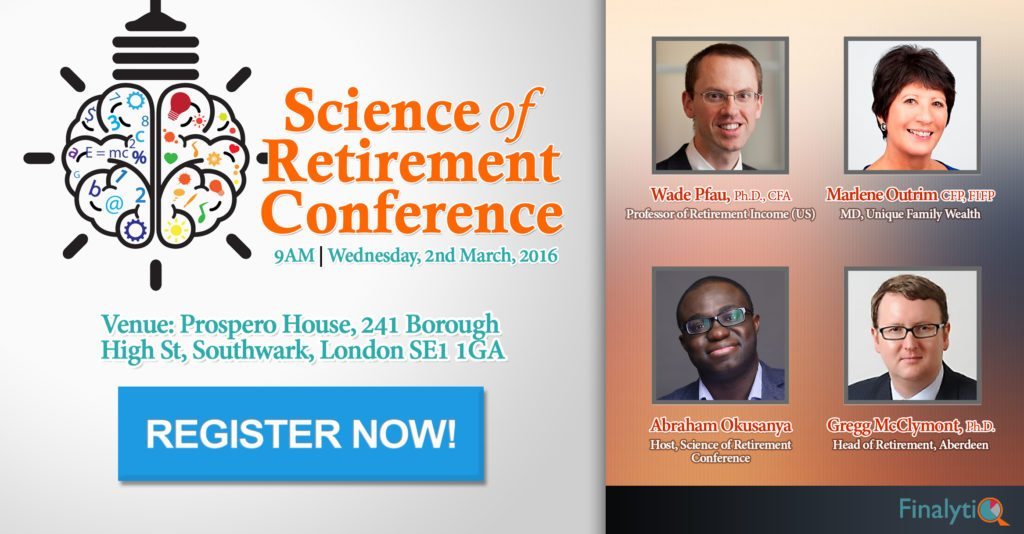

Finally, a CPD event that actually teaches you something new about retirement income planning!? Join us at the Science of Retirement Income Conference 2016!

So why are the robo’s selling out?

I think it’s becoming clear that roboadvisers misunderstood the real challenges of providing low cost investment advice – the cost of client acquisition! And they are finding out that, when it comes to financial services, the idea that ‘if you build it, they would come’ simply doesn’t hold up. The cost of client acquisition is one main reason why investment advice is so expensive and while roboadvice startups have managed to improve efficiency in the areas of portfolio management, client reporting and on-boarding process, it’s costing them way more that they have anticipated to acquire clients!

Accordingly, after nearly 5 years of operating, profitability is NOT even on the horizon of most robo startups. A research by Morningstar suggests that robos would require 16 to 40 times their current assets, just to break-even, let alone reach profitability. And they will actually need to burn through all the venture capital funds they have raised so far to achieve that. The trouble is that, the VC funding these roboadvice firms aren’t particularly known for sticking with their investments for the very long term.

[bctt tweet=” In financial services, the idea that ‘if you build it, they would come’ simply doesn’t hold up.”]

But why are asset managers splashing out on robos?

Isn’t that obvious already? Asset managers, particularly those who provide index funds recognise that roboadviser are effectively distribution channels to get their products to the end investors. Think about it, since roboadvisers mostly use passive funds as the building blocks of the portfolios, providers like Vanguard, Fidelity, Schwab, Invesco (parent company of Powershares) and BlackRock can effectively use the robos to distribute their products and charge additional fee of 30 to 50 bps! Add to the fact that, owning a roboadvice channel helps close the gap between asset managers and the end customer, reversing a trend of growing intermediation that we have seen over the last few years.

With the sale of at least 4 roboadvice service to the industry ‘fat cats’ they sought to disrupt in the first place, I’m beginning to see roboadvice startups as the ‘outsourced R&D lab’ to the traditional wealth management industry. We are likely to see more roboadvice startups selling out to the incumbent and most of the technology will end up in the hands of traditional advisers and wealth managers.

One thing is sure, roboadvice will ‘disrupt’ traditional wealth management, but probably not in the way they imagined!