Thanks to Pension Freedoms, and the demonisation (yes, that’s a real word) of annuities, around additional £8bn a year is now expected to find its way into drawdown products. But with drawdown comes the risk of running out of money, no thanks to sequence risk and pound cost ravaging.

Apparently, retirees want to eat their cake and have it. They want the security of an annuity and the flexibility of drawdown. So how are providers trying to solve that conundrum? Enter Guaranteed Drawdown; one of the so called third-way products. A middle ground between annuities and traditional drawdown. Here’s a quick summary of the products currently on the market, but we know from our work with providers that other providers are gearing up to come into the market.

| Provider | Guaranteed Income Rate @ 65 | Product Charge | Fund Charge | Guaranteed Charge | Total Cost (pa) |

| Met Life | 4.00% | 0.70% | 0.55% | 0.70% | 1.95% |

| Aegon SRI | 4.05% | 0.30% | 0.53% | 1.15% | 1.98% |

| Axa Secure Advantage | 3.75% | 0.45% | 0.50% | 1.25% | 2.20% |

Now, just the case you’re wondering, the total cost doesn’t include adviser charge. And these products tend to be adviser-only product, so not available to consumers directly.

One challenge for advisers is, how to evaluate if guarantee drawdown are worth paying for? Thankfully, the extensive body of research of ‘Sustainable Withdrawal Rates’ (SWR) offers some insight to this.

[bctt tweet=”Extensive body of research of ‘Sustainable Withdrawal Rates’ (SWR) offers some insight into how advisers can evaluate guaranteed drawdown products.”]

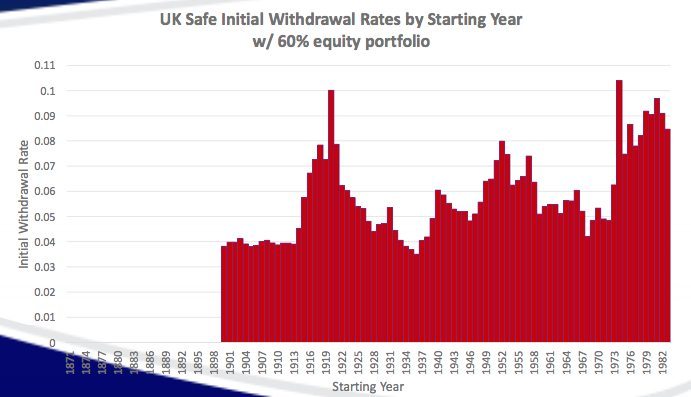

The classical SWR is the highest percentage of the initial portfolio, indexed with inflation, which can be withdrawn without running out of money over a 30 year period. Over 100 years of market data for a 60/40 portfolio puts the SWR for UK at 3.7%.

Source: Michael Kitces, see here

It is important to understand that this figure is derived from the worse case scenario is history, meaning the data is very robust indeed and its failure would warrant worse economic condition than any we have seen in history.

So how does the income rate on Guaranteed Drawdown product compare with SWR?

- First you have to account for inflation. The income rate of guaranteed drawdown products is not indexed with inflation like the SWR. Research shows, if withdrawals are not indexed with inflation, a withdrawal of 5.7% of the initial portfolio would be sustainable, over a 30 year period.

- Fees; the income rate on Guaranteed Drawdown products is net of product costs (although not adviser fee), while the SWR does not include product costs. On that basis, I will adjust SWR by -0.5% to account for the fund and tax wrapper cost. This is realistic because, virtually all guaranteed drawdown product are based constructed using index trackers. It’s not hard to build a decent passive portfolio cost of around 0.20% and platform cost of around 0.30%.

- Asset Allocation: Guaranteed drawdown products tend to offer cautious portfolios, with the maximum equity allocation of 60%. This implies that you shouldn’t expect the portfolio to grow significantly.

- Residual Capital: In over 80% of historical scenarios, after a 30 year period, the classical SWR would have resulted in retiree actually having more money than they started with. By contrast, guaranteed income products are more likely to deplete capital value due to their high fees, and the guaranteed income is only really effective if clients is still alive after the pot has been depleted. This means that only clients who happen to be both unlucky with their sequence of market returns AND also end up living very long would actually benefit from this guarantees.

Accordingly, when you compare the guaranteed income rate of 4.0% to SWR (no inflation) of 5.2%, I don’t believe that guaranteed drawdown products offer much value for advised clients.

Let’s be clear, SWR is based on the worse possible case in market history, which includes retiring through the depression of 1929.Equally important is the fact that SWR are based on simple equity/bond allocation. Accordingly, future market condition would need to be worse than any we have seen in history for the SWR to become unsustainable. In any case, it’s often argue that such a market condition that would warrant the failure of SWR will probably lead to the collapse of insurance companies providing guarantees on drawdown. This means that it’s important to really understand how the product providers are actually able to secure the guarantees they offer clients; is it backed by the providers’ balance sheet or is it secured via a counterparty.

Now, that not to say that guaranteed drawdown products are entirely useless. I think they can be useful is the cost are low – i.e total cost less than 1% and if they are offered direct to consumers rather than via adviser. Guaranteed drawdowns can help mitigate the ‘stupidity risk’ – where retires don’t have an adviser. When an adviser is involved, and the adviser fees added to the already exorbitant product fees, the numbers just don’t add up.

I’m speaking at a couple of events in October, if you are in or around London, it would be great if you could join us.

- FinaMetrica Sequence Risk Workshop taking place on Tuesday 13th October, 2015 8.45am for 9am-12pm, UBS Offices 3 Finsbury Avenue, London, EC2M 2AN. Register here

- Henry Stewart’s SIPPs and Retirement Options Conference taking place on Wednesday, 14 October 2015 at Le Meridien Piccadilly, London W1. You can get a 10% discount off the brochure price by quoting SPEAKER10. The full registration details and how to book are on the conference website

The short answer is No. Clients are better off buying an annuity instead which offer higher guaranteed income.

Our average annuity rate for (non-advised) customers is 5.43%, the majority (95%) of which are enhanced/lifestyle underwritten to some degree and on a ‘level’ basis. That beats SWR (no inflation) without the risk of running out of money. Ever. Well, except in the black swan event of an insurer going pop, followed by FSCS, followed by all the preppers telling us I told you so…

No, annuities don’t beat SWR per see because, with annuities you have to forgo capital. With SWR, there’s 80% chance you’ll end up with more residual capital than you actually started with, after 30 years of withdrawal.

And yes, if we had another 1929-type Depression, the FSCS could go belly up.