Today, we publish our Multi-Asset Fund Guide 2018 titled Dysfunctional Families. This guide is an in-depth analysis of 91 fund families consisting of 402 individual funds in which a £148bn of client’s money is invested.

The story of the cobra in India during British colonization is a surprisingly valuable one when it comes to multi-asset funds.

The venomous creature was a constant irritation to the Brits, given their lack of familiarity with the species. To rid this newly inhabited land of cobras, the colonial administrators devised a cunning plan: they offered a bounty for every dead cobra! The plan was an instant success as the locals were handsomely rewarded for killing large numbers of snakes. But then the enterprising Indians started to breed cobra to keep benefiting from this lucrative offer by the Brits.

Upon realising this, the colonisers scrapped the scheme. The cobra breeders, in turn, abandoned the now worthless endeavour and let the snakes free. The population of these petulant and dangerous creatures increased once again to a level similar to that before the scheme was devised.

As to whether the story is entirely true is a question for another time, but it illustrates a valuable lesson about how a perceived solution often comes with its own problems.

Multi-Asset Funds

Multi-asset funds have grown significantly in popularity over the past decade. In the wake of the 2008 financial crisis, UK regulators turned their attention to the suitability of investment vehicles to the risk-profiles of clients. In response, asset-managers created a range of new products tailored to their clients’ appetite for risk.

[bctt tweet=”The median OCF for multi-asset funds is 0.96%, but there are instances of fees as high as 2.78%. ” username=”AbrahamOnMoney”]

With an increasing number of advisers focusing on financial planning, multi-asset funds have become of one of the key ways for advisers to ‘outsource’ portfolio management to a third-party. By delegating asset allocation and fund selection to the asset manager, the adviser has more time for client-facing activities and financial planning. Ongoing management includes keeping the portfolio within a pre-defined risk boundary.

However, much like in the tale of the troublesome cobra, the industry’s solution to the problem of the pre-crisis misalignment of investment vehicles to clients’ tolerances for risk comes with its own problems.

[bctt tweet=”The clear majority of multi-asset fund families have a sub-optimal risk-adjusted return profile when compared with a simple equity-bond portfolio dubbed ‘No-Brainer portfolio’ and Vanguard LifeStrategy.” username=”AbrahamOnMoney”]

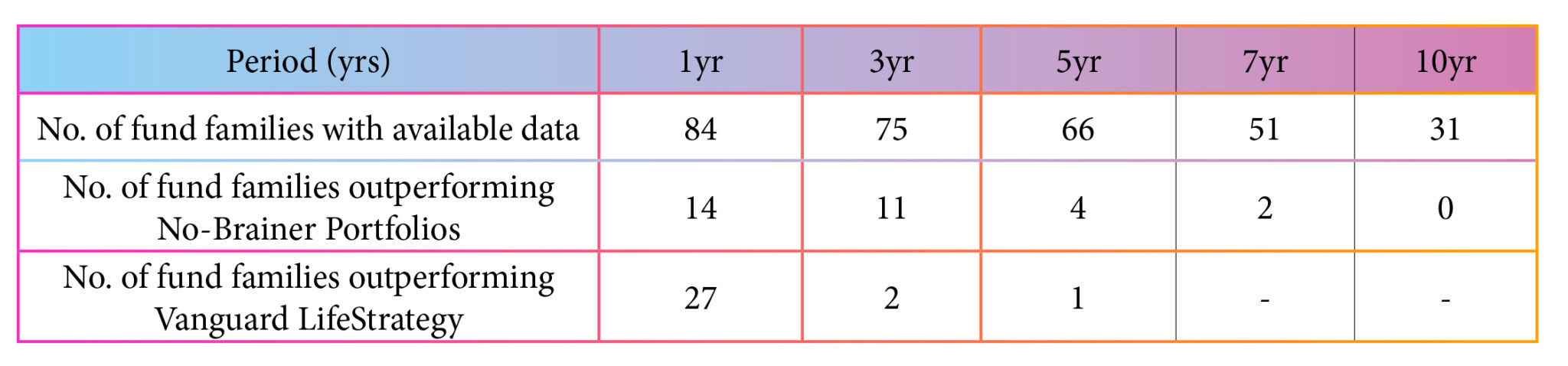

In our latest Multi-Asset Fund Report, we analyse an array of prominent multi-asset funds within the context of their families. Using a simple equity-bond portfolio benchmark (dubbed No Brainer portfolio) designed merely to capture market return, we assessed the Sharper of multi-asset funds over 1, 3, 5, 7 and 10 years. Where the fund has no performance data for a given period, they are excluded for that analysis.

The result is somewhat worrying: the clear majority of multi-asset fund families have a sub-optimal risk-adjusted return profile when compared with a simple equity-bond portfolio dubbed ‘No-Brainer portfolio’ and Vanguard LifeStrategy.

Regardless of the period examined, the vast majority of funds underperform both benchmarks, and thus we conclude that the fund families demonstrate sub-optimal asset allocation.

The implication here is that the vast majority of multi-asset funds not only fail to add value, they detract from the return. For every unit of risk taken by an investor, multi-asset funds delivered less than the market portfolio benchmark.

To add salt to the injury, our research shows the median OCF of 0.96%, but there are instances of fees as high as 2.78%. This is before adviser charge (typically 0.8%), and platform fees (typically 0.30%pa ) are added. Once you take these into account, the total ongoing fee is close to 2.5%!

Advisers have a regulatory obligation to ensure that their recommendations are in the client’s best interest (see COBS 6.1A.16G). Cold hard data shows that most multi-asset fund managers don’t consistently add value through asset allocation and fund selection. So what’s the justification for making clients pay a premium for incompetence?

[bctt tweet=”Cold hard data shows that most multi-asset fund managers don’t consistently add value through asset allocation and fund selection. So what’s the justification for making clients pay a premium for incompetence? ” username=”AbrahamOnMoney”]

We hope that this report and the accompanying excel help advisers benchmark the multi-asset fund families effectively to ensure that their recommendations add value to clients in a measurable way.

Access the report: