We’ve been accused of ‘obsessing over profitability’ of platforms a few times lately. Fair enough, but then again it’s no greater a crime than obsessing over cost or whatever else happens to be your own addiction. We’re all human and we all have addictions right? Profitability and long term sustainability of platforms just happens to be one of ours 🙂 Given more than half the platform industry have bought our latest Profitability Guide, we’re probably not the only one obsessing about this.

Here’s the thing; it’s in no one’s interest for a platform to fail, shut down or become a ghost town as a result of falling behind on service and technology. Sustainability of platforms is in the interests of advisers, and clients.

We know from our work with advisers that moving assets from a platform to another costs over £500 per client in administration and paraplanning costs, not counting the cost of advisers facetime to explain to clients why they have to move from A to B. And the potential damage it does to the trust between adviser and client. We see increasing number of cases where advisers are reluctant to move assets because of the associated cost, and not being able to deliver the highest standard of service they would like.

[bctt tweet=”It’s in no one’s interest for a platform to fail, shut down or become a ghost town.”]

We are a bit old fashioned here at FinalytiQ and we happen to believe that ‘a pension/ISA/GIA on platform is for life’. Or at least it should be.

With a typical client facing a retirement of over 25-30 years, the last thing they want to have to worry about is the risk that their platform might be shut down, exit the market or fall behind in terms of technology and service. While the demise of a platform doesn’t pose a direct threat to client assets, lack of profits to reinvest in technology and service delivery hampers an adviser’s ability to deliver on their promises to clients. Platforms are businesses and without profits, it’s hard to see how a business can continue to exist, compete and serve its customers.

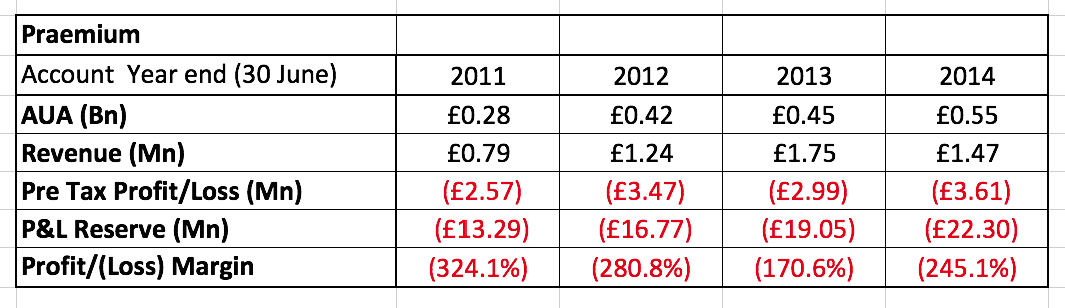

One platform that sends shiver down my spine when I look at the numbers is Praemium. If you’ve never heard of this platform, we don’t blame you; we don’t use the platform either and we don’t know anyone who does, which probably not a great thing. Praemium started out in Australian in 2001 and came into the UK market 7 years later in 2008. Here’s a quick snapshot of their UK accounts in the last 4 years;

Praemium UK continues to pile on losses but has gained little traction in terms of AUA.  As at y/e June 2014, the platform sits on £22.30million of accumulated losses on its P&L reserve but is hanging on thanks to a £20.9million loan from the Australian parent. The accounts for year ending 2014 noted that the parent company has no intention of recalling this loan and will continue to support the company for ongoing working capital requirements for 18 months from August 2014.

As at y/e June 2014, the platform sits on £22.30million of accumulated losses on its P&L reserve but is hanging on thanks to a £20.9million loan from the Australian parent. The accounts for year ending 2014 noted that the parent company has no intention of recalling this loan and will continue to support the company for ongoing working capital requirements for 18 months from August 2014.

On a positive note, it appears the Australian parent company turned a profit for the first time in y/e June 2015.

Depending on your view, you could call a 7 year business in the UK ‘a startup’ and justify the losses on the basis that they are investing in building the business. But the business is about the same age as Novia, Parmenion and Wealthtime.

Praemium recently acquired adviser back-office software Plum, an indication its commitment to the UK market, I supposed. Deep integration between the platform and back office system suggest the platform is heading in the similar direction as successful rivals True Potential Wealth Platform and Creative Technologies’ Enable/Fusion platform, giving it a bit of an edge in the marketplace. Having said that, those two platforms have their own advice networks, although no reason why the model can’t work as stand alone proposition. I guess time would tell.

- Check out the Platform Profitability Guide (2015) to see how this provider stacks up against 22 other platforms.

- To request a free excerpt of the report, just complete the form below and we’ll email you a copy ;

I’m speaking at a couple of events in November, so if you’re there, be sure to say hello.

- PFS National Symposiums in 4 locations below: Practitioner Panel – Delivering predictable income in retirement.

- London (3/11),

- Newport (18/11)

- Edinburgh (26/11)

- Birmingham (30/11)

- Pinsent Mason DC Conference, London (27/11): Session – The choices people face at retirement.

See you there?