One of the more prominent myths about evidence-based investing is the idea that an index fund (I loathe the term ‘passive’ because EBI is anything but) is guaranteed to underperform the benchmark. This argument is usually put forward by those blindly promoting active funds – fund salespeople and financial journalists are amongst the worst offenders.

The idea is that once expenses are taken into account, an index for will invariable underperform the index. Well, nothing is further from the truth. In fact, in many cases, index funds do actually beat their benchmarks and some do so consistently, which is something that cannot be said for vast majority of active funds. Wait! Did I just say that you could beat the ‘market’ without even trying? Absolutely, I just did.

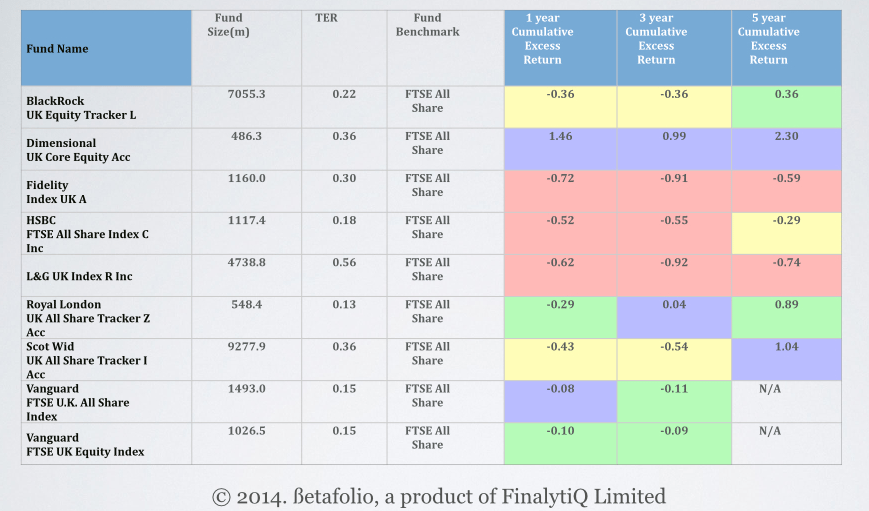

The table below shows the cumulative excess return of major index funds in the UK All Companies sector after we have applied our screening criteria. The colour coding shows quartile ranking of the funds with Blue, Green, Amber and Red meaning 1st, 2nd , 3rd and 4th quartile respectively.

So what does this tell us? Well, for starters the myth that ‘passive funds guarantee underperformance’ is simply that – a big massive myth invented in the overly active imagination of fund salespeople and financial journalists.

The second and more important message is that, selecting an index fund is more than just choosing the fund with lowest cost. Tracking error, which is something many index fund investors also look at, is important but it doesn’t tell you the full story either. There are a number of factors that influence the performance of an index fund; their trading strategies – (e.g. whether or not they are tracking the index slavishly, buying/selling at any costs when the index composition changes), factor tilts (e.g size, value, momentum, profitability etc – yeap, all the Dimensional stuff) and off course what they do with regards to securities lending profits!

This means that you need to take a look under the bonnet of the fund. While the aim of an index fund isn’t to outperform and fund selection shouldn’t be based on past performance, it’s crucial to understand what’s going on within the fund. Bad trading practices could actually mean that clients are paying the cost of active fund for a passive fund! And this is very important because the difference between the best index funds and the worse could be as much as 1% a year.

At ßetafolio, this is one area we pay particular attention to when selecting funds. We are not aiming to beat the market, just making sure the market doesn’t beat us!