Why is it that very few clients log into their platform online accounts at all? It’s all easy to put this down to the fact that clients trust their advisers and don’t bother to look at their investments on a regular basis. This excuse hides one important fact; clients’ UX on platforms suck!

In fact, with very few exemption, clients’ user experience on platform is beyond dreadful.

This problem of course emanates from a philosophy that permeates platform land; they are built to do a whole lot more for advisers than they do for clients. Yet it is the client who fork out money to pay for platforms.

When platforms first came on the scene, it was suggested that they could eventually be the centre of gravity for the client’s financial life. This hasn’t materialised. In fact, platforms are so useless for client reporting that many advisers now consider using new client reporting tools such MoneyInfo and MoneyHub. So we are effectively in a world where advisers need one system/software to hold assets (platforms), another to administer those assets and run their practices effectively (back office systems) and yet another for client reporting.

Take rebalancing for instance, most platforms rebalancing processes fall short of what advisers need to communicate the effectively to clients. So back office system have to pick up the flack and even then, many advisers have had to adopt a middleware such as Sprint FasTrak

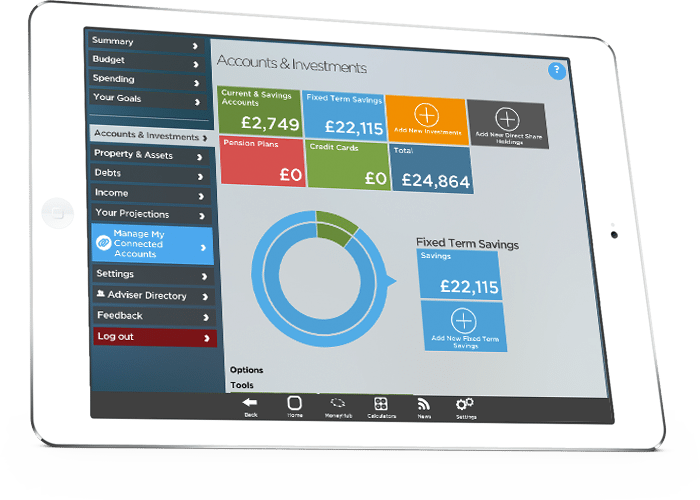

One missed opportunity here is account aggregation, with TruePotential being the only platform offering this.

Another example is mobile app; again True Potential and 7IM being the only platform offering this.

So while it may feel that platforms are winning more and more assets from lifeco, it’s safe to say that, when it come to client reporting, adviser platform are stuck in era gone by. And this is unlikely to change any time soon. Many platform are still unprofitable, let alone recoup their development costs. And some are having to deal with the challenge of re-platforming – migrating asset to a new back office system. So, don’t hold your breath on shiny new client portals any time soon.

The upshot of this is that platforms are in danger becoming less relevant, at least to client. As newbee client reporting tools such as MoneyHub and MoneyInfo are adopted by more and more planners, with unflinching focus on reporting clients entire wealth (as opposed to their investments and pensions) and doing so in a way that clients find meaningful and engaging, the danger is that platform just become nothing more than blackbox in the background that buys and holds assets. This will inevitably increase margin pressure on platforms.

In addition to newbee client reporting tools, back office systems are also competing for clients’ eyeballs, with the likes of Intelliflo planning to introduce PFM tools to improve client reporting.

The industry keeps having this conversation about who should pay for platforms, given that it does more for the adviser than clients. Perhaps if platforms become better at client reporting, that would take the heat off a tiny bit (but then with folks like me banging on about stuff like this, probably not: -) Of course there are those who suggest that the platform industry is still in its infancy and we should cut it some slack. Perhaps, but I wonder if clients would be so forgiving. Research suggests that they are not, with around 57% of HNWI’s expecting their wealth management to be primarily digital within the next 5 years and 66% would consider switching financial firms due to their digital shortcomings. I doubt that advisers will continue to tolerate platforms poor reporting and UX, if its starts to impair their relationship with clients.

Image: MoneyHub

Perhaps the adviser orientated platforms have been hampered by their ethos of keeping a low brand profile, a trend started by Transact 15 years ago and much copied since. From this viewpoint, the adviser is the most important brand and the platform is just an enabler. This means that the main user interface needs to sit on an adviser’s web page, not the platform. Few advisers have the web capability to do that. Perhaps the D2C platforms will be better at engaging directly with the investor, adviser platforms risk alienating advisers if they try that. The UI can’t be that bad because all platforms can tell anecdotal stories about ‘platform uplift’, that is clients enjoying the platform experience and volunteering additional assets to be included. Standard Life even tried quantifying it at 25% for an ‘average client’ some years ago.

I pretty much agree with Eugen and Stan (no surprise there). Moneyinfo is a good idea, but it depends on the make up of your client base and I have struggled to get my clients to engage with it. In anycase, a combination of a WRAP like Transact combined with a platform like Fidelity then providing a feed in to a good cashflow modelling program like Prestwood’s Trust is pretty much ALL you need. The one thing I wish Prestwood would do is allow limited “client view” of their Transact records, possibly with a bank feed for their expenditure

Phil

Interesting to here this. I heard about Moneyinfo from you and every client we added him/her to this proposition loves it to bits.

Stanley, like usual makes a very good point.

Becoming too smart is a risk for the platforms. In my opinion, platforms should be simpler and cheaper, but better at the ‘best execution’ outcome when buying ETFs, investment trusts, REITs, individual equities.

All they need is to provide valuation feeds and transaction feeds to other systems, either to a CRM software, where the client could login or some independent platform as Moneyinfo paid by the adviser, from the fees charged from the client, not by the client directly or by deduction.

It is worth nothing that in the US are either free or cost single digits bips.