Whether you run an in-house investment proposition, or refer clients to discretionary investments managers, use multi-manager/asset funds or you’re yet to decide exactly what your investment proposition is, Aviva’s new white paper of investment propositions is definitely worth a read.

Why? Ehr….. because I wrote a chapter of the paper and my very humble and dispassionate opinion is

that anything I write must be worth a few minutes of your time 🙂

Seriously though, there’s a lot of good stuff in the paper from people who know a lot about the subject like Graham Bentley of gbi2 ( formerly of Skandia), Morningstar’s Dan Kemp, Square Mile’s Jason Broomer and PFS CEO Keith Richards, just to name but a few. You also get views from a number of advisers as to how the approach their own investment process, as well as some useful stuff from a compliance perspective.

The paper is accompanied by a short video of an enjoyable roundtable discussion we had on the same subject.

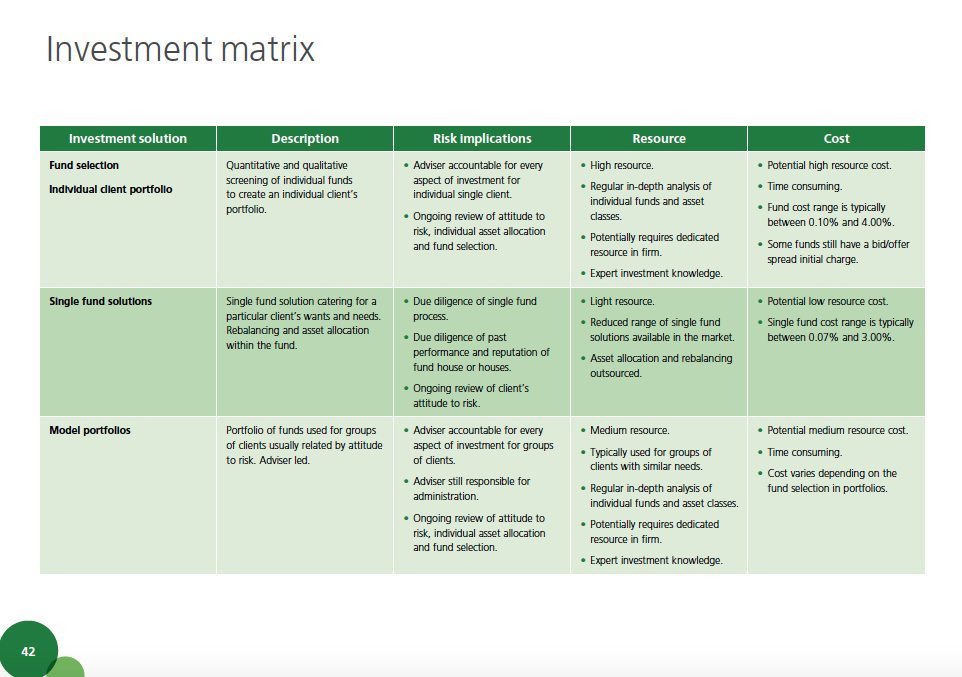

The paper is packed full of useful information on everything investment proposition related, from designing the CIP process to choosing your investment committee. But I think the best bit, apart from the bit I wrote of course, is the Investment Matrix at the end of the paper which lays out the main options, with the associated risks and costs.

Advisers can download a free copy of the paper here.

I really like your claims: ‘high resource’and ‘expect investment knowledge’. I thought that portfolio design is the job given to monkeys.

Your claims sound the same like a ‘DFM’ pitch, although the ‘DFM’ pitch is a bit better. They add words like ‘relationship’ to it or a new one is ‘use of an office’ – obviously that they are not going to meet the client up there in a tree.

One thing I learned when investing is to stay away from people who claim ‘expert investment knowledge’. The more they claim this, the further you should go. The truth is that there is no one who is an ‘expert in investments’. An expert would be someone who can make enough good decisions than bad decisions and have an informational advantage of what will happen tomorrow or in next three months time. We have to agree that such person does not exist.

What we have we have people who have ‘views’ or ‘educated views’ on how the future may pan out. But this are not experts, they are ‘investment advisers’. Sometimes their views pays off, other times it does not. For example there are ‘investment advisers’ who believe that the ‘value’ factor will pay off if they tilt the portfolio towards it – in the last 10 years it did not pay off and they have little to show to their clients for their ‘knowledge’ or ‘expertise’.

Similar like you I have my own views: I believe that in UK the main exposure should be towards ‘high yield’ companies, but in Europe towards ‘minimum volatility’ with a higher allocation to Europe and in US the exposure should be tilted towards ‘value’ and ‘mid cap’.

But I am not an ‘expert’.

Eugen, you are one cynical financial adviser, which is clearly a great way to approach the world of investing.

First, this table isn’t my ‘claims’ as such. Someone else wrote this bit – I did say its the best bit besides the one I wrote.

Second point is that expertise doesn’t necessarily have to relates to being able to predict the market or having some edge that others don’t. The point is, if you are going to run an investment proposition in-house, which what I encourage firms to do, I do believe you need dedicate time, effort and resources to it.