[bctt tweet=”Once you’ve worked out the right portfolio, leave it the hell alone! Be like the legendary investor Warren Buffet, who often quips ‘benign neglect, bordering on sloth, remains the hallmark of our investment process.'” username=”AbrahamOnMoney”]

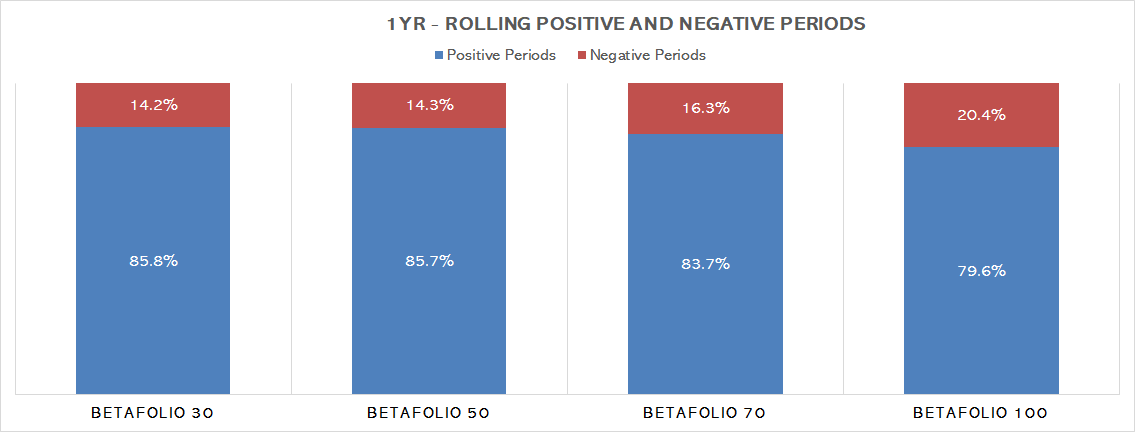

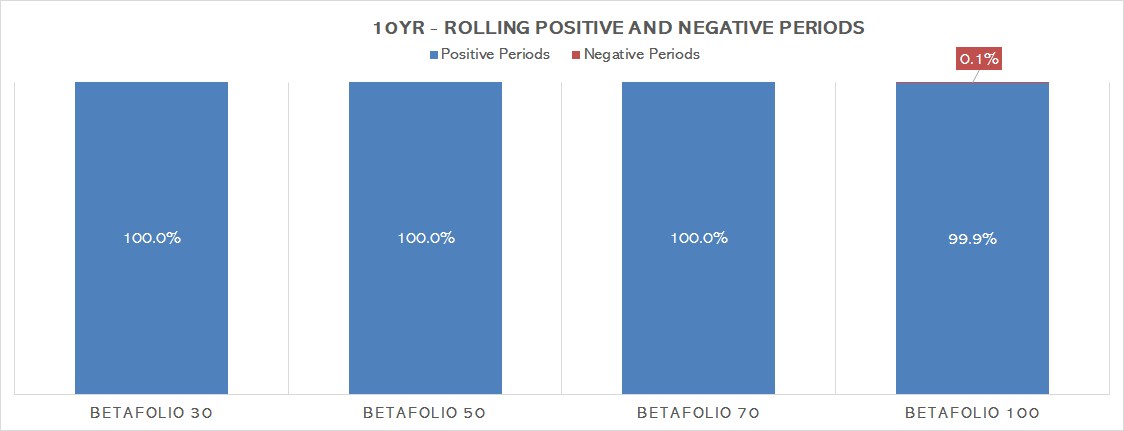

But suppose you resist the temptation to constantly check your portfolio each month. Instead, you only look at it once every twelve months? The result is that you see a negative return about once every six years. So, 85% of yearly return is positive!

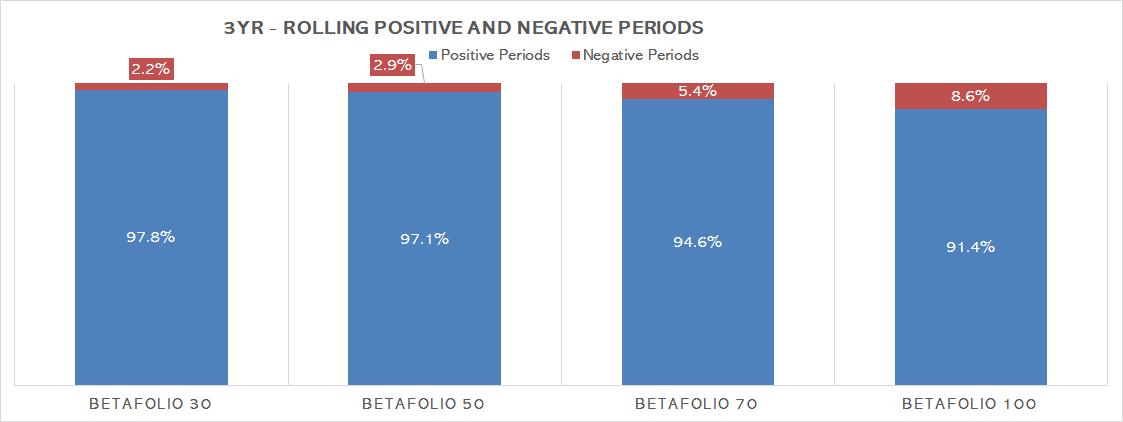

What if you’re one of the level-headed ones, prepared to only look at your portfolio every three years? Well, you improved your investment experience significantly. Over 90% of times, you’ll see a positive return. Your portfolio’s value is higher than the last time you checked in nine out of 10 times.

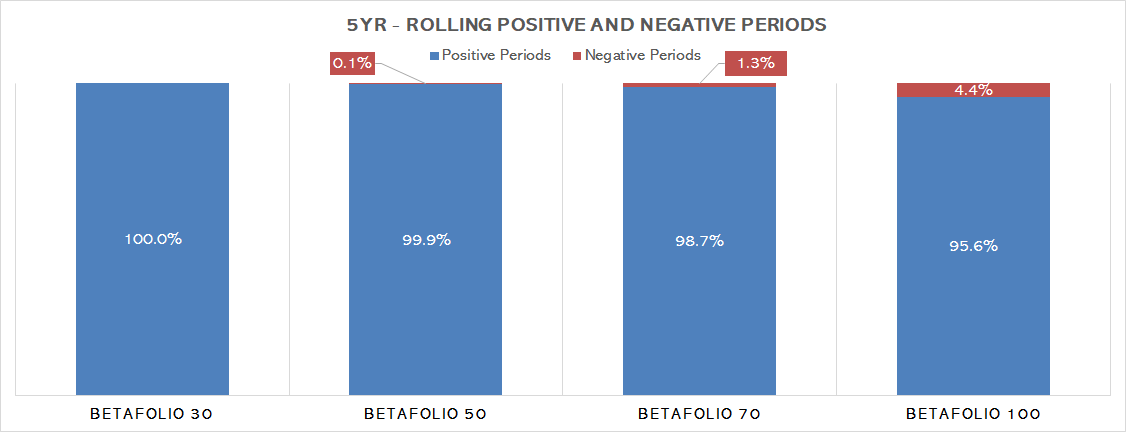

What about once every five years?

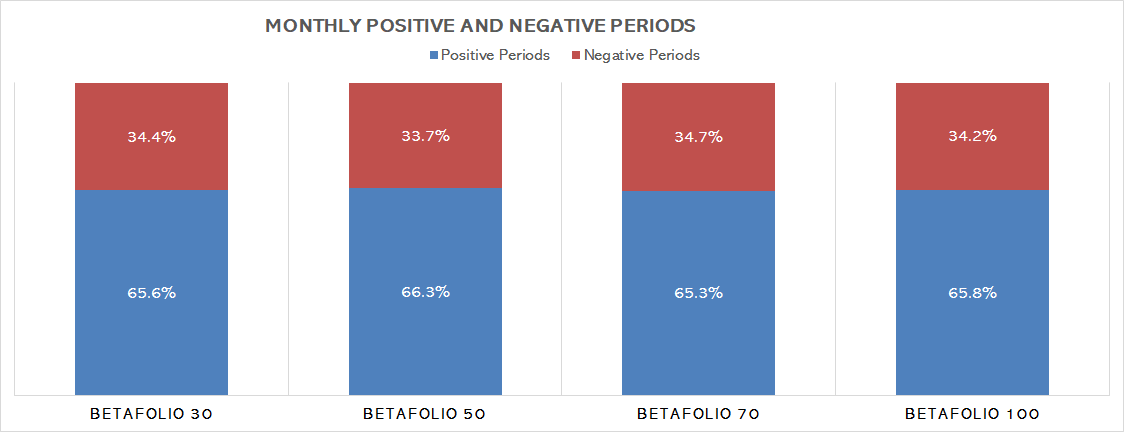

[bctt tweet=”If you check a balanced portfolio (50/50) on a monthly basis, you’re depressed and/or tempted to punch your financial adviser one-third of the time. But if you check it once a year, you only see a negative return about once every 6 years.” username=”AbrahamOnMoney”]

.