Welcome our blog. This is where we share thought-provoking, no-holds-barred opinions and commentaries on all things retirement income, financial planning and investing!

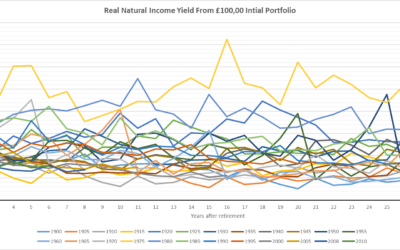

Natural yield: a totally bonkers retirement income strategy

One of the most common questions I receive about retirement income planning is, how realistic is the idea of relying on natural yield in one’s portfolio to meet retirement income needs. The rational is that by relying on the natural yield from their portfolio,...

It ain’t volatility, stupid!

"It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so' – Mark Twain The movie Big Short opens with above quote, which sums up the danger of thinking you know something that isn’t actually true. There’s only one...

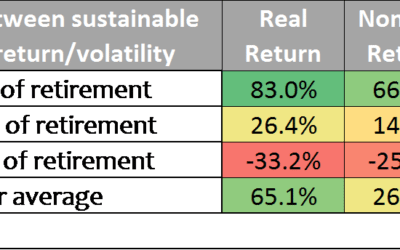

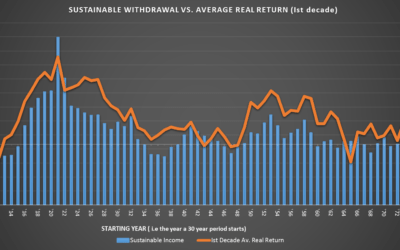

Technically buggered: historical evidence of sequence risk in retirement portfolios

I know, I know. I've been banging on about the subject for some time now... well, ehr... since George Osborne uttered these seemingly harmless words 'No caps. No drawdown limits. Let me be clear. No one will have to buy an annuity.” And the reason I keep banging on...

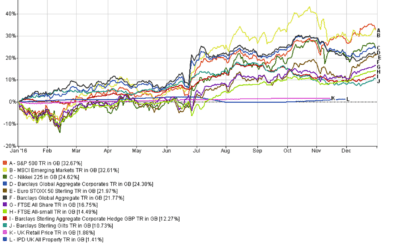

Nobody Knows Sh**

When the now famous RBS analyst cried ‘sell everything’ in January 2016, it was apparent the intent was to grab attention. And grab attention it did. It was echoed by the financial press. Never mind that it was downright reckless for any investor to do so. As it turns...

FCA Market Study: Give closet indexers the ‘PPI treatment’

One clear indictment of asset managers in the FCA interim report is the regulator's verdict on closet indexers. Closet indexers are funds charging active management fees for what amounts to a little more than merely tracking an index. The FCA’s term for this...

A study on how asset managers stick two fingers up at investors

'You are having a wet dream Abraham. There is no way the FCA wrote this stuff.' Those were my first thoughts as I read the FCA’s interim report on its asset management market study. If a wet dream isn't your thing, don't worry, the report will give you far more...

3,000+

Avid Subscribers