When consumer journalist Paul Lewis published his research which shows that ‘Active Cash’ beats equities over most time periods between 1995 and 2016, my faith in the capital markets took a bit of a knock.

Paul kindly sent me his data and I replicated the research looking at how equities fared against ‘active cash’ for the same period. In line with Paul’s research, I looked at an investment of £1 made on 1/1/1995 and ending after 1yr, 2yrs, 3yrs …. 15yrs. Then £1 invested on 1/2/1995 ending after 1yr, 2yrs, 3yrs …. 15yrs. And so on.

- For cash, I used the same data Paul used – Moneyfact Best Buy 1 Year Fixed Rate Deposit. ‘Active Cash’ is a concept Paul invented to describe the simple and sensible act of a savvy saver moving their money into the best interest paying account each year.

- For UK equities, like Paul, I used the FTSE 100 returns after an annual fee of 0.5%pa have been deducted. Returns data is from FE and shows rolling 1yr return, starting Jan 1995, Feb 1995, ……. Jan 2015, essentially mimicking Paul’s Best Buy Cash returns data.

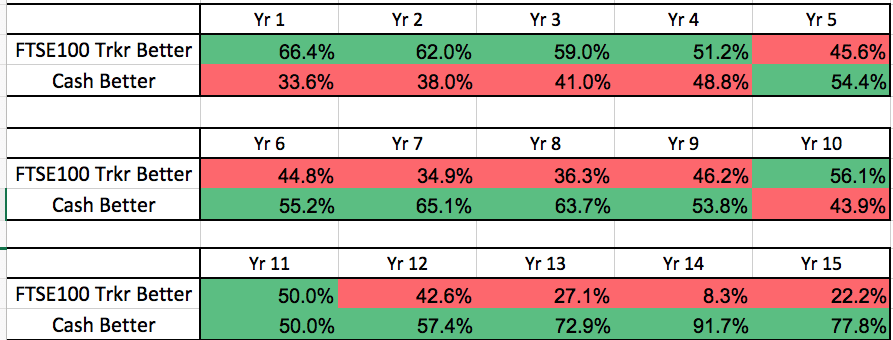

The table below shows the proportion of times that active cash outperformed/underperformed hypothetical FTSE100 tracker (with 0.50%pa fee) over each time periods, between Jan 1995 and Jan 2016.

‘Oh my goodness, he’s right! Have I been lied to? Is everything I’ve learnt about the capital markets just false?’ That was my initial reaction after replicated the Paul’s research.

How does that happen? How do you get cash to beat equities over the long term? Well, here’s how…

STEP 1: Ignore the most important investment lesson of all times – diversification!

If you want cash to beat equities, don’t diversify!

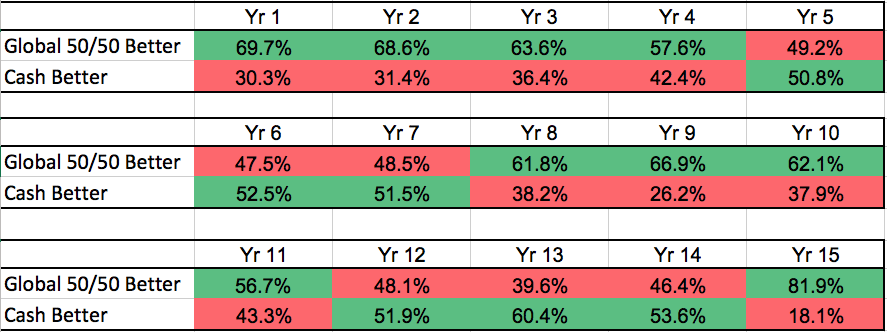

I replicated Paul’s research using a simple Global 50/50 portfolio, which is made up of 50% MSCI World Index and 50% Barclays Global Aggregate Index ( with a fee of 0.50% pa, hedged backed to £ and rebalanced annually)

The table below shows the proportion of times that Active Cash outperformed/underperformed Global 50/50 portfolio over each time periods, between Jan 1995 and Jan 2016.

The results show a simple, low-cost diversified portfolio beats Paul’s ‘active cash’ over most time periods!

Investment professionals and academics don’t agree on much but one thing most agree on is that diversification across main asset classes is key to investment success! What Paul seem to be suggesting in his research is that our hypothetical investor is smart enough to find the best deposit account each year but too lazy/arrogant to diversify?

You will expect even a novice investor to understand the basics of diversification, otherwise they should working with an adviser.

[bctt tweet=”A simple, low-cost diversified portfolio beats Paul Lewis’s ‘active cash’ over most time periods” username=”AbrahamOnMoney”]

STEP 2: Choose a bad index fund.

For his research, Paul used the HSBC FTSE 100 Index Fund to represent equity returns. His argument is that the FTSE 100 shows the real experience of a novice investor who selected a tracker funds in 1995. But this argument is flawed on many levels. Paul conjured the image of an investor who won’t lift a finger in 21 years pick a half decent tracker fund but they have the energy to hunt down the best deposit account each year!

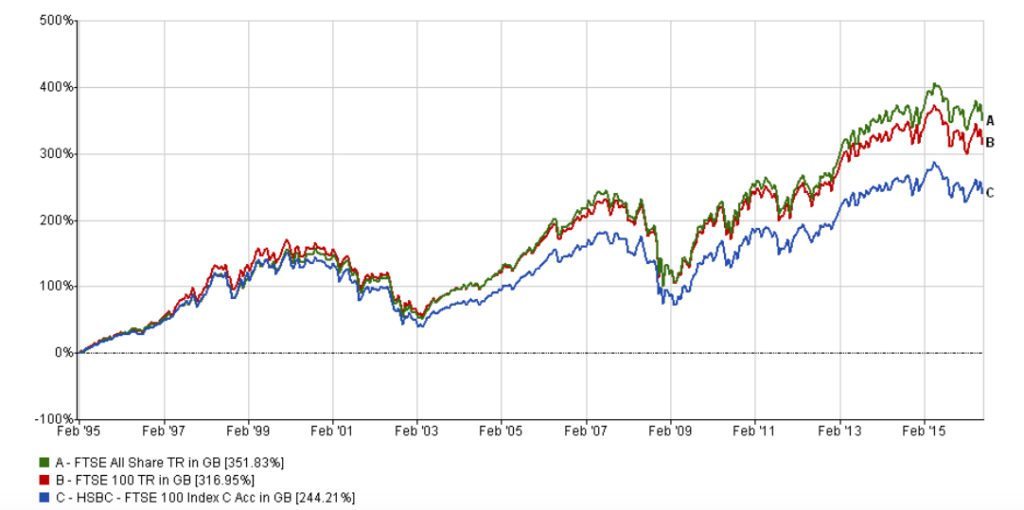

The HSBC FTSE 100 Tracker is truly horrendous! It underperformed the index by an average of 3.4%pa over the 21-year period of the research! While the FTSE 100 returned around 316% over the period, the HSBC fund returned 244%!

I think if you are comparing equities with ‘Best Buy’ active, you should at least use a decent index fund!

In the table shown earlier, which replicated Paul’s research using the FTSE 100 (with a fee of 0.5%pa), equities fared much better, although not as much as I expected. But the point here is it’s important to take the effort to identify a low cost index fund with the least tracking error and performance difference. That’s the least an investor should do.

Paul insists that a ‘real fund’ must be used for a research like this to get a sense of what an investor actually experienced. I disagree. I doubt anyone in the UK invested exclusive trackers (FTSE 100 or otherwise) 21 years ago, neither was anyone aware of Paul’s ‘active cash’ idea but that’s not really the point. The point is, standing where we are today, what should a reasonable investor have done based on the data available to us? There’s really no way to use a real fund. I accept that there was no global equity/bond tracker fund in the UK 21yrs ago. Thankfully, equity/bond tracker funds are now available from Vanguard, BlackRock and Fidelity, with a typical fee of 0.25%pa!

[bctt tweet=”Even a novice investor should understand the basics of diversification and picking low cost tracker funds.” username=”AbrahamOnMoney”]

STEP 3: Use one of the worst possible periods for equities.

One fundamental issue in Paul’s research is that the 21-year period is far too short to make the kind of profound statement he’s making. I think you need at least 50 years of market data, ideally 100 years to make this kind of a bold statement. I have offered to replicate the research over much longer period, if Paul supplies data for Best Buy Cash pre 1995.

When I inspected the dataset for the 21 year period, it is dominated by two of the worst market declines of all times – the 2001 and 2008 market corrections. Regardless of the time period you look at, if you started in 1995, there’s no way to escape those major market corrections unless you ehrrr… ehrrr… diversify!

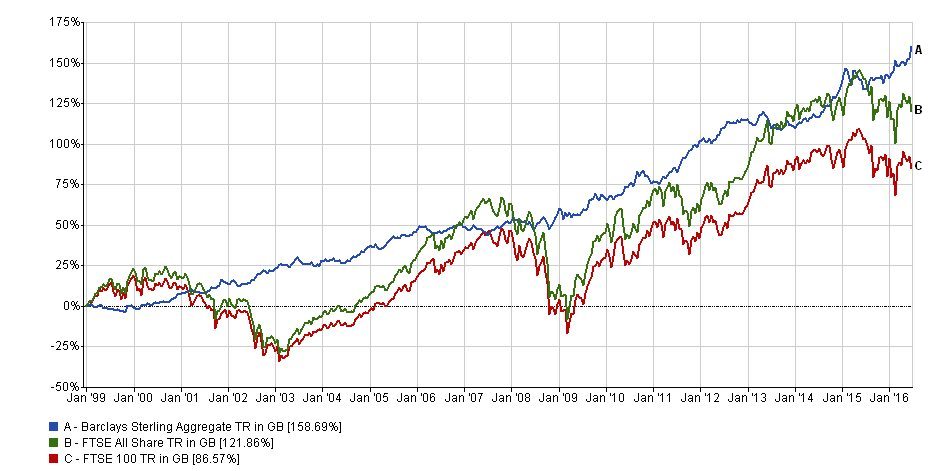

Cash isn’t the only asset class that outperformed UK equities for much of the time period Paul used for his research. Bonds have also outperformed equities over much of this period, in part due to unprecedented level of central bank interventions but it’s hard to imagine this will continue in the foreseeable future.

The Key Takeaway?

The lesson here for me in the importance of diversification and keeping cost//performance difference low when investing. This is the least you will expect even a novice investor to understand. And it’s not really a problem (well, I hope not) for advised clients.

Let’s not undermine Paul’s research – cash is often underrated by those of us in the investment world and savers should be encouraged to shop around frequently for the best rates. But the argument that cash beat a low-cost diversified portfolio in the long term? Well, that takes a quantum leap!

[bctt tweet=”The argument that cash beats a low-cost diversified portfolio in the long term takes a bit of a quantum leap” username=”AbrahamOnMoney”]

.

You can prove anything if you are selective with your time periods. Peter Worcester

Abraham – I think you are being too kind to Paul Lewis with your comments. He has just proven he is a journalist with an agenda and not a researcher or adviser. Does any ADVISER recommend a 100% FTSE 100 fund in isolation? Who were pushing 100% FTSE 100 trackers back in the day I wonder? Journalists I suspect sponsored by adverts from certain firms.

Interesting counters Abraham – many thanks