I have seen some remarks recently about how the Safe Withdrawal Rate (SWR) framework is likely to fare under extreme market conditions, for instance if the market tanks 50%!. Yet, this question has been asked and answered by 20 years of extensive research since the SWR framework was first published in 1994 by Bill Bengen.

The idea behind SWR is that, based on actual historical sequence of returns and inflation, an annual withdrawal of 4% (US, 3.7% in the UK) of the initial portfolio, adjusted for inflation would have survived any 30 year market condition over the last 100 years. In other words, SWR is based on the most severe economic and market conditions in 100 years of market history and it’s designed to survive extreme market conditions.

Enjoy reading this stuff? Then join us for more at the Science of Retirement Income Conference 2016!

The Market Conditions That Created SWR

Perhaps it’s worth exploring the market conditions that created the SWR in the first place. In the UK, the SWR is based on someone who started their retirement in the 1936/37 – we’ll call them ‘Class 1936’.

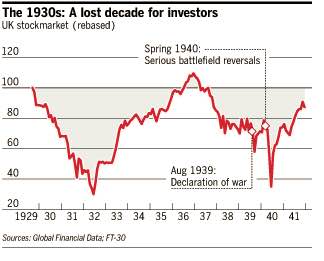

Our Class 1936 retiree would have started their retirement in the worse possible time in living memory; bang in the middle of two World Wars. Britain’s economy was already struggling in the 1920s, having borrowed so much to pay for a very expensive First World War, but then the Great Depression hit the US in 1929 and spilled over into the UK shortly after. The UK stock market plummeted and by 1931, unemployment was at record level – 20% nationally but parts of the country witnessed up to 60% unemployment. Britain’s export revenue halved and the government of the day was forced to come off the Gold Standard.

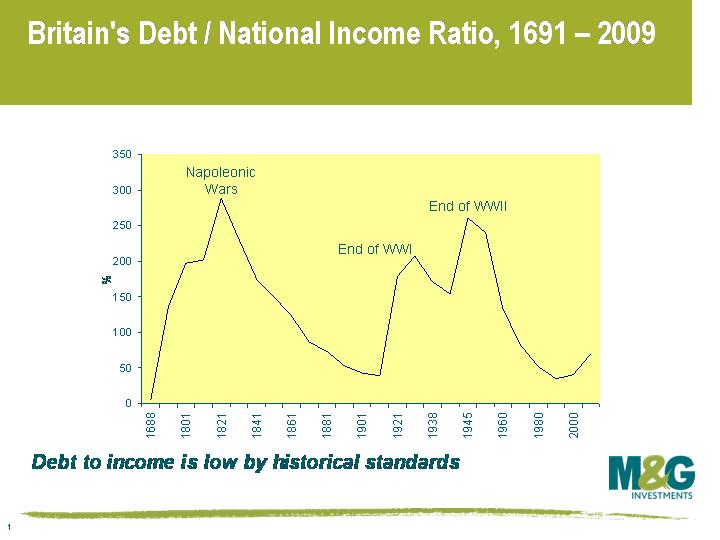

During this period, Britain’s Debt to National Income Ratio was in excess of 200%! In 1932, in the grip of the Great Depression, Britain (and France) defaulted on First World War debt to the United States – the so-called inter-allied debt.

UK stock market started to recover around the mid-1930s, only for another recession to hit just as our ‘Class 1936’ client was getting ready to start their retirement. This was then followed by news of possible 2nd World War, which eventually broke out in 1939. From the peak of the market in 1936, to the through in 1940, the UK stock market fell by over 60%!

So our Class 1936 retiree would seen their portfolio tanked massively in the first few years of their retirement, lived through World Wars and political instability, yet wouldn’t have ran out of money over a 30 year period, if they adopted the SWR framework!

The point here ISN’T to suggest that there are no future market conditions capable of ruining SWR but rather to demonstrate how bad things have to get, and the potential impact of such market conditions on alternative solutions such as annuities and guaranteed drawdowns, specifically to point out that

- A market condition that would be so severe as to ruin the SWR framework is also very likely to cause the failure of annuity providers in anyway! People often tell me this is just an exaggeration of the robustness of SWR, yet they forget than only 6 years ago, the 2008/9 financial crisis forced the US government to set up the Troubled Asset Relief Programme (TARP) to stop AIG and several insurers/annuity providers in the US from going belly up. Yet, as latter shown in this article, the SWR framework fared rather well during the same period.

- And it’s my own view that, a severe economic condition that would ruin the SWR framework would probably cause the FSCS to go belly up. As mentioned earlier, the severe economic conditions of the 1930s that created the SWR in the first place caused the UK Government to default on its debt to the US!

The point here is that SWR is most robust withdrawal framework we could come up with in financial planning, other than telling clients to spend less or die sooner!

[bctt tweet=”Safe Withdrawal Rate is by far the best framework we could come up with, other than telling clients to spend less or die sooner!” via=”no”]

How Has SWR Held Up Since The Tech Bubble and The 2008 Financial Crisis?

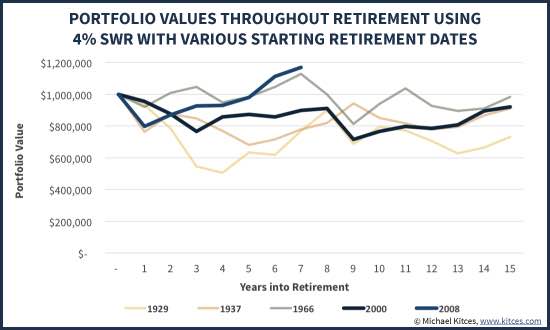

SWR has also held up pretty well in the other several financial crises; in particular the Tech Bubble and the 2008 financial crisis. While retirees who started out in 2000 and 2008 have yet to complete a full 30 year retirement period, it’s possible to compare the path dependency of their portfolio balances at various point against someone who retired under the 1929 or 1937(US) scenario.

In this excellent piece, Kitces (2015) showed that, if a 2008 or even a 2000 retiree had been following the 4% rule since retirement, their portfolios would be no worse off than any of the other “terrible” historical market scenarios that created the 4% rule from retirement years like 1929 and 1937(US). In other words, if they adopted the SWR framework, 2008 retirees would actually have higher account balances 6 years into their retirement than the retiree that created the SWR in the first place!

Finally, it’s important to realise that SWR is only meant to be a framework; it’s only crude guide but a pretty robust one. A good planner would adapt this framework based on the requirements of the client, fees, asset allocation etc and there are several other adaptations, which aims to start with higher withdrawal rate but adjust dynamically depending on market conditions, the most notable being the Guyton-Klinger rules, which I previously wrote about.

Enjoy reading this stuff? Then join us for more at the Science of Retirement Income Conference 2016!

.