Just as I’m about to head off on holiday after wrapping up our Evolution of Passive and Strategic Beta Investing Report, folks at BlackRock’s padded City offices hit us with a price cut across a number of their passive fund range. This is great news for investors of course, I only wish BlackRock checks with us first. Oh, well… next time?

You may recall we generated a bit of hoo ha in the press a few weeks back when we picked on BlackRock for not using its scale to cut prices for investors? Well, BlackRock’s decided to slash prices and done so with such gusto and brilliance (yes, folks in the fund industry do exhibit that trait, even if too infrequently 🙂 ) that BlackRock now has the cheapest index fund in 8 out of the 11 asset classes covered in our report.

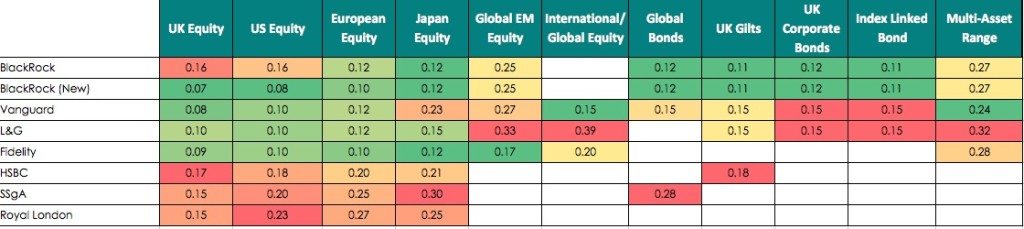

So, we stayed up last night and added the new OCF to our price grid and this is what it looks like;

Note, we use the cheapest OCF of clean shareclasses widely available on platforms and NOT SuperClean share classes which are restricted to a select number of platforms. For instance, you could buy Fidelity’s funds a bit cheaper on their own FundsNetwork platform.

The price cut relates only to the equity funds, as BlackRock is already keenly priced in the fixed income space. And frankly, there’s very limited product range and little competition there, so they decided not to bother.

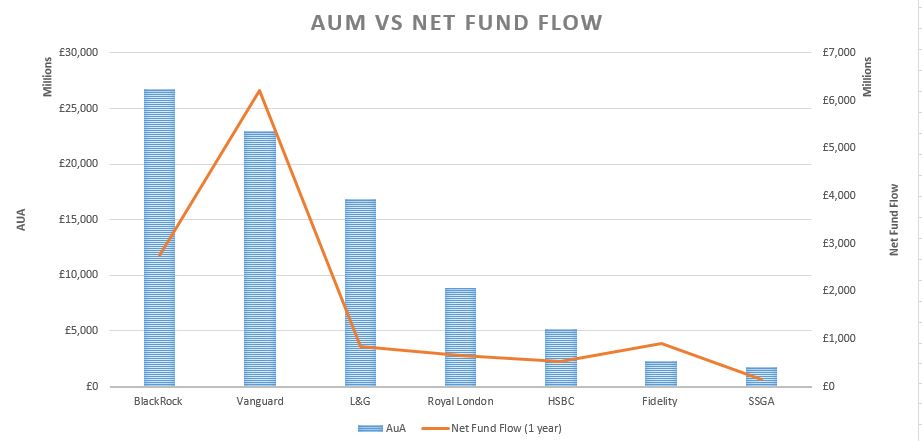

As you can see, before this price cut, BlackRock’s fees look a bit pricey for retail and advisory channels, when compared to Fidelity and Vanguard (although it’s very competitive in the institutional space) and this is probably beginning to take a toil on fund flows. The chart below plots providers AuM against their net fund flow across 10 asset classes over the last 12 months. It shows Vangaurd taking twice as much money as BlackRock, and Fidelity punching above their weight. This, no doubt contributed to BlackRock’s decision to slash fund cost. Good on you folks…. good on you!

Clearly, with this move, BlackRock has now undercut both Fidelity and Vanguard, it’ll be interesting to see how this impacts fund flow and how other providers respond! But if any passive fund provider is planning to retaliate, can I please ask you not to announce this until I return from my holiday in Paris, which includes enjoyable activities such as kissing and hugging Minnie Mouse with my 3 year old! Wouldn’t want to miss a second of that.

Deal….? Thanks!

.

So is this price cut for new money, existing money or both??

Hi Duncan, the new price applies to existing and new investors in the D share class.

D share class presumambly has the majority of assets for each fund??