Yup, you read that title right! We’re going ‘dark’ with this one. You’ve been warned! Read on at your own peril.

If we are to believe the media, there’s a price war raging between index fund providers. And so, a key focus of our Evolution of Passive & Strategic Beta Investing Report due out shortly, is to see if there’s any truth to this. As part of the research, we are looking at, among other things, the effectiveness of tracker funds and how pricing is influencing fund flow.

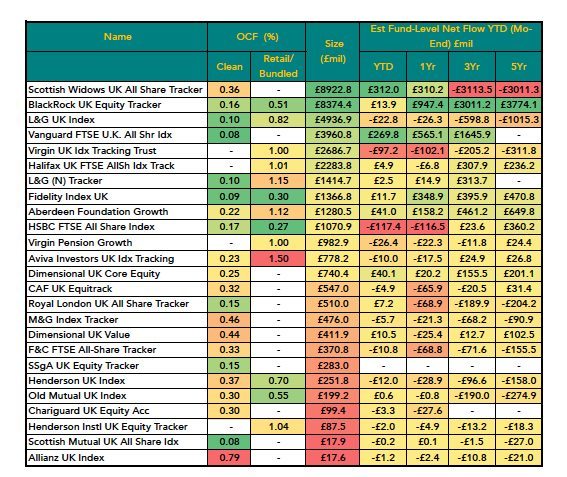

The cold hard data suggest something far short of a full-blown war; more like a friendly fistfight. Nonetheless, we think that there are funds that deserve a horrible painful death. If look at the largest sector for index trackers – there are at least 23 funds tracking the FTSE Allshare alone. And that’s just OIECS and Unit Trusts, not to mention ETFs.

While competition is nothing like the headlines suggest, there is just no way so many funds doing exactly the same thing (albeit at varying degree of accuracy) are going to survive. Over the next few years, we expect to see the back of subscale and overpriced index funds.

- These are funds with less than £500M asset size and tend to be quite pricey, charging between 3 to 10 times the price of the cheapest competitors.

- They lack the scale and inflow needed to cut prices for their investors

- They tend to be sub-advised funds from active fund houses, which tend to do indexing very badly and they have no complimentary product range.

Yes, M&G, Scottish Mutual, Henderson, Chariguard, Allianz, we are looking at you! The Henderson fund is actually managed by State Street (SSgA) and the Old Mutual funds by BlackRock. These active fund houses simply take a fee for distributing the funds under their brand names.

And then, there are large bloated funds who aren’t using their scale to cut price for their investors. Scottish Widows and Virgin are the arch offenders in this later category.

We see a huge potential for consolidation in this space – and by that we mean fund mergers rather than provider mergers . We think (and sincerely hope) some providers would eventually put up their hands and admit that they can’t make index tracking work. One possibility is for the likes of BlackRock, Vanguard, Fidelity and L&G to take over these funds, but I’m sure no one at their padded City offices are thinking about that just yet. Merging these laggards into larger index funds is good for the providers and for clients. It helps existing providers get rid of failing business stream that has no future whatsoever and for the providers taking over the funds, it is probably more cost effective than going off to acquire new customers. And invariably, this means lower fees and better products for the investors.

If I were a betting man or certain pollster, I’ll be prepared to eat my hat if these funds subscale tracker funds don’t merge in the next 5 years. But of course I’m not, so my wish is that those funds die a slow painful death in the coming years. (I told you this post is dark, didn’t I?)