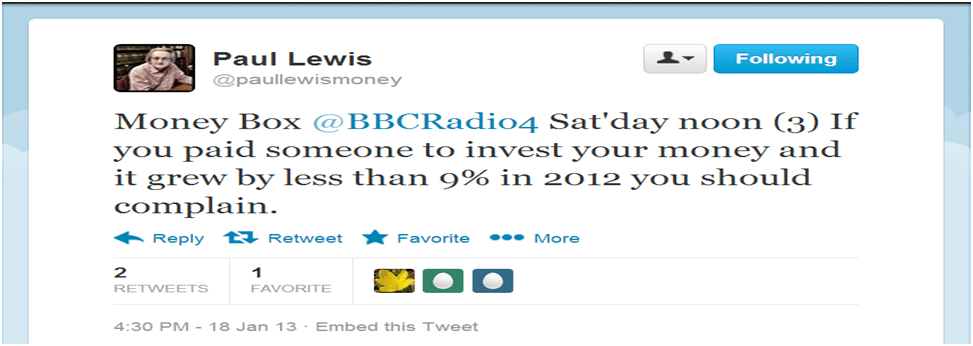

On Friday, Paul Lewis, host of BBC Radio4 Moneybox programme said this on Twitter…

Yes he did!

I understand what Paul was doing; teasing his followers to tune in and listen to his programme. Apparently, the programme includes a debate of sorts on what returns investors should have got in 2012! ??? (The programme airs later today)

The problem with this is that social media is exactly that; media in itself. It may be used to promote content of other media but the message equally stands on its own. I mean, you couldn’t possibly go on TV, say something that is highly misleading and then tell viewers to ‘tune into my radio programme for the low down!’ Why do the same on twitter?

It is impossible to know how many of Paul’s 46,763 followers actually listens to the programme to get the whole story but the statement is misleading on every level. The power of social media also means that others who don’t follow Paul and don’t/won’t listen to his programme will see the tweet and won’t get the full story either.

I am all for good financial journalism, the kind that champions consumer rights and seek to right the wrong that has been done to investors by some sections of our industry. That’s the kind of journalism that Paul is known for but this tweet isn’t doing any of that! Not only is any complaint based solely on investment performance highly unlikely to be successful (but Paul already knows that!), this is the kind of half -baked message that has fueled an up-rise of claims management companies we have seen recently, encouraging consumers to pursue frivolous claims against advisers. The Ombudsman is now struggling to cope and it takes months for them to deal with legitimate claims. This result of which is increased cost of regulation and by extension, cost of much needed financial advice for consumers.

I couldn’t help but wonder where the figure 9% came from? It’s probably based on FTSE performance in 2012 but surely any adviser who put all their client’s money in the FTSE is barking mad! And you know, if they did, Paul would have been the first to tell the client to complain about lack of diversification in their portfolio.

In fact last year, Paul suggested on several occasions that people should invest their pension funds in cash. I didn’t hear him qualify that advice in any way in terms of age, risk profile or financial objectives, just that ‘cash is king!’ Surely those who followed his ‘advice’ didn’t get 9%, did they? Should they complain too? But to whom? The BBC or the FSA?

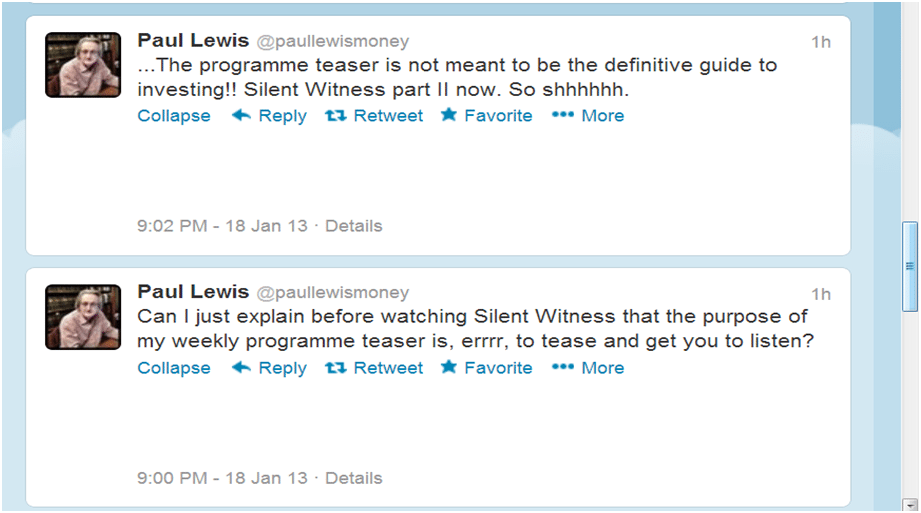

When challenged on his tweet, this was Paul’s response….

So that makes it alright then! It’s sensational, misleading and completely untrue! It does nothing to help consumers but as long as it is a tease to promote his radio programme, which is funded by taxpayers, then that’s absolutely fine!

How far can a journalist go just to score a few cheap points? Surely there are boundaries both in terms of regulation and common expectation, but how clear are they? How do we deal with situations where the media mislead consumers or strays into regulated advice? Surely there are consequences?

I know some people have called for financial journalist to be as qualified as advisers and/or regulated in some shape or form. I am having no part in that! Being a Gen Y who loves new media, do I want bureaucrats to stick their nose in what’s been said on blogs and twitter? Hell no! Certainly not the FSA in its current form! But on very few occasions like this when Paul Lewis (sadly someone I have a lot respect for) or some other influential media figure says something that is completely uncalled for on twitter, it just makes me think… ‘is financial journalism going too far?’ and ‘what can we do about it?

The BBC isn’t funded by tax payers. It’s funded by the tv license.

Its actually a compulsory television tax as acknowledged by the ONS.

If you buy a television, the retailer is legally obliged to send your address details

to a government agency who then pester you for money for eternity.

If that is not a tax, I dont know what is.

TV license is tax by another name!

Brilliant! Well said. I only wish financial journos were subject to the same financial promotion (FP) rules as IFAs. Paul has hinted that these are in fact ‘not his words’ and you need to tune in to the programme to find out more. This is utter rubbish. You can’t use that as an excuse – certainly an IFA couldn’t. Imagine the trouble an IFA would get in if he tweeted: “Has your IFA sold you an investment that netted less than9% growth last year? You should complain and come to me for advice instead.” The FSA is very clear that IFA tweets are subject to the same FP rules as other ‘real & non real-time financial promotions’ and as such must at the very least meet the ‘clear, fair and not misleading’ guidelines.

Paul often highlights the malpractices within the industry, which is all good and fine, I just wish he would apply the same ‘whiter than white’ attitude to his own output. Putting a sensationalist statement like that in a tweet will, I am sure, guarantee some extra listeners, but is he being fair, clear and not misleading in his advertising (a form of financial promotion as far as the FSA is concerned)?

Some people have threatened to ‘unfollow’ Paul as a result of this and other dubious tweets he has issued. I don’t think that is the right approach. Unfollows don’t bother someone who has a pot of over 46,000. I think he should be chastised by his followers in a very public way so that others can see the mistakes he has made. Perhaps in doing so he might, just might, learn a valuable lesson about how he communicates issues relating to financial services, just as IFAs have had to.

which is paid for by taxpayers

If Paul was being serious he should and would say something like:

If your goal is to invest in UK blue chip equities, then over extended periods index trackers based on the FTSE100 reinvested index may be a low cost tool to help you achieve your objectives. This is because, on average, two thirds of active managers under perform net of charges, and it can be very difficult to select active managers that outperform consistently. Some professional help may assist you if you do wish to take this risk.

Thanks for comment Stephen. Well, Paul didn’t say that! In fairness to him, does try to be accurate on most occasions but I think we all agree he fell short this time around.

Thanks for comment Stephen. Well, Paul didn’t say that! In fairness to him, does try to be accurate on most occasions but I think we all agree he fell short this time around.

https://finalytiq.co.uk/paul-lewis-social-media-and-financial-journalism-gone-too-far/

My comment on Paul Lewis complaint.

.

Abraham, what a good post. I too have a lot of time for Paul and the educational role that Moneybox has. Unfortunately, he seems to come across an awful lot of bad practice. Everyone makes mistakes and frankly this is certainly one of Paul’s. You and I (and many besides) are still failing to get our message out there that financial planning when done well can be life-changing for clients. Investment returns and financial products are frankly secondary (at best) to ensuring that people protect and maintain the lifestyle they want – for life. The focus by both the media and financial services industry is in totally the wrong place – always focussing on returns and very very rarely on values.

Thanks for your comments Dominic. I agree with much of what you said; we all need to get the word out there. That’s why I love new media, provide a means of doing just that!

Abraham. I also had a run in with Paul Lewis on Twitter who clearly doesn’t understand equity/bond based investing at all (he loves cash which is about his investment level). He stated that most people who invest in equity ISA’s would be better off in cash ISA’s after tax considerations. I told him he should resign for such a lazy comment as it misinformed readers. He followed up with comments about risk. I suggested that he also talk about asset allocation and perhaps explaining to readers that “Equity ISA’s” can invest in bonds too (could there ever be a worse title than Equity ISA’s, my clients hold 20-80% of their Equity ISA in bonds?) I also invited him to come to my practice, so we could discuss these issues further, he didn’t reply to that tweet!

I agree with Stuart that we shouldn’t unfollow Paul, merely reply and react every time he makes an innaccurate/simplistic tweet.