Contrary to what you might have read in the papers, 2018 was a pretty uneventful year for the UK stock market – and indeed, the global market as a whole.

While the financial media appears to be up in arms about the negative return experienced by most major stock market indices in the past year, this sort of temporary decline should be expected, and dare I say welcomed?

Historical data shows that, over the last 100 years, UK Equity ended with a negative return in around one in four calendar years. (This is also true for US and global stock markets.)

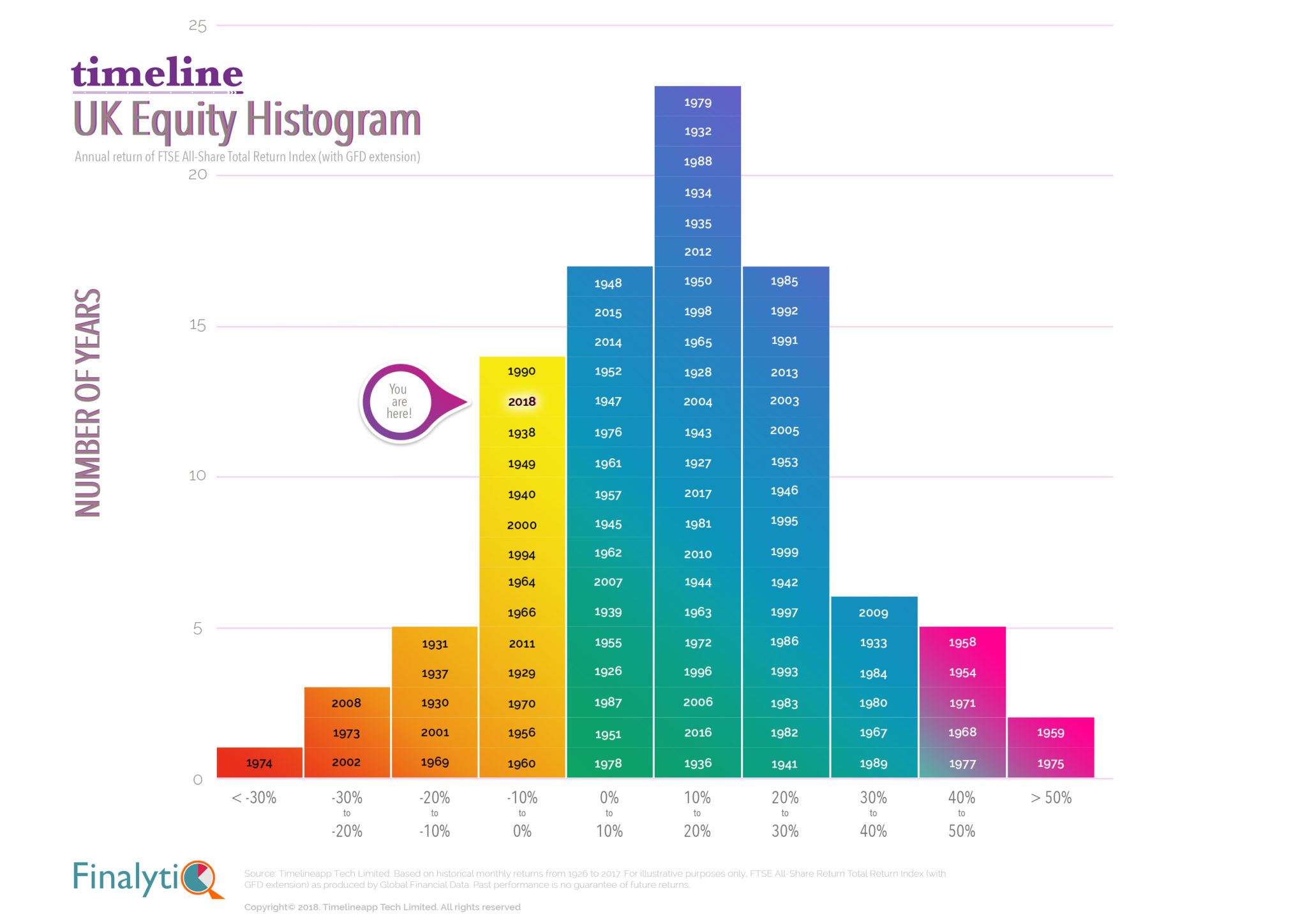

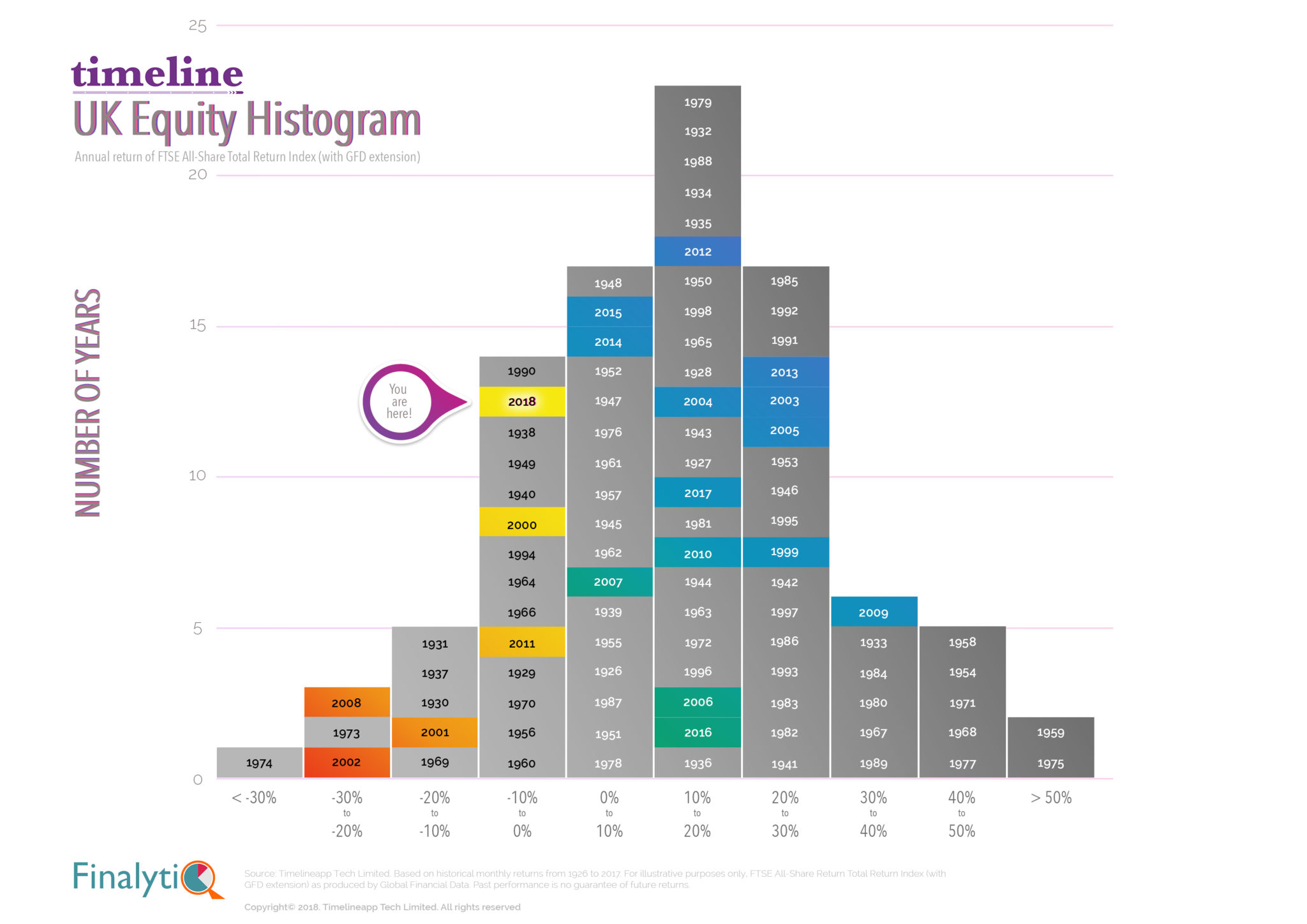

The chart below is a histogram showing the range of annual return since 1900 in bands of 10%. Of the 119 years shown on this chart, UK stock markets delivered a negative return in 23 calendar years. Most of those 23 years of negative return saw the equity markets falling by up to 20%. There are a few years with losses of more than 20% but alas, there are three times as many years with gains of more than 20% a year. The odds of an exceptionally high return is way more than the odds of an exceptionally low return in any one year.

And since the global financial crisis ended 10 years ago, UK Equity has ended with a positive return every year – with the exception of 2011. So, after six consecutive years of positive return, a ‘correction’ is long overdue. And in 2018, the equity markets did just that.