Welcome our blog. This is where we share thought-provoking, no-holds-barred opinions and commentaries on all things retirement income, financial planning and investing!

Mind The Behaviour Gap

It’s highly unlikely you will read this in the money section of your Saturday newspaper, but if you are anything like an average investor, you’re losing 2.49%pa to ‘behavior gap.’ Behaviour gap (or performance gap) is the difference between return on an average fund...

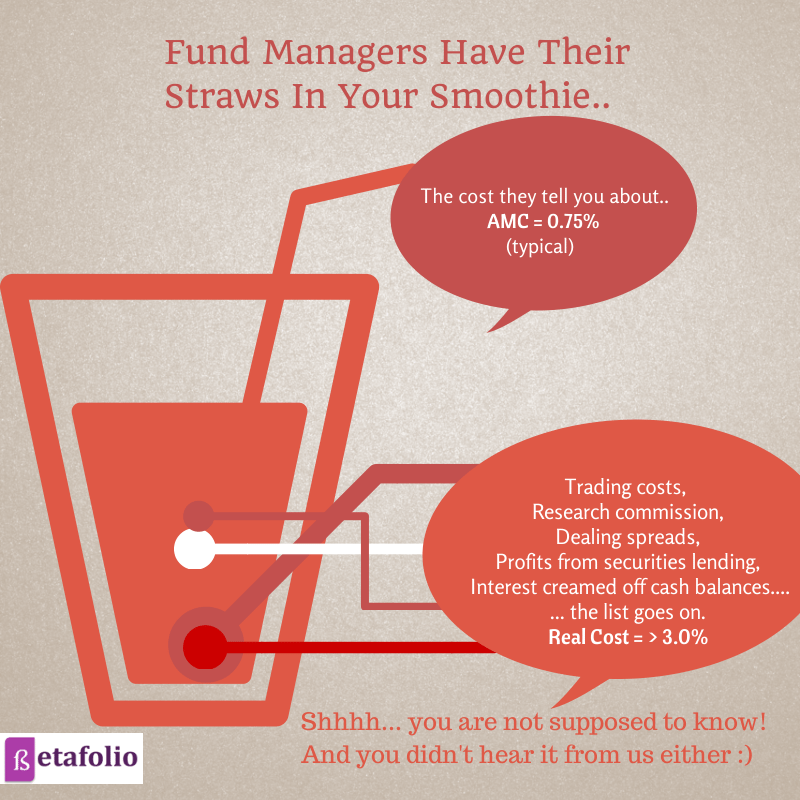

Infographics: Cost of Active Funds

Video: Behaviour Gap

This piece is a video scribe that explains the powerful concept of Behaviour Gap – the difference between the return of a fund and the return of a typical investor in that fund. It also emphasis the value a good adviser can add by helping clients to stay the course when investing.

… More →

Adviser’s Alpha and The Cure for Behaviour Gap

If the latest data from Morningstar[1] (US) is anything to go by, Behaviour Gap seems to be getting wider and wider. For the uninitiated, 'behaviour gap' or 'performance gap' is the difference between the return of a fund and the return an average investor in that...

Fund Industry Has Its Straws In Your Smoothie (Or The Melting Iceberg of Fund Expenses)

Every time Mrs Smith walks into her adviser’s office to top up her ISA, a whole chain of reaction is set in motion and the number of ‘entities’ getting paid in the process should make your blood boil. It is estimated that there are, at least, 11 to 14 service points...

Essential Reading for Advisers: Arithmetic of the Investing Costs

As part of our focus on Evidence-Based Investing, I am currently reviewing literature on a range of investment topics. I want to share some of the interesting stuff I’m reading, and I will update the page from time to time. I get a lot of flak for obsessing...

3,000+

Avid Subscribers