Welcome our blog. This is where we share thought-provoking, no-holds-barred opinions and commentaries on all things retirement income, financial planning and investing!

Breaking Up Old Mutual: Possible Implications for Advisers’ Due Diligence

Following reports by Sky News over the weekend that Old Mutual Wealth is up for sale, I'm probably not the only one left wondering which platform isn't actually up for sale? OK.. OK.. I know there are but a few... Apparently, in a bid to break up the parent company...

Why Asset Managers And Direct Platforms Don’t Mix

Today, I'm off to Luxembourg to speak at the International Transfer Agency Summit (ITAS)! Someone in their twisted mind decided that it's a good idea to put me on a panel discussion on whether fund managers should get into the direct platform business. Luckily for...

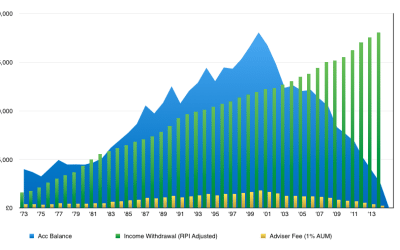

Impact of Adviser Fees on Withdrawal Rates in Retirement Portfolios

One of the more common misconceptions about the ''Safe Withdrawal Rate' framework is the impact of fees; advice fees, fund expenses and platform charges. An example of this gross misconception was recently shown in this article which slams percentage fee model for...

Why A Withdrawal Policy Statement Is Vital In Retirement Planning

Avoiding pound cost ravaging in a retirement portfolio is a bit like running an egg-and-spoon race. It's a big balancing act. With the markets constantly throwing tantrums like a toddler deprived of her toys, it can be quite challenging for clients stay on track,...

Economics of Direct Platforms And Robo Advice Report

We are beyond chuffed to introduce the maiden edition of our Economics of Direct Platforms & Robo-Advice Report. The UK direct platform market has come a long way and now caters for well over £150 billion of investors assets at the end of 2015. However the...

Meet The Professor of Retirement Income Planning

A lot of what we do in financial planning today are simply based on rules of thumb, handed down from adviser to adviser, and in many case flawed ideas pushed down by insurers and asset managers. I have always believed that planning people's retirement should be based...

3,000+

Avid Subscribers